Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Bitcoin vs Fiat Currency: Which Fails First?

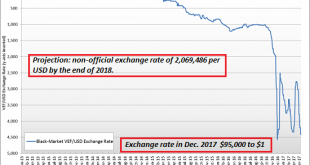

What if bitcoin is a reflection of trust in the future value of fiat currencies? I am struck by the mainstream confidence that bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela’s fiat currency, which has declined from 10 to the US dollar in 2012 to...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »A Race To The Potential Behind Bitcoin

The timing just never seems to fall in our favor. If we had had this conversation ten years ago as would have been appropriate, then this evolution might have fell perfectly in our collective laps. Just as the global financial system, really the international, interbank monetary system of the eurodollar, was crashing all around us, the genesis block of the Bitcoin blockchain was hard coded. Within it contained very...

Read More »Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

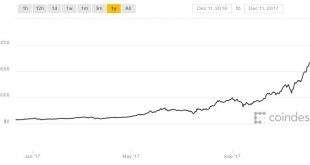

Bitcoin - Plan Your Exit Strategy Now - Maybe With Gold Made money in bitcoin? Well done. Don’t wait until the stampede starts. Here’s what you must do now. by Dominic Frisby in Money Week So there I was on Sunday afternoon, doing what it is one does on a Sunday – very little in my case – and a notification comes up on my phone: “Bitcoin rises over 10% to $11,800”. Bitcoin in USD (1 Year). Source: CoinDesk On a Sunday. When every other market is closed. It’s bad enough that bitcoin is making...

Read More »What Is Money? (Yes, We’re Talking About Bitcoin)

Good ideas don’t require force. That describes the Internet, mobile telephony and cryptocurrencies. What is money? We all assume we know, because money is a commonplace feature of everyday life. Money is what we earn and exchange for goods and services. Everyone thinks the money they’re familiar with is the only possible system of money—until they run across an entirely different system of money. Then they realize money...

Read More »Bitcoin und die Theorie des grösseren Trottels

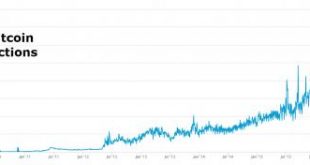

Das Bitcom-Zeichen in Riga, Lettland. Foto: Ints Kalnins (Reuters) Bitcoin fasziniert. Der Preis der Kryptowährung hat sich seit Anfang des Jahres mehr als versiebzehnfacht. Am Mittwoch kostete ein Bitcoin 14’000 Dollar, am Donnerstag Abend schoss der Preis auf rund 17’000 Dollar in die Höhe (Quelle: Cryptocoinsnews.com): In den letzten Tagen verlief der Preisanstieg beinahe senkrecht. Längst beschäftigt Bitcoin nicht mehr bloss einige Nerds in der Computerwelt; das Thema ist in der...

Read More »Frustrated Investors File Lawsuits Against World’s Largest ICO

Here’s the latest sign that the massively fraudulent ICO market is headed for a collapse. Tezos’s investors are still waiting to learn when they can expect to receive the digital tokens that they paid a premium for during the company’s record-setting crowdsale. But as reports of abuse, internal strife and outright embezzlement have surfaced in the press, three groups of angry investors have filed class action lawsuits...

Read More »What Gives Cryptocurrencies Their Value

The value of cryptocurrencies like bitcoin, just like any other kind of money, comes fundamentally from what you can do with it. As a follow up to What Backs Bitcoin, I want to dig into that value. The idea, which comes from Austrian economist Carl Menger, is that just as a shovel’s value comes from its ability to dig, a currency’s value comes from its ability to help you do two things: transactions and savings. Think...

Read More »Low Cost Gold In The Age Of QE, AI, Trump and War

Key topics in the video: – A bullion dealers view on ‘What will drive the markets in 2018?’– QE, inflation, Fed rates, debt bomb, China, populism, EU cohesion, Brexit, digital disruption, cashless society, demographics, Trump (war), Artificial intelligence (AI)– Solve global debt crisis with humongous amount of debt!?– Inflation – U.S. health insurance has increased 13% per annum since – How Artificial Intelligence...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org