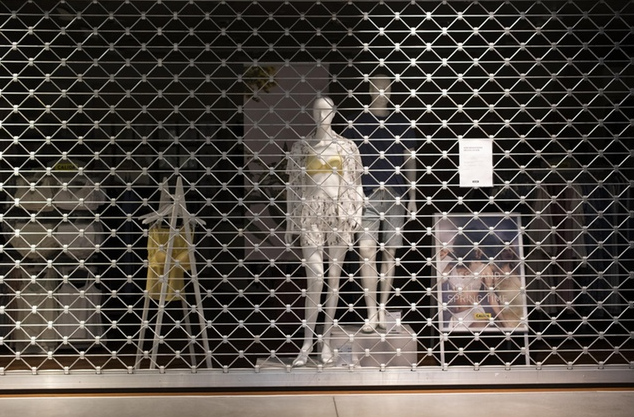

Closed shops, cancelled flights, shut construction sites: the pandemic is causing the Swiss economy to lose an estimated CHF4-5 billion a week (Keystone) The current pandemic will plunge the world economy into recession, at least in the first part of the year. What tools does Switzerland have to minimise the economic and social damage of this crisis? And what factors could jeopardise the prospects for an economic recovery? The CHF10 billion (.3 billion) in emergency aid announced by the Swiss government on March 13 was increased to CHF40 billion on March 20 and then to CHF60 billion on April 3. With this money, which is far from final, the government intends to implement measures to stem the economic and social consequences of the coronavirus pandemic. In

Topics:

Swissinfo considers the following as important: 3.) Swiss Info, 3) Swiss Markets and News, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Closed shops, cancelled flights, shut construction sites: the pandemic is causing the Swiss economy to lose an estimated CHF4-5 billion a week (Keystone)

The current pandemic will plunge the world economy into recession, at least in the first part of the year. What tools does Switzerland have to minimise the economic and social damage of this crisis? And what factors could jeopardise the prospects for an economic recovery?

The CHF10 billion ($10.3 billion) in emergency aid announced by the Swiss government on March 13 was increased to CHF40 billion on March 20 and then to CHF60 billion on April 3. With this money, which is far from final, the government intends to implement measures to stem the economic and social consequences of the coronavirus pandemic. In particular, they will serve to provide liquidity for companies, prevent redundancies as far as possible and cover the loss of earnings of employees.

This is the largest aid package ever agreed by the Swiss government. The CHF60 billion planned so far corresponds almost to what the government spends in one year (CHF71 billion in 2019) and is 8.5% of gross domestic product (GDP). But it will probably not be enough to cope with the economic repercussions of the pandemic. According to various estimates, the Swiss economy is losing CHF4-5 billion a week, which is likely to increase considerably if the current situation continues and many companies close down.

Switzerland overcame the 2008 crisis better than many other European countries, although the crisis had directly hit one of the pillars of its economy, the banking sector. It has at least three strengths to deal with this historic challenge, but just as many weaknesses.

+ Moderate public debt

The G20 countriesexternal link, which provide 85% of global economic output, have said they will earmark $5 trillion to minimise the economic and social damage of the pandemic, boost growth and maintain market stability. Several other governments intend to inject huge amounts of money into their economies. These contributions are essential to deal with the current emergency, but they will further burden an increasingly unsustainable public debt for many countries.

According to OECD data, in 2018 the debt burden was already overwhelming for Japan (240% of GDP), Italy (147%), the United States (136%), France (122%), (Britain 117%) and Spain (115%), to name but a few countries. In Switzerland, public debt (government, cantons and municipalities) amounts to just 27% of GDP.

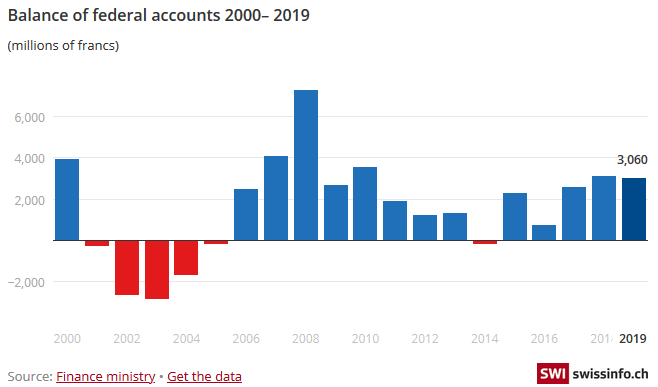

| This low share is linked in particular to the debt brakeexternal link, a mechanism introduced by the government since 2003 to prevent structural financial imbalances and to put an end to the persistent deficits accumulated since the 1990s. Since 2006, government accounts have almost systematically recorded surpluses, which are used to relieve debt. The debt brake, which has also been adopted by the cantons, now gives Switzerland good financial leeway to alleviate the repercussions of the inevitable economic recession.

