Summary:

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what’s the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs. The media’s glorification of the few at the top of these sectors masks the statistical reality that those who attain wealth in these pursuits number in the hundreds or perhaps thousands, not in the millions. As in a lottery, the odds of joining such a limited group are extremely low. There are 330 million Americans and 150 million people reporting income, so statistically, the odds of getting

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what’s the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs. The media’s glorification of the few at the top of these sectors masks the statistical reality that those who attain wealth in these pursuits number in the hundreds or perhaps thousands, not in the millions. As in a lottery, the odds of joining such a limited group are extremely low. There are 330 million Americans and 150 million people reporting income, so statistically, the odds of getting

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Wealth is flowing to those who earn money from their human capital and enterprise.

So you want to get rich: OK, what’s the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs.

The media’s glorification of the few at the top of these sectors masks the statistical reality that those who attain wealth in these pursuits number in the hundreds or perhaps thousands, not in the millions. As in a lottery, the odds of joining such a limited group are extremely low.

There are 330 million Americans and 150 million people reporting income, so statistically, the odds of getting rich improve significantly if we focus on joining the ranks of the 11 million people who are getting rich from their human capital rather than on the few thousand people earning big bucks in music, film, sports, etc.

As I noted yesterday in The “Working Rich” Are Not Like You and Me, the nature of work and capital is changing. Markers that were once scarce–college degrees, for example– are now abundant, and have lost their scarcity value. What’s scarce isn’t credentials–what’s scarce are skills that generate productive problem-solving: human capital.

Work has been commoditized, that is, sliced and diced into processes that can be semi-automated or performed by workers anywhere in the globalized economy. Just as college degrees have been commoditized, so has the work the graduates are qualified to perform. The scarcity value of commoditized credentials and skills is low, and as a result, wages for commoditized work are low.

As noted yesterday, wealth is flowing to those who earn money from their human capital and enterprise: the income going to business owners dwarfs that going to the relative handful of highly paid CEOs or passive owners of stocks.

There are 11 million enterprise owners, and 1.1 million of these are reporting substantial incomes. These owners aren’t passively receiving dividends and interest; they’re running enterprises. When they retire or die, the profits of their company drop by 75%. It wasn’t the physical or financial capital they owned that was making the big money, it was their skills, values and experience.

I’ve described human and social capital at length in my book Get a Job, Build a Real Career and Defy a Bewildering Economy.

It’s very tough to make money competing against global corporations and cartels, and so it’s no surprise that many of the most successful business owners are in sectors that place a premium on skilled labor, i.e. labor that cannot be completely automated or commoditized.

|

As the research mentioned yesterday explained, having control of how your income is taxed is extremely advantageous. Employees earning big money in states with high income tax rates may be paying almost half of much of their wages in taxes: 7.65% in Social Security and Medicare taxes, 32% or 35% federal taxes and state income taxes of around 10%. (The details are in yesterday’s post.)

Business owners can elect to pass through some of their income as profits, which are taxed at roughly half the rate of total taxes levied on wages (20% compared to 40%). That 20% reduction in tax burden adds up, and is a key reason why business owners get rich while high-wage employees struggle to get ahead.

There’s another advantageous strategy to getting rich that is not politically correct, so it must be mentioned in whispers: marry someone who is highly skilled, ambitious, thrifty, kind and who has productive values. Getting rich on one income is much more difficult than getting rich on two incomes, especially if the savvy couple lives on one income and invests the other income in their own high-skill enterprise.

|

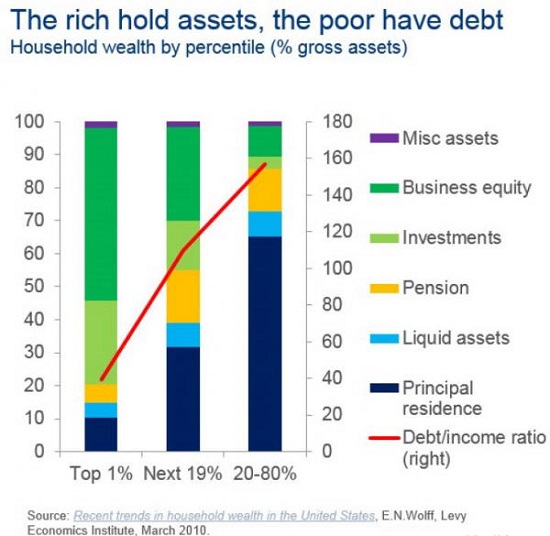

The rich hold assets, the poor have debt |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Tags: Featured,newsletter