Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More »Trump, Clinton, “Ugliest” Election Coming – Gold’s “Summer Doldrums” Prior To Resumption of Bull Market

The Trump and Clinton election is set to be one of the "ugliest" and "messiest" U.S. elections ever, astute gold analyst Frank Holmes warned this week. He believes this is a reason to own gold and will be one of the factors that will see a resumption of gold's bull market after the summer doldrums which we explore below. Republican presidential candidate Donald Trump delivers a speech at the Republican National Convention on July 21, 2016 (Photo by John Moore/Getty Images) Gold...

Read More »Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today’s uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of “helicopter money” is about to be unveiled in Japan by the world’s most experimental central bank. However, as Nomura’s Richard Koo warns, central banks may get much more than they bargained for, because helicopter money “probably marks the end of the road for believers in the omnipotence of monetary policy who have...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

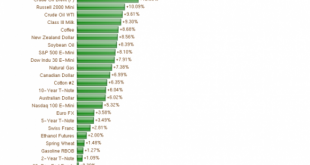

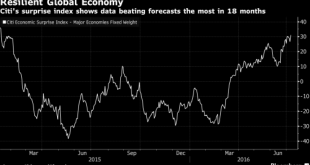

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

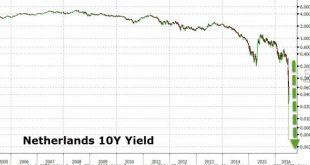

Read More »Going Dutch? Netherlands Joins The 10Y NIRP Club

Netherlands 10Y Yield For the first time in Dutch history, 10Y government bond yields have turned negative (-0.001% intraday) closing at 0.00%… Click to enlarge. Joining Switzerland, Japan, Germany, and Denmark… Pushing Global NIRP bonds over the $13 trillion! Click to enlarge. Chart: Bloomberg

Read More »Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub’s mind-numbingly-elitist rebuttal of the democratic rights of “we, the people” in favor of allowing “they, the elite” to ensure the average joe doesn’t run with scissors, “It’s time for the elites to rise up against the ignorant masses.” The Brexit has laid bare the political schism of our time. It’s not about the left vs. the right; it’s about the sane vs. the mindlessly angry… The Guardian’s...

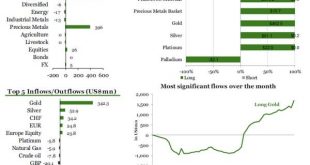

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org