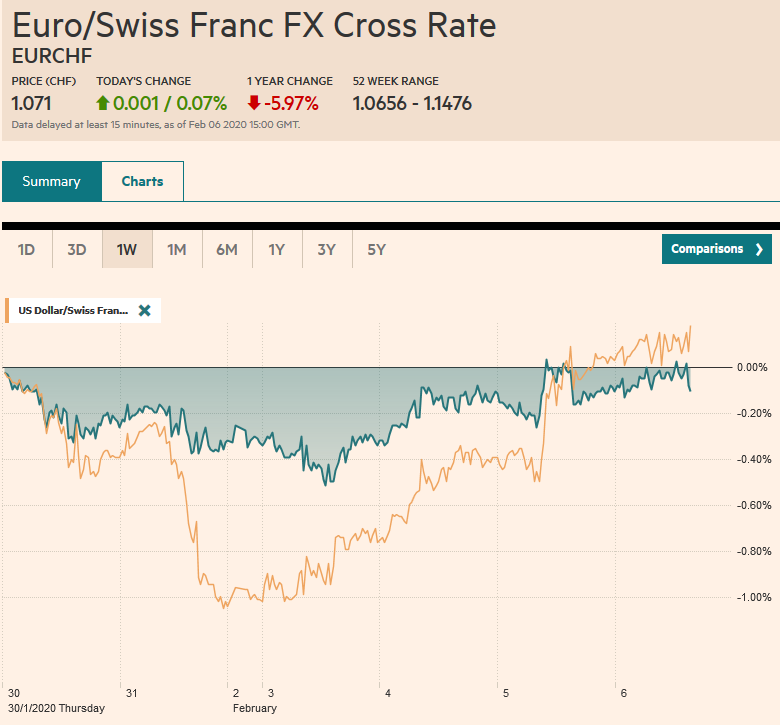

Swiss Franc The Euro has risen by 0.07% to 1.071 EUR/CHF and USD/CHF, February 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe’s Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer. Benchmark bond yields have edged higher in Europe and Asia, while the US 10-year yield is hovering around 1.65%. The greenback is bid against all the major currencies and most emerging market currencies, but ranges are

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brazil, Brexit, Currency Movement, Featured, Germany, India, newsletter, trade, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% to 1.071 |

EUR/CHF and USD/CHF, February 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

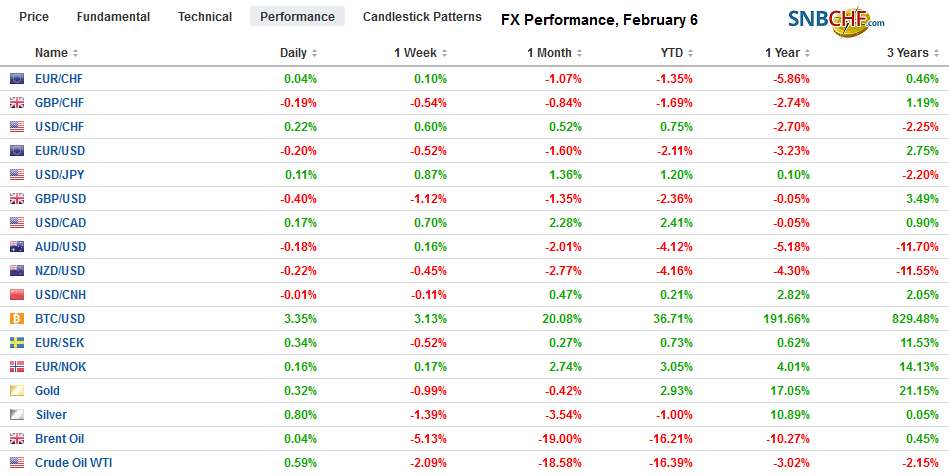

FX RatesOverview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe’s Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer. Benchmark bond yields have edged higher in Europe and Asia, while the US 10-year yield is hovering around 1.65%. The greenback is bid against all the major currencies and most emerging market currencies, but ranges are narrow. Only a handful of emerging market currencies are resisting the dollar’s strength today, and the South Korean won is leading almost a 1% gain. Gold found support around the $1550 level and consolidating around $1560. March WTI, which had probed below $49.50 in the past two sessions, is flirting with the $52-mark as OPEC+ talks extend for another day. |

FX Performance, February 6 |

Asia Pacific

As part of the US-China trade agreement, both sides promised to reduce tariffs at the end of next week. Although there is speculation that the natural catastrophe clause in the agreement will be used to modify this year’s targets, it is too early to expect a formal discussion. The easing of the tariff schedules will be implemented as planned. China’s part includes cutting tariffs on soy and meat from the US. The 15% tariffs the US has levied will be halved. None of this is in response to the coronavirus.

