The US Fed is considering lifting its inflation target above 2 percent in order to revive the economy. Contrary to the accepted practice, the Fed is not expected to raise an alarm if the measured price inflation begins to rise. The US central bank is not expected to counter this increase with a tighter monetary stance as in the past. In fact, the idea is to continue robust monetary pumping until the economic data points toward a strong economy. According to most experts, when an economy falls into a recession the central bank can pull it out of the slump by pumping money. This way of thinking implies that money pumping can somehow grow the economy. The question is, How is this possible? After all, if money pumping can grow the economy, then why not pump plenty

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The US Fed is considering lifting its inflation target above 2 percent in order to revive the economy. Contrary to the accepted practice, the Fed is not expected to raise an alarm if the measured price inflation begins to rise. The US central bank is not expected to counter this increase with a tighter monetary stance as in the past. In fact, the idea is to continue robust monetary pumping until the economic data points toward a strong economy.

According to most experts, when an economy falls into a recession the central bank can pull it out of the slump by pumping money. This way of thinking implies that money pumping can somehow grow the economy. The question is, How is this possible? After all, if money pumping can grow the economy, then why not pump plenty of it to generate massive economic growth? By doing that central banks worldwide could have already created everlasting prosperity on the planet.

For most commentators the arrival of a recession is due to shocks such as the covid-19 that push the economy away from a trajectory of stable economic growth. Shocks weaken the economy, i.e. lower the economic growth, so it is held. As a rule, however, a recession or an economic bust emerges in response to a decline in the growth rate of money supply. Note that a decline in the monetary growth works with a time lag. This means that the effect of past declines in the growth rate of money supply could start asserting their influence after a prolonged period.

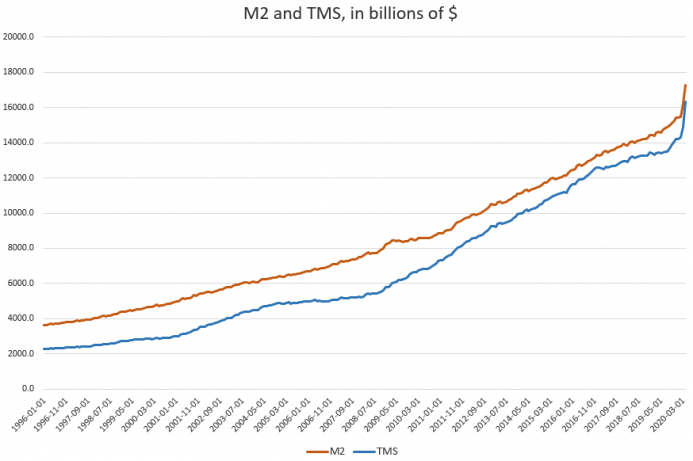

It is likely that the present economic slump was set in motion by a strong downtrend in the yearly growth rate of AMS money supply from 14.3 percent in August 2011 to –0.6 percent by August 2019. As a result, various activities that sprang up on the back of the previous strong money growth rate came under pressure. (Observe that the yearly growth rate of AMS jumped from 0.7 percent in March 2007 to 14.3 percent by August 2009.) These activities cannot fund themselves independently. They survive on account of the support that the increase in money supply provides. The increase in money diverts to them real savings from wealth generating activities and consequently weakens wealth generators.

A decline in the growth rate of money supply undermines various false nonproductive activities, and this is what a recession is all about. Recessions, then, are not about a weakening in economic activity as such but about the liquidation of various nonproductive activities that sprang up on the back of the previous increase in money supply.

Real Savings Fund Economic Activity

Irrespective of whether an activity is productive or nonproductive, it must be funded. At any point in time the number and the size of activities that can be undertaken is determined by the available amount of real savings. From this, we can infer that the overall growth rate of productive and nonproductive activities as a whole is set by the growth rate in the pool of real savings. (Individuals, whether in productive or nonproductive activities, must have access to real savings in order to sustain their lives and well-being. Also, note that money cannot sustain individuals but can only fulfill the role of the medium of exchange.)

As long as wealth producers can generate enough real savings to support productive and nonproductive activities, easy money policies will appear to be successful. Over time a situation could, however, emerge where as a result of persistent easy monetary policy and reckless government fiscal policies, there are not enough wealth generators left. (Wealth generators are badly damaged by loose monetary and reckless government policies.) Consequently, real savings are not large enough to support an increase in economic activity.

Once this happens, the illusion of loose monetary and fiscal policies is shattered—real economic growth must come under downward pressure. Now, if the Fed were to accelerate its monetary pumping while the pool of real savings is declining, it runs the risk of severely damaging further the pool of real savings.

The various commentators who subscribe to the view that the acceleration in money pumping could fix things imply that something can be created out of nothing. Neither the Fed nor the government can grow the economy. All that stimulatory policies can do is redistribute real savings from wealth producers to nonproductive activities. These policies encourage consumption that is not supported by wealth generating production. Without arresting the massive pumping and cutting government outlays, the US economy is heading toward a prolonged slump

Now, the pool of real savings has been badly hurt by the past reckless monetary policies of the Fed, in particular by Ben Bernanke’s Fed in 2008. Also, the recent huge monetary pumping by the Fed, which is mirrored by the large increase in our monetary measure AMS, is going to weaken significantly the process of real savings formation. This in turn is setting the foundation for a prolonged economic slump. Observe that the yearly growth rate of AMS shot up from 3 percent in September 2019 to 60 percent by July 2020.

The response of the government and the Fed to the covid-19, coupled with the likely depleted pool of real savings on account of the past reckless policies of the Fed and the government, has made the economic bust more severe. Contrary to popular thinking, the covid-19 did not set the economic bust as such. It was set in motion by a downtrend in the monetary growth during August 2011 to August 2019.

The response of central authorities to the covid-19 in terms of lockdowns and massive monetary pumping has damaged further the pool of real savings and pushed the economy into a severe slump. I suspect that the pool of real savings is currently declining. The likely decline in the pool of real savings undermines not only false nonproductive activities but also productive economic activities. Consequently, if reckless Fed and government policies that have weakened the process of real savings formation continue, it is quite likely that the US economy could experience a prolonged economic stagnation.

In the meantime, rather than allowing businesses to get on with wealth generation, American politicians are making plans for how to redistribute further the already diluted real savings of the wealth generators. While the White House proposes a $1.3 trillion coronavirus aid bill, the Democrats hold that this sum is not large enough and are suggesting that it should instead be around $2.2 trillion.

There is a way out of the crisis: by cutting to the bone government spending and the closing of all the loopholes for the creation of money out of “thin air.” By allowing businesses to do their jobs, the process of real wealth generation could be activated and the economy could escape the path of prolonged stagnation in no time. All that is required is that central authorities step aside and allow businesses, which know better how to generate prosperity, to get on with the task of growing the economy.

Tags: Featured,newsletter