CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. Keith and Jay discuss why...

Read More »Silver Update: Scarcity Gets More Extreme

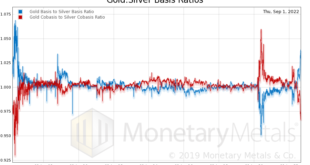

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »The Silver Phoenix Market

Listen to the audio version of this article here. The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. Breaking Down Fundamental Silver Prices However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price. The market price is down a lot since that...

Read More »Gold Beats Inflation & Treasury Yields Too!

Keith Weiner and Michael Oliver return as guests on this week’s program. The U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. They can’t say that any longer because Monetary Metals now pays interest rates to small...

Read More »Ep 39 – Tavi Costa: Breaking Down the Pressures on the Market

Tavi Costa of Crescat Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the current state of the market, investing in good times and bad, and what future indicators to watch. Connect with Tavi on Twitter: @TaviCosta Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources Fed Zugzwang Germany Announcement Jerome Powell Nose Tweet Bloomberg Misery Index Zombie Company...

Read More »The Knockout Blow to Crypto

A New Type of Fighter Bonus The UFC has started paying fan bonuses to its fighters in Bitcoin. The UFC buys crypto at a fixed dollar amount and pays their fighters a bonus in cryptocurrency. As someone who loves the UFC and monetary economics, I wanted to offer an alternative solution to the UFC and its athletes. The Problems with Crypto This takedown of crypto will focus on the speculative aspect of cryptocurrencies. Crypto’s greatest draw is also its fatal flaw....

Read More »Buy Gold, Because…

The coin which helped win the gold vs bitcoin debate at the Soho Forum Photo credit: the author It’s pretty, isn’t it? Gold, Liquid Gold, and Inflation Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. It’s just an inch and a quarter in diameter yet weighs 0.075 pounds. Everyone should hold one in his hand (and own a few). But that’s not why many gold analysts today are saying you should buy gold. They are saying...

Read More »Ep 38 – Jp Cortez: Fighting for Sound Money

Jp Cortez of the Sound Money Defense League joins Keith and Ben on the Gold Exchange Podcast to talk about problems with central planning, the morality of sound money, which states are topping the Sound Money Index and why, and what you can do to support grass roots initiatives in the fight for sound money. To connect with Jp and the Sound Money Defense League click here. Connect with Jp on Twitter: @JpCortez27 Connect with Keith Weiner and Monetary Metals on...

Read More »What the Heck Is Happening to Silver?!

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%. As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis. JP Morgan and Motte and Bailey JP Morgan’s manipulation of...

Read More »Soho Forum Debate: Gold vs Bitcoin

The Soho Forum is a monthly debate series held in Soho/Noho, Manhattan. A project of the Reason Foundation, the series features topics of special interest to libertarians and aims to enhance social and professional ties within the NYC libertarian community. Moderated by Gene Epstein, former economics editor of Barron’s, The Soho Forum features some of the most highly regarded speakers across varied fields. At each event, the audience actively engages with the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org