Swiss Franc The Euro has fallen to 1.0872 or by 0.09%. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets have turned quiet. There have been no more headline bombs about trade, and China set the dollar’s reference rate much lower than projected. Asia Pacific equities were mixed. Hong Kong, China, India, and Singapore were on the downside, while Taiwan,...

Read More »FX Daily, August 23: Market has Second Thoughts on Magnitude of Fed Cuts Ahead of Powell

Swiss Franc The Euro has fallen by 0.07% to 1.0887 EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Powell speech at Jackson Hole stands before the weekend. Equities in Asia and Europe are finishing the week on a firm tone. Most markets in the Asia Pacific region closed higher today, and the MSCI Asia Pacific Index snapped a four-week slide. European bourses are edging higher, and...

Read More »FX Daily, August 21: European Stocks Snap Back, Market Hopeful Italian Election can be Delayed

Swiss Franc The Euro has risen by 0.27% to 1.0882 FX Rates The end of the US equity three-day advance yesterday weighed on Asia Pacific shares today. Most benchmarks fell. Better than expected trade data helped Thailand buck the trend. A firmer tone emerged in the European morning, and the Dow Jones Stoxx 600 has recouped yesterday’s losses and more. It was led higher by consumer discretionary, energy, and industrials. US shares are also trading firmer today,...

Read More »FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0. China set the reference rate for the dollar lower than models based on the basket the PBOC uses implied for the past three sessions, and this...

Read More »FX Weekly Preview: The Dog Days of August are Upon Us

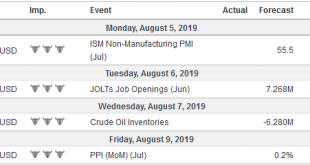

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies). Following the end of the tariff truce, and after the July...

Read More »Brexit Update

The October 31 deadline for the UK to leave the EU is less than 100 days away. The new Prime Minister is beginning to convince others that that UK will, in fact, leave at the end of October. PredictIt.Org shows the odds of the UK leaving has risen to almost 50% from about a 33% chance a month ago. Here is a summary of where the situation stands and some key dates going forward. Boris Johnson handily won the Tory...

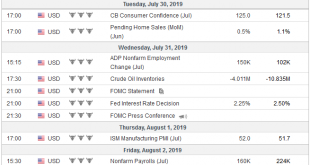

Read More »FX Daily, August 2: End of Tariff Truce Trumps Jobs

Swiss Franc The Euro has fallen by 0.40% to 1.0929 EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell’s attempt to give insight into the Fed’s thinking. Trump’s tweet than signaled an end to the tariff...

Read More »FX Daily, July 30: Sterling Pounded

Swiss Franc The Euro has fallen by 0.10% to 1.1037 EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year...

Read More »FX Daily, July 29: Prospects of a No-Deal Brexit Weigh on Sterling

Swiss Franc The Euro has fallen by 0.13% to 1.1037 EUR/CHF and USD/CHF, July 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading....

Read More »FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance. Although a minority, and maybe worth a dissent or two (Rosengren? George?), we are sympathetic to those Fed officials that do not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org