With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today. Disappointing April industrial production figures in Germany and France did not do the euro any favors. Sterling is faring better than the euro after Prime Minister May survived yet another mini-crisis within her cabinet. Japan failed to revise higher its initial estimate that Q1 GDP contracted 0.6% at an annual pace. The composition was changed, however. Consumption was shaved, while business spending was revised higher. Separately, Japan reported a somewhat smaller than expected April

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China Trade Balance, Featured, Germany Trade Balance, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today. Disappointing April industrial production figures in Germany and France did not do the euro any favors. Sterling is faring better than the euro after Prime Minister May survived yet another mini-crisis within her cabinet.

Japan failed to revise higher its initial estimate that Q1 GDP contracted 0.6% at an annual pace. The composition was changed, however. Consumption was shaved, while business spending was revised higher. Separately, Japan reported a somewhat smaller than expected April current account surplus. More interesting for investors was the portfolio flow data contained in the balance of payments report.

In April, following the Italian election in early March, Japanese investors bought JPY196.4 bln (~$1.8 bln) of Italian bonds, the most in two years. Japanese investors also bought the most Spanish bonds since at least 2005 (~JPY350 bln), though note that this may include some non-sovereign Spanish paper as well. Japanese investors continue to buy French bonds (~JPY218 bln). They also bought nearly JPY172 bln US bonds. The bulk of these purchases were financed by the liquidation of German Bunds, of which Japanese investors sold JPY685 bln. Some of the pressure on the euro in recent weeks was thought to be related to the decision to boost the currency hedge ratio on EMU assets.

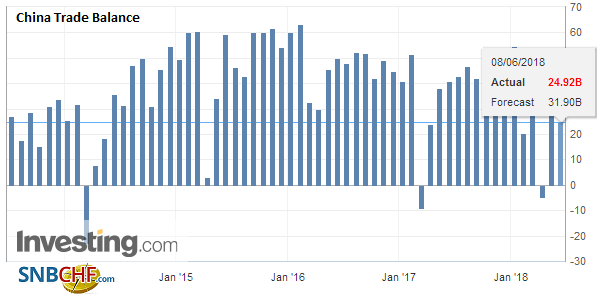

| China reported a May trade surplus of just less than $25 bln after the $28.8 bln surplus in April was revised to $28.3 bln. Exports were steady, rising 12.6% from a year ago, the same as in April, after the revisions. However, imports surged 26% but were expected to have slowed after the 21.5% rise in March. Meanwhile, the US-Chinese trade tensions come to a head next week. The US is expected to specify the $50 bln goods that will be hit with an extra 25% tariff for the intellectual property dispute. China has said that if the US goes through with this, its trade concession offers will be retracted. |

China Trade Balance (USD), May 2018(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

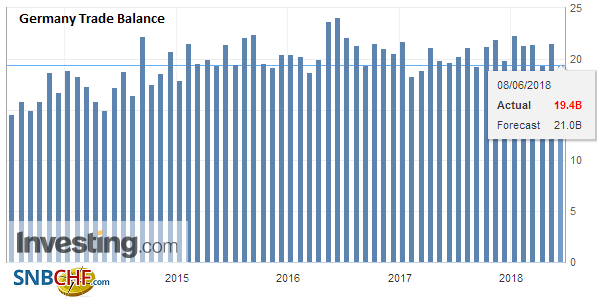

| Germany reported a smaller trade surplus for April. The 20.4 bln euro surplus contrasts with March’s 25.2 bln euro surplus. Here too it was mostly a function of rising imports (2.2% vs. -0.2% in March), but exports also fell (-0.3% vs. 1.7%). This follows yesterday’s news of an unexpected fall in factory orders and today’s surprisingly poor industrial output figures. Industrial production slumped 1% in April, and even though the March series was revised higher (1.7% from 1.0%), the overall tone was disappointing, and this euro retreated on the news. |

Germany Trade Balance, May 2018(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

France also missed on its April industrial production report. It fell 0.5% in contrast to expectations of a 0.3% rise. It follows a 0.4% decline in March and is the first back-to-back decline since Sept-Oct 2016. If there was a silver lining, it was the manufacturing edged up (0.4%) after the March report was revised to 0.3% from 0.1%.

