The social media space is absolutely ripe for a new entrant who demands arduous verification and constantly monitors its user base to eliminate cloned and fake accounts. How many accounts on Facebook are fake? Recent estimates of half could be low. Here’s an experiment: open a Facebook account with a name that cannot possibly be anyone else’s real name, for example, Johns XQR Citizenry. Solicit a few real people to...

Read More »So You Want to Get Rich: Focus on Human Capital

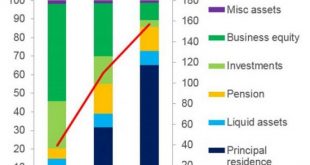

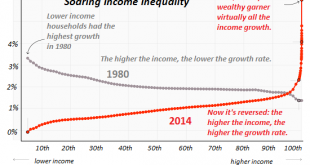

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what’s the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs. The media’s glorification of the few at the top of these sectors masks the statistical reality...

Read More »The “Working Rich” Are Not Like You and Me-or the Oligarchs

Rising income inequality may be a reflection of the changing nature of work. F. Scott Fitzgerald’s story The Rich Boy included this famous line: “Let me tell you about the very rich. They are different from you and me.” According to a recent paper published by the National Bureau of Economic Research (NBER),Capitalists in the Twenty-First Century (abstract only), the “working rich” are different from you and me, and...

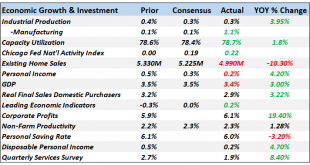

Read More »Monthly Macro Monitor – January 2019

A Return To Normalcy In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor. This President is widely rumored to have...

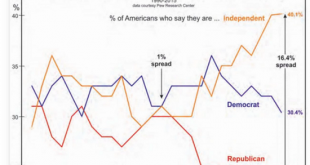

Read More »The Ruling Elites Love How Easily We’re Distracted and Turned Against Each Other

No wonder the ruling elites love how easily we’re distracted and divided against ourselves: it’s so easy to dominate a distracted, divided, blinded-by-propaganda and negative emotions populace. Let’s say you’re one of the ruling elites operating the nation for the benefit of the oligarchy. What’s the best way to distract the populace from your self-serving dominance in a blatantly neofeudal system? 1. Provide modern-day...

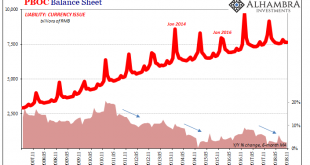

Read More »China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream. Only, you can see just on the other side of the hill the bright reflective lights of one of China’s many glittering modern cities. Not only are you reminded of the stark difference between what...

Read More »Gentrified Urban America Will Be Hit Hard by the Recession

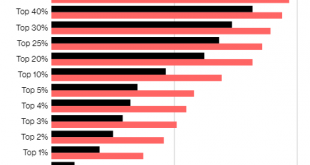

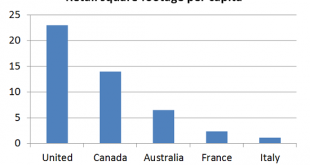

Combine sky-high commercial rents in homogenized, gentrified urban areas and sharp declines in the incomes of the limited populace who can afford gentrified urban areas and what do you get? A number of macro dynamics have set up gentrified urban America for a big fall in the coming recession. What does gentrified mean? Gentrified means only the gentry (top 10%) can afford to enjoy the urban amenities as commercial rents...

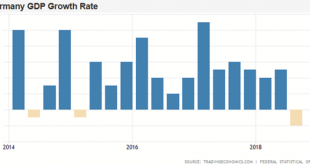

Read More »Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin Shaky China: Chinese landing could be harder than expected Brexit and EU Breakage: “I have long thought the EU will eventually fall apart” Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold We may see “yellow vests” spread globally: Economics is about to get interesting … by John Mauldin via Thoughts from the Frontline For a...

Read More »Want to Heal the Internet? Ban All Collection of User Data

The social media/search giants have mastered the dark arts of obfuscating how they’re reaping billions of dollars in profits from monetizing user data, and lobbying technologically naive politicos to leave their vast skimming operations untouched. I’ve been commenting on the cancerous disease that’s taken control of the Internet– what Shoshana Zuboff calls Surveillance Capitalism–for many years. Here is a selection of...

Read More »Two Ways the System Is Rigged: HFT and Oligarchic Inheritance

The net result of a rigged system is the vast majority of the gains in income and wealth flow to the very tippy-top of the wealth/power pyramid. We often hear how the system (i.e. our economy) is rigged to benefit the few at the expense of the many, but exactly how is it rigged? Longtime correspondent Zeus Y. recently highlighted two specific mechanisms that favor the top 0.01%: high frequency trading (HFT) and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org