Australia reported somewhat disappointing data. Retail sales in December fell by 0.5%. Economists had anticipated a decline half as much. The November series was revised to show a 1% gain instead of 0.9%, as was originally reported. On the other hand, when adjusted for inflation, retail sales rose by 0.5% in Q4, which is a bit more than expected and follows a 0.1% decline in Q3. Separately, Austalia reported a slightly smaller than expected trade surplus in December of A$5.2 bln. Exports rose 1% on the month while imports rose by 2%.

As widely expected, the Reserve Bank of India kept rates steady. High December inflation (~7.3%) and the jump in the January composite PMI (56.3 from 53.7 and below 50 in September and October) took away the urgency to move. Growth has steadily slowed over the past several quarters, from an 8.1% pace in Q1 2018 to 4.5% in Q3 19. The government unveiled the new budget last week, and it was widely seen as unimpressive. However, for international business and investors, an important element is that India will move toward becoming more integrated into the global capital markets, and this means efforts over time to get its bond market included in world benchmarks and boost INR trading onshore. The Bank for International Settlements data suggests daily INR turnover in India is around $35 bln a day and $47 bln a day in London (mostly non-deliverable forwards) and $22 bln in rest of the world. Separately, and against a more divided call, the central bank of the Philippines kept rates unchanged as well at 3.75%. After the decision, the US dollar gave up yesterday’s gains against the peso.

The dollar rose to almost JPY110 in Asia before coming off a bit in Europe. The dollar has not traded above there since January 22. Initial support near JPY109.75 remains intact. An option for almost $900 mln at JPY109.50 may also protect the downside. The Australian dollar is trading quietly within yesterday’s range. It is stuck now in about a 15-tick range on either side of $0.6750, where an A$1.3 bln option expires today. There is another expiring option at $0.6770 (for ~A$535 mln). The Chinese yuan extended its recovery before stabilizing without re-entering the range seen prior to the close for the lunar holiday. On January 23, the dollar reached around CNY6.9425. Today’s low was about CNY6.96. To put it in some perspective, consider that the 200-day moving average is found near CNY6.9655. The dollar is finishing the mainland session near CNY6.97.

Europe

German factory orders at the end of last year disappointed and warns of the fragility of the recovery not only Europe’s largest economy but in the entire region. German factory orders were expected to have risen by 0.6% but instead dropped by 2.1%. The upward revision in November to show a 0.8% decline instead of a 1.3% fall hardly is sufficient to remove the sting of the December disappointment. Domestic orders actually increased for the second consecutive month (1.4% after 1.3%). Foreign orders fell 4.5%, and this is not a “China slowdown story.” The problem was in the EMU, where orders fell by almost 14%. Non-eurozone foreign orders rose by a little more than 2%. Germany reports industrial production figures tomorrow, and there is not a close fit in the short-run. A small decline is expected after a 1.1% surge in November.

The failure of the anti-establishment movement that seemed to be everywhere after the Great Financial Crisis appears to be giving way to two forces that are filling the vacuum that offer a new set of priorities; nationalism and environmentalism. The drama in this weekend’s Irish election is coming from what appears to be a surge of support for the nationalist Sinn Fein. Here is the rub; neither of the main parties is likely to get a majority, and both swear against forming a coalition with the former political arm of the IRA. Varadker heads up a minority government. In Germany, the CDU joined forces with its old ally, the FDP, in Thuringia to push out The Left Premier. Following the inconclusive election last October, The Left looked to hold the premiership with the support of the SPD and Greens, but with the help of AfD support the center-right won on a 45-44 vote. It is the first time the FDP has a premiership, and the local party disregarded the national party’s efforts to isolate the nationalist AfD. Meanwhile, Italy’s League leader Salvini has not given up toppling the government and forcing national elections A new opportunity could be created by a poor showing in the spring round of local elections, and the Five-Star Movement imploding with the League picking up some defectors.

