In response to the U.S. government’s weaponization of the dollar through such measures as sanctions and trade wars, China, along with Russia and other nations, are making efforts to dethrone the dollar as the world’s international reserve currency. For example, Russia and China are now using the Chinese yuan, rather than the dollar, for payment for Russian oil. Saudi Arabia is now talking about doing the same thing. One of the interesting aspects of this process involves gold. According to an article at Forexlive, China has purchased 62 tons of gold in the last two months. China’s gold reserves now total 2,010 tons. An article at BNP Paribas Asset Management by Chi Lo, the company’s senior market strategist for Asia and the Pacific, speculates that China might

Topics:

Jacob G. Hornberger considers the following as important: 6b.) The Future of Freedom Foundation, Featured, Hornberger's Blog, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In response to the U.S. government’s weaponization of the dollar through such measures as sanctions and trade wars, China, along with Russia and other nations, are making efforts to dethrone the dollar as the world’s international reserve currency. For example, Russia and China are now using the Chinese yuan, rather than the dollar, for payment for Russian oil. Saudi Arabia is now talking about doing the same thing.

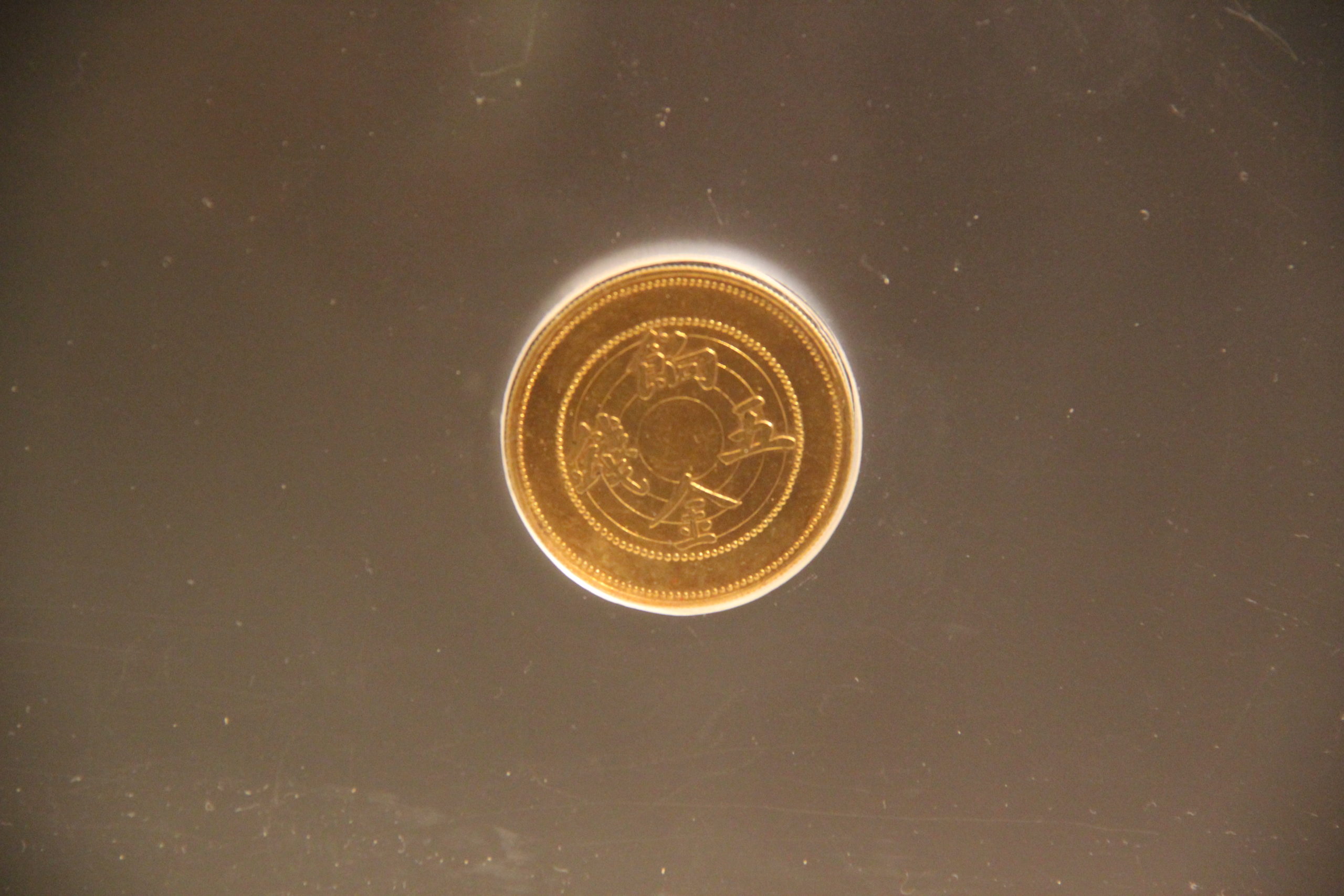

One of the interesting aspects of this process involves gold. According to an article at Forexlive, China has purchased 62 tons of gold in the last two months. China’s gold reserves now total 2,010 tons.

An article at BNP Paribas Asset Management by Chi Lo, the company’s senior market strategist for Asia and the Pacific, speculates that China might be considering making its currency convertible into gold. Lo writes: “Making the renminbi convertible into gold effectively turns the currency into a global investable asset for foreign renminbi owners, boosting their confidence in and demand for the Chinese currency.”

If China goes down that road, then gold, not the yuan/renminbe, automatically becomes China’s official currency. That’s because the paper instruments effectively become debt instruments promising to pay gold.

What effect would that have on the U.S. dollar? It is impossible to say. But one thing is for sure: The U.S. dollar promises to pay nothing. Ever since the 1930s, the U.S. official currency has been irredeemable paper. When given a choice between paper that promises gold and paper that promises nothing, will the world stick with the U.S. dollar?

