We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list. To

Topics:

George Dorgan considers the following as important: 2.) Trade Balance News Service Bunt [FR], 2) Swiss and European Macro, Featured, newsletter, Switzerland Exports, Switzerland Exports by Sector, Switzerland Imports, Switzerland Imports by Sector, Switzerland Trade Balance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

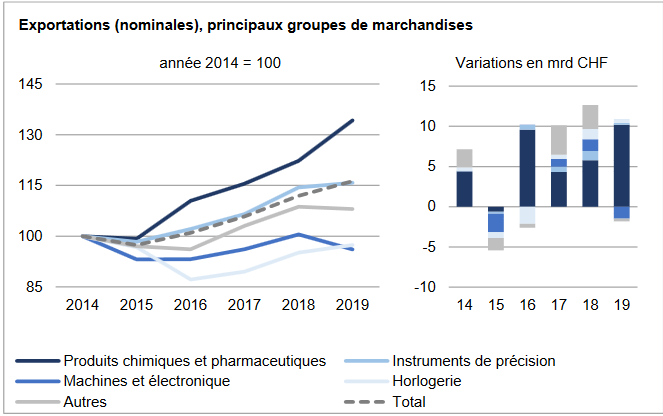

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

Exports and Imports YoY DevelopmentDespite a climate of uncertainty linked to trade tensions and the global economy, Swiss foreign trade grew in 2019, albeit at a slower pace. Exports increased by 3.9% to 242.3 billion francs while imports increased by 1.6% to 205.0 billion francs, the two directions of traffic thus reaching an historic peak. The trade balance closed with a record surplus of 37.3 billion francs. In short ▲ Fourth consecutive annual growth in exports ▲ Exports from the chemical-pharmaceutical sector: jump of more than 10 billion francs ▼ Slowdown in watchmaking and precision instrument exports and contraction in the machinery and electronics sector |

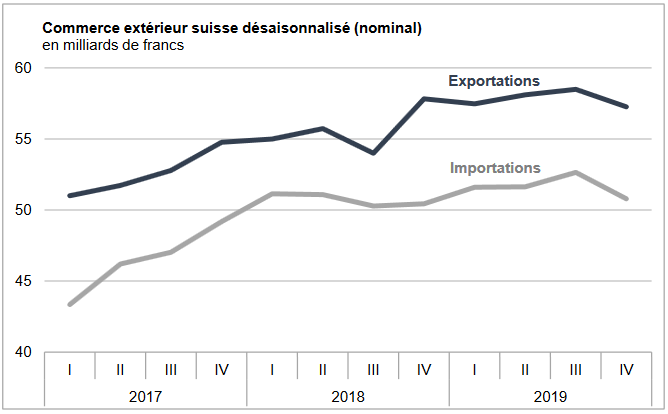

Swiss exports and imports, seasonally adjusted (in bn CHF), December 2019(see more posts on Switzerland Exports, Switzerland Imports, ) Source: newsd.admin.ch - Click to enlarge |

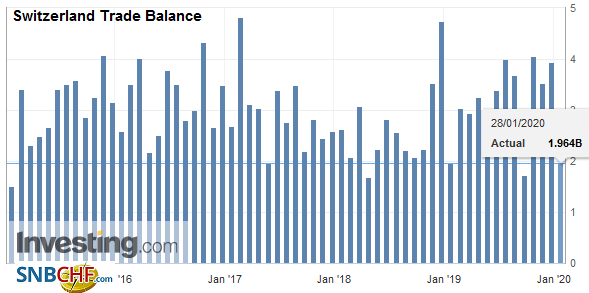

Overall EvolutionIn 2019, Swiss foreign trade grew in both directions of traffic for the fourth consecutive year, albeit at a slower pace. Exports increased by 9.1 billion francs to reach a record level of 242.3 billion francs (+ 3.9%; real: -1.2%). Imports increased by 3.1 billion francs to reach a historic peak at 205.0 billion francs (+ 1.6%; real: -1.0%). However, in the last quarter, a downturn affected both directions of traffic. The trade balance closed with a record surplus of 37.3 billion francs, which is explained by the positive balance of 61.9 billion francs in the chemicals and pharmaceuticals sector. |

Switzerland Trade Balance, December 2019(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

ExportsExports to the USA have doubled since 2011 Exit growth was driven by the heavyweight in exports, chemicals and pharmaceuticals. Their sales indeed swelled by 10.2 billion francs over one year (+ 9.8%). The largest contributions were made by immunological products (+5.8 billion francs; + 20.6%) and drugs (+3.1 billion). Watchmaking, up 500 million to 21.7 billion francs, as well as precision instruments (+203 million) also improved, even if they registered a loss of speed. After having increased in the previous three years, the machinery and electronics sectors as well as the metals (other goods group) weakened by 4.4 and 5.7% respectively. In 2019, Swiss products saw their demand gain ground in the three main markets. North America was the most dynamic (+ 8.9%), although the increase was mainly due to the USA (+3.4 billion francs). Sales to Europe (+ 3.1%) and Asia (+ 3.5%) increased at almost the same rate. The European increase notably took root in Belgium (+ 24.0%), the Netherlands (+ 14.7%), Spain (+ 14.3%) as well as in Russia (+ 23.7%) , and mainly concerned chemical and pharmaceutical products. Conversely, France (-6.0%) declined, as did the United Kingdom (-1.8%). The latter, however, limited the breakage after the double-digit decline of the previous year. As for Asian dynamism, it was concentrated in China (+ 9.7%) and Singapore (+ 13.3%). |

Swiss Exports per Sector December 2019 vs. 2018(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) Source: newsd.admin.ch - Click to enlarge |

ImportsImports: jewelery exceeds 16 billion francs Also at entry, the increase rested on the chemical-pharmaceutical sector (+2.5 billion francs), which has progressed steadfastly since 2015. Medicines (+1.9 billion) as well as raw materials and base (+1.6 billion) played the role of spearhead while the active ingredients declined (-1.1 billion). Also worth noting is the performance of the jewelry industry (+ 3.3%; other goods group), which confirmed its high level after two years of double-digit growth. The machinery and electronics sector, the second largest group at the outset, stagnated. From a geographic perspective, imports from Asia (+ 8.8%) posted the strongest growth. This largely depended on the United Arab Emirates (+1.3 billion francs; jewelry). Up 4.5% to 14.9 billion francs, arrivals from China reached a record level. North America continued its momentum (+ 1.2%); here, the US (+ 9.3%) offset the decline in Canada, however. Deliveries from Europe stagnated (euro area: -1.4%). The positive development of the United Kingdom (+1.6 billion) and Spain (+844 million) offset the decline in France and Ireland (1.1 billion each). |

Swiss Imports per Sector December 2019 vs. 2018(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) Source: newsd.admin.ch - Click to enlarge |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance