Share: USD/CHF finds support at 0.9010, with buyers lifting pair to 0.9057 in late North American session. ‘Golden cross’ formation of 50-day moving average crossing above 200-day moving average opens door for bullish resumption. Sellers must push prices below 0.9000 mark and reclaim latest cycle low at 0.8887 to maintain control. The USD/CHF finds some support at around the 0.9010 area, though it failed to print a green day on Thursday after market participants...

Read More »2023-03-23 – Monetary policy assessment of 23 March 2023

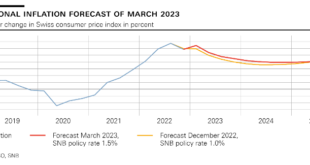

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB...

Read More »Übernahme der Credit Suisse kostet jeden Schweizer 12’500 Franken

Für den Bundesrat ist der Übernahme-Deal zwischen UBS und Credit Suisse keine Staatsrettung. Dennoch tragen die Steuerzahler mit den Staatsgarantien enorme Risiken. Die Kosten der Schweiz zur Stützung ihres Rufs als Finanzzentrum könnten sich auf 12’500 Franken für jeden Mann, jede Frau und jedes Kind im Land belaufen. Denn um den Notverkauf der Credit Suisse an die UBS abzusichern, hat der Bundesrat zugesagt, bis zu 109 Milliarden Franken zur Verfügung zu stellen....

Read More »Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank. With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation. Both banks have unrestricted access to the SNB’s existing facilities, through which they can...

Read More »«Status quo keine Option mehr»: Bekannter Bank-Experte sieht Übernahme der Credit Suisse durch UBS als Szenario Nummer Eins

Die Krise der Credit Suisse wird nach Einschätzung eines renommierten Branchenexperten von JPMorgan mit einer Übernahme der Bank enden. Die Analysten unter der Leitung des langjährigen und bekannten Bankanalysten Kian Abouhossein haben drei Szenarien für die Zukunft der Credit Suisse durchgespielt. Eine Übernahme halten sie für die wahrscheinlichste Option, und als Übernehmer kommt für sie am ehesten der Lokalrivale UBS in Frage. Einer Übernahme durch die UBS...

Read More »While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention! A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight: ECB Knot: ECB can be expected to keep raising rates for quite some time after March ECB can be expected to keep raising rates for quite some time after March And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again We can use interest rates but also sell foreign currencies to get the right monetary...

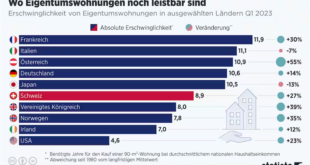

Read More »Wie viele Arbeitsjahre bis zur Traumwohnung notwendig sind

Viele Menschen in der Schweiz können sich Wohneigentum nicht leisten. Und wer es kann, muss länger sparen als früher. Die Preise für Wohneigentum haben sich in den letzten zwanzig Jahren fast immer in die gleiche Richtung entwickelt. Nach oben – und zwar ziemlich steil. Sogar jetzt, nachdem die Nationalbank schon dreimal den Leitzins erhöht hat, sind Einfamilienhäuser und Eigentumswohnungen nicht merklich günstiger geworden – um lediglich 0,2 Prozent gingen die...

Read More »2023-02-16 – Markus K. Brunnermeier to hold the 2023 Karl Brunner Distinguished Lecture

The Swiss National Bank has named Markus K. Brunnermeier as the next speaker for its Karl Brunner Distinguished Lecture Series. Markus K. Brunnermeier is Professor of Economics at Princeton University and also Director of the Bendheim Center for Finance. His research focuses on the interaction between financial markets and the macroeconomy. His work on price bubbles in stock and real estate markets, systemic risks, liquidity crises and digital currencies is of great...

Read More »Rekordzahlen ZKB: Das sagt die Kantonalbank zum CS-Effekt

Die Zürcher Kantonalbank profitierte von der Krise der CS und machte im vergangenen Jahr Rekordgewinne. Das sagt die ZKB-Führung dazu. Fassade der Filiale der Zürcher Kantonalbank bei der Hardbrücke im Industriequartier. Quelle: imago images / Andreas Haas Zwei Zahlen stechen beim Jahresabschluss der ZKB ins Auge: Zum einen knackt die grösste Kantonalbank der Schweiz zum ersten Mal in ihrer Geschichte die Marke von einer Milliarde Franken beim Gewinn. Der Überschuss...

Read More »The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison? Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a consequence, money from central banks in many countries ceased to flow to governments. Have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org