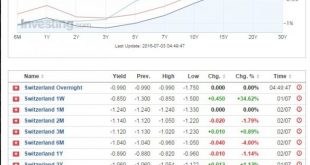

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2. That’s because this is where every other month the world’s central bankers meet in complete secrecy – no minutes are ever kept – to discuss the global economy completely unfettered of any concerns of accountability, and decide on what monetary policies they will implement to...

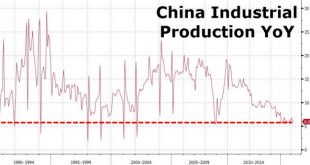

Read More »China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better. Economic Data from China Then Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER...

Read More »Chart up-date: Stocks, Bonds, Copper, Bonds

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

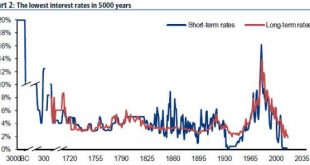

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »Global Stocks Slide, S&P Set To Open Red For The Year As Hawkish Fed Ignites “Risk Off”

After yesterday's algo-driven mad dash to close the S&P green both for the day and for the year following Fed minutes that came in shocking hawkish, the selling has continued overnight, led by the commodity complex as rate hike fears have pushed oil back down some 2% from yesterday's 7 month highs, which in turn has dragged global stocks lower to a six-week low, while pushing bond yields higher across developed nations as the market suddenly reprices the probability of a June/July rate...

Read More »Spain Sells 3x Oversubscribed 50-Year Bond

Following a scramble by European nations to issue ultra long-dated government paper, which saw France and Belgium sell 50-year bonds last month, while Ireland and Belgium went all the way and issued century bonds, with even Switzerland locking in 42-year paper yesterday, moments ago Spain was the latest to extend maturities all the way to 2066 when it sold €3 billion in 50 year bonds at Midswaps+50. According to MarketNews, the issue was over 3 times oversubscribed with the orderbook...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org