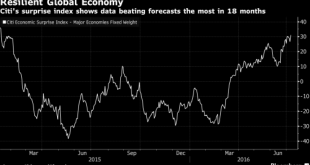

Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »BOJ fails to meet expectations on easing

Macroview Further action may come once the BOJ has fully reviewed the effectiveness of existing policies, but for now the focus is turning to the latest fiscal package On 29 July, the Bank of Japan (BOJ) announced that it would keep the current pace of monetary base expansion unchanged at JPY80 trillion per year and left the policy interest rate unchanged at -0.1%.Although the central bank did announce a doubling of its purchases of exchange-traded funds (ETFs) and an expansion of its...

Read More »Trump, Clinton, “Ugliest” Election Coming – Gold’s “Summer Doldrums” Prior To Resumption of Bull Market

The Trump and Clinton election is set to be one of the "ugliest" and "messiest" U.S. elections ever, astute gold analyst Frank Holmes warned this week. He believes this is a reason to own gold and will be one of the factors that will see a resumption of gold's bull market after the summer doldrums which we explore below. Republican presidential candidate Donald Trump delivers a speech at the Republican National Convention on July 21, 2016 (Photo by John Moore/Getty Images) Gold...

Read More »FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More »G7 Summit: Risk of a Global Crisis, Maritime Disputes and the Dollar

The G7 heads of state summit has begun. The host, Japan’s Prime Minister Abe began with doom and gloom. Accounts suggest he warned of the risk of a crisis on the scale of Lehman if appropriate policies are not taken. It is not clear to whom Abe was addressing. It may not have been the other heads of state. It may have been a domestic audience Abe had in mind. At the finance ministers and central bankers meeting last week, Japan’s Aso indicated that contrary to speculation, the retail...

Read More »Daily FX, May 13: Toward a New Mouse Trap

The Great Financial Crisis has exposed a deep chasm in economics and economic policy. No single institution is this crystallized more than at the Bank of Japan. The former Governor, Shirakawa brought policy rates to nearly zero to combat deflation. His successor, Kuroda, took the central bank in the completely other direction. He has introduced three elements of unconventional policy in an institution that was wedded to orthodoxy. These include an aggressive expansion of the central...

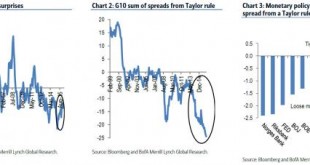

Read More »Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »More Thoughts about the Yen

Every so often there is a market move that appears inexplicable. The conundrum now is the yen’s strength. Of course, there are numerous attempts to shed light on the yen’s rise, but many, like ourselves, are not very satisfied. Perhaps part of the problem is that many participants are looking for a single narrative that explains why the dollar peaked against the yen last June near JPY125.85 and fell to almost JPY107.60 yesterday. However, closer inspection suggests the dollar’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org