Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week’s high near $1.24, and...

Read More »FX Daily,April 16: Market Struggles for Direction

Swiss Franc The Euro has risen by 0.06% to 1.187 CHF. EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Syrian strike over the weekend, and the official indication that “mission accomplished” and that was a limited one-off strike has spurred little market reaction. There is one more loose end, as it were, and that is that the US has...

Read More »FX Daily, April 13: Markets Struggle to Find Footing while News Stream Improves

Swiss Franc The Euro has fallen by 0.03% to 1.1858 CHF. EUR/CHf and USD/CHF, April 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump’s rhetoric on trade took a more constructive tone, and a divided Administration...

Read More »Great Graphic: Aussie-Kiwi Approaches Trendline

Today is the fifth consecutive session that the Australian dollar has weakened against the New Zealand dollar. It has now fallen to test a three-year old trendline that we show on the Great Graphic, composed on Bloomberg. The last leg down in the Aussie actually began last October, and through today’s low, it is off by a little more than 7%. In fairness, it has really been in a broad range fro several years, roughly...

Read More »FX Daily, April 10: XI’s Day, but Not So Good for Putin

Swiss Franc The Euro has risen by 0.25% to 1.1807 CHF. EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump’s lawyer’s office, house and hotel were the subject of search warrants. A...

Read More »FX Daily, April 09: Asian and European Equities Shrug Off US Decline

Swiss Franc The Euro has risen by 0.10% to 1.1786 CHF. EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing...

Read More »FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Swiss Franc The Euro has fallen by 0.07% to 1.1787 CHF. EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today....

Read More »FX Daily, April 04: Trade Specificities Rattle Markets

Swiss Franc The Euro has risen by 0.31% to 1.1799 CHF. EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations...

Read More »Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues. In the first clip, which runs about 2.5 minutes, I sketch out the argument for the US economy being in a late-stage expansion. I cite the 12-month moving average of...

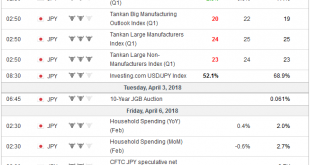

Read More »FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March. Other bourses did not. These include the DAX,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org