The US dollar is paring this week’s losses against most of the major currencies. The yen is the only currency gaining on the dollar today and for the week, and the Canadian dollar and Australian dollars are the only major currencies the greenback has gained against this week, coming into the North American session. The euro has approached initial support near $1.1750, where the five-day moving average is also found, after probing as high as $1.1840. The euro has not closed below its 5-day moving average since it bottomed on May 29 near $1.1510. We suspect upticks toward $1.18 will be sold.

While the euro has been sold through yesterday’s lows, sterling has not. Its low was a little below $1.3375. Initial resistance is pegged near $1.3440 in the North American session. The dollar failed to close above JPY110 yesterday and has retreated further today. Softer US yields and weaker equities are encouraging yen gains today. The nearly $700 mln option struck at JPY110 that expires today is less relevant today than it seemed like yesterday as the dollar is being sold to new lows for the week, near JPY109.25.

The Australian dollar is the weakest of the major currencies, losing about 0.75% against the greenback. It is holding a little above the week’s low set on Monday near $0.7555. It has approached $0.7680 in the middle of the week. The Australian dollar bottomed (May 9) before the other major currencies, and its sell-off over the past couple sessions may be a sign that the greenback’s downside correction has ended or is in a late phase.

The US dollar has managed to close above CAD1.30 once here in Q2 (May 29), but it may do so again today. There is a large option ($1.3 bln) struck there that expires today. The US dollar made a high in the European morning near CAD1.3025, but the intraday technical indicators are stretched. With a light US economic calendar, Canada’s employment data has little rival for the data spotlight. Canada is expected to have grown around 15k full-time positions after almost twice as much in April, though near the three-month average of 19k. A rise in the participation rate that is not offset by a commensurate increase in the unemployment rate would be understood as constructive. A favorable report would likely boost expectations for a July rate hike. Given the proximity to the Mexican election (July 1), barring a US withdrawal, NAFTA negotiations may have to resume later, and this may help ease the uncertainty sufficiently for the Bank of Canada to move.

The rout in emerging market currencies is continuing today. The liquid and accessible currencies, such as Turkey and South Africa are leading the move with more than 1% losses. India and Mexico do not appear far behind. The MSCI Emerging Markes Index is off 1.5%, the most in nearly a month. It is holding on to a slight gain on the week (~0.1) before Latam markets open. A deeper loss today would extend the losing streak to a fourth consecutive week and 10 of the past 13 weeks.

Oher equities are also in retreat mode today. The MSCI Asia Pacific Index is off 0.85%, its biggest drop this week, but still leaves the regional benchmark up 1.5% this week, and snaps a three-week slide. The Nikkei fared the best in the region with a 2.35% rise. Chinese stocks were mixed this week, with a small gain in Shenzhen offset by a similar loss in Shanghai. Of note, foreign investors were buyers of Korean shares this week (~$263 mln) and Taiwanese shares (~$827 mln).

European markets are extending this week’s decline. The Dow Jones Stoxx 600 is off 0.6% near midday on the Continent and has failed to rise since Monday. All the sectors but real estate are under pressure, and financials and utilities are the hardest hit with more than 1% losses. Barring a strong recovery in the waning hours of activity, it will be the third consecutive weekly decline, which follows an eight-week rally. Spain’s bourse is among the best performers this week, gaining 1% for the week despite today’s loss of roughly the same magnitude. If Spain’s weekly gain is halved today, Italy’s loss has doubled. The 1.6% decline today brings the weekly drop to almost 3.2%.

Italian bond markets are also under pressure. The 10-year yield (~3.05%) is up two basis points today and 55 bp for the week. The 2-year yield (~1.57%) is up five basis points today and 90 on the week. Core European bond yields are 4-6 bp lower, while US 10-year Treasury yields are a couple basis points softer near 2.90%.

Tags: China Trade Balance,Featured,Germany Trade Balance,newsletter