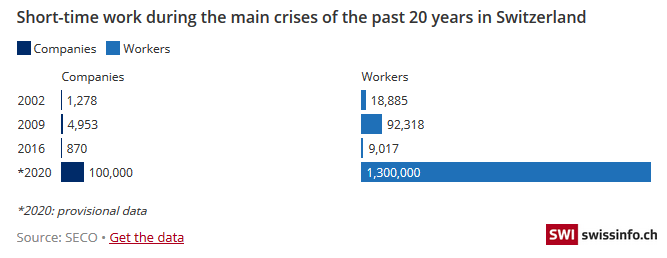

+ Compensation for short-time work Another important tool to ease the economic and social consequences of the pandemic is compensation for short-time work, set up to cope with temporary declines in business activities and to safeguard jobs. In times of crisis, instead of making people redundant, companies can reduce working hours for a certain period of time and use this compensation to cover part of the wages. Thanks to this, employers hold on to already trained employees who can quickly resume activities. For their part, employees don’t end up unemployed and keep their social protection intact. In the United States in comparison some ten million workers have found themselves unemployed in the past three weeks. |

Balance of federal accounts, 2000-2019 |

| Short-time work compensation has already been paid to thousands of companies in recent crises, but never at levels comparable to the current one. Since mid-March, benefits have been claimed for around 1.3 million employees – a quarter of the active workforce in Switzerland.

+ Own central bank Under Mario Draghi, the European Central Bank played a key role in stabilising the economic situation in the eurozone after the international crisis of 2008. But the current disputes over whether to issue eurobonds demonstrate once again the conflicting expectations of European states. The Swiss National Bankexternal link (SNB), however, can implement a monetary policy tailored to the specific needs of an individual economy. |

Short-time work during the main crises of the past 20 years in Switzerland |

Should the coronavirus crisis drain the government’s resources, the SNB could intervene with large injections of money. The idea of such interventions by the SNB has always horrified more liberal parties and economists. But it was primarily the SNB that saved the largest Swiss bank (UBS) in 2008. The pressure on the central bank, which posted a profit of CHF50 billion last year, would become quite strong in the event of major social imbalances.

– Dependence on exports

Switzerland does not have a large domestic market like Germany or Japan and earns around one franc in two abroad. More than two-thirds of its exports are absorbed by the EU and the US. If these countries were to slide into a long and deep recession, Switzerland could not come out of it lightly either, as was the case after the collapse of the world economy in 2008.

– Franc too strong

The strength of the Swiss franc has symbolised the stability of the Swiss economy for decades and helped attract investment in companies and capital into banks. However, since the introduction of the euro at the latest, the strong franc has also become one of Switzerland’s weak points: any strengthening of the franc against the European currency weakens the competitiveness of the export industry and the tourism sector. Over the past fortnight the SNB has once again had to intervene on several occasions to prevent another surge in the franc, which is regarded as a safe haven in times of crisis. But even these interventions may not be enough in the event of new turbulence in the eurozone.

– Hazardous isolation

In the wake of the 2008 crisis, the United States and the main European countries were forced to finance enormous bank rescue and economic recovery measures which left behind a mountain of debt. In order to get money back into the state coffers, the governments of these countries decided to adopt a common strategy to eliminate loopholes used by companies and individuals to escape the tax authorities.

Under the aegis of the G20, the OECD and the EU, major international tax reforms have been introduced, leading to the automatic exchange of information on bank accounts and new rules on the taxation of transnational corporations. Switzerland, completely isolated, is among the countries that have been most affected by the new international standards.

A scenario that risks being repeated with this new crisis. The Swiss government, for example, will have little say in defending its interests in the ongoing negotiations at the G20 and the OECD on a new international corporate tax system. It should enable countries with a large market to get a much more substantial share of the taxes paid by web giants and other transnational corporations. According to initial estimates, the government risks losing CHF5 billion in tax revenue a year.

Tags: Business,Featured,newsletter