By Lauren Rublin, via Barrons.com Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond. Simply put, Felix, president of Zulauf Asset Management in Baar,...

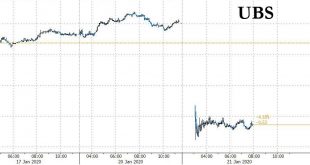

Read More »UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals. As Saxobank notes, “UBS has been hit by wealth management outflows, negative...

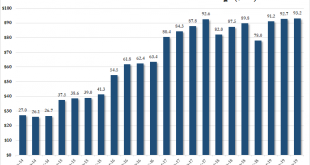

Read More »Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump’s “trade optimism” tweets. It seemed quite evident over the quarter that President Trump’s tweeting of constant...

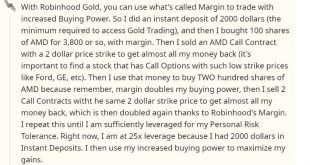

Read More »Robinhood’s “Infinite Money Cheat Code” Gives Traders Access To Unlimited Funds

If one is a central bank – such as the SNB and BOJ – life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing. It now appears that the millennial-targeting brokerage Robinhood, which offers its users “free” online trades in exchange for quietly selling their orderflow to frontrunning HFTs, has a...

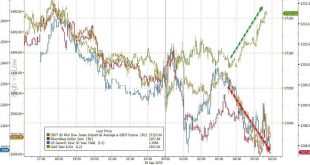

Read More »A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

Central Banks Remain Calm, Investors Not So Much The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions. Despite on-going, and universal,...

Read More »Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

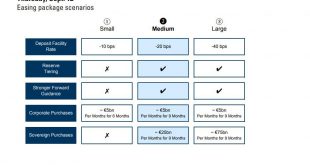

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews… About this MNI story on a possible delay in ECB QE announcement: 1) No substance, including from the ECB “sources” 2) Let’s hope the story is as accurate as the previous ones — Frederik Ducrozet...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org