What effect would that have on the U.S. dollar? It is impossible to say. But one thing is for sure: The U.S. dollar promises to pay nothing. Ever since the 1930s, the U.S. official currency has been irredeemable paper. When given a choice between paper that promises gold and paper that promises nothing, will the world stick with the U.S. dollar?

The irony is that if China, which is ruled by a communist regime, decides to make gold its official money, it will essentially be copying the monetary system that America had from the founding of the United States until the 1930s.

The official money of the American people for more than a century after the U.S. was established consisted of gold coins and silver coins. During that time, there were paper instruments of indebtedness, such as bank notes, but everyone understood that they were promises to pay money, not money themselves. The money they promised to pay was gold coins and silver coins.

America’s monetary system was established by the Constitution, which is supposed to be the highest law of the land. It gave the federal government the power to coin money but not print money. It also prohibited the states from making anything but gold and silver coins legal tender.

It was the finest monetary system in history, especially since there was no Federal Reserve to debauch the value of the currency by printing gobs of paper money. But it all came to an end in the 1930s when President Roosevelt nationalized gold, ordered Americans to surrender their gold to the government, and made it a felony offense to own gold. It was all done without even the semblance of a constitutional amendment.

The result has been a continual drop in the value of the dollar ever since the 1930s. That’s because the Federal Reserve, decade after decade, has flooded the economy with newly printed paper money to finance the ever-increasing costs of America’s welfare-warfare state way of life. At the same time, U.S officials have weaponized the dollar to wage economic war against other nations that they consider to be “enemies, “rivals,” “antagonists,” “opponents,” “adversaries,” or “competitors.”

If China does adopt gold as its official money, market conditions could force U.S. officials to readopt gold coins and silver coins as America’s official money. Wouldn’t that be ironic — a communist regime forcing a U.S regime to restore the sound money to our land that was established by the Constitution?

Tags: Featured,Hornberger's Blog,newsletter