The euro has found some support ahead of last week’s lows a little above $1.0990. The upside has been limited to about $1.1015. The single currency needs to resurface above $1.1030 to stabilize the tone, and there is an option for approximately 890 mln euro struck there that expires today. The UK and EU have not begun the formal negotiation process of trade talks, but both sides appear to be doing their best to antagonize the other. As expectations face the cold shock of reality, that a no-deal Brexit has not been avoided and rather represents a strong likelihood, sterling has been unable to resist the tug of the bid dollar. Sterling is at the lower end of the consolidative range that has been seen since the rally on the early election results carried it a little through $1.35. This week’s low is about $1.2940, and below, there is the low from around Xmas nearer $1.29. There is an expiring option for about GBP460 mln at $1.30 today. The euro is about in the middle of its roughly GBP0.8400-GBP0.8600 trading range.

America

Given the importance of trade as a driver of the capital markets, and US threat to treat currency undervaluation as an improper subsidy that can be responded to by countervailing tariffs, should investors rest assured that the US trade deficit narrowed in 2019 for the first time in six years? The US goods and services trade deficit narrowed by about $11 bln. However, it is more than accounted for by the $74 bln fall in the US deficit with China. And that means that the US trade deficit with the rest of the world grew. Just like China joining the WTO posed a significant challenge for Mexico, the recent tariff conflict has seen Mexico’s trade surplus with the US rose by a quarter last year to a little more than $100 bln. More important in terms of the Trump Administration’s agenda is the record trade deficit the US has with Europe at almost $180 bln, a roughly three-fold increase in the past decade. Consider too that petroleum imports fell by about $31.5 bln, which means that the US non-oil goods deficit was a record high of nearly $840 bln.

Today’s US data schedule features the Challenger job cuts, which may see economists tweak expectations for tomorrow’s national jobs report. Weekly initial jobless claims are overshadowed by tomorrow’s report. The Q4 data on productivity and unit labor costs are derived from the recent GDP report and tend not to move the market. More interesting may be the comments from the Fed’s Kaplan and Quarles for insight into how officials are thinking about the impact of the coronavirus on the US. San Francisco Fed President Daly seemed to play it down, suggesting no material impact on the US economy. Still, even with the S&P 500 at record highs, the December 2020 fed funds futures contract continues to price in a little more than one cut this year. Specifically, since the FOMC meeting and the adjustment in interest on reserves (interest is paid on all reserves not just excess as in IOER), the effective fed funds rate has ticked up to 1.59% from 1.55%. The December fed funds futures contract implies an effective rate of 1.28%. Last year’s three rate cuts were attributed to the global risks, some of which were materializing. Isn’t the case even more potent now?

Mexico reports January inflation figures today. The month-over-month headline and core rates are expected to rise at a slower rate than December, but the base effect means that the year-over-year rate will likely edge up. Mexico’s headline rate may increase to nearly 3.3% from a little more than 2.8%. Nevertheless, Mexico’s high real and nominal rates and the strength of the peso gives the central bank room to cut rates at next week’s (February 13) meeting (to 7% from 7.25%). Separately, the central bank of Brazil cut the Selic rate by 25 bp yesterday (to 4.25%) as widely anticipated. However, with the rate slipping through inflation (~4.3%), the central bank signaled it will hold policy steady for some time.

The US dollar has tested the CAD1.33 level for the past three sessions. It has not closed above there, but at the same time, it has been unable to really distance itself from the cap either. Yesterday’s low was a little below CAD1.3265. A break, and ideally, a close below CAD1.3250, would help confirm a high is in place. The daily technical indicators have not turned lower yet but are poised to do so shortly. The US dollar has fallen to a new low for the year today against the Mexican peso near MXN18.56 in Asia, where long peso short yen plays are popular. The greenback bounced to about MXN18.63 in Europe before new sellers emerged. Important support is seen near MXN18.50. The Dollar Index has a three-day rally coming into today’s session. The proximity of the November highs (~98.50) and tomorrow’s US employment data may be injected a note of caution today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brazil,Brexit,Currency Movement,Featured,Germany,India,newsletter,Trade