Swiss Franc The Euro has fallen by 0.14% to 1.0903 CHF. EUR/CHF - Euro Swiss Franc, May 25(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates have seen a choppy day of trading but almost no net movement whatsoever, with the percentage difference on buying Swiss Franc rates since the opening bell at a paltry 0.01%. Why the quiet market? We are at the back end of the month now, with little economic news of note to be released for markets to trade on. As such, unless large political forces are at play, rates are unlikely to be shifting heavily at any one moment. Furthermore, it could be argued that due to the escalation of threat level in the UK to critical, it is likely

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, GBP/CHF, JPY, newslettersent, Spain Gross Domestic Product, SPY, U.K. Gross Domestic Product, U.K. Gross Domestic Product (QoQ), U.S. Initial Jobless Claims, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.14% to 1.0903 CHF. |

EUR/CHF - Euro Swiss Franc, May 25(see more posts on EUR/CHF, ) |

GBP/CHFPound to Swiss Franc exchange rates have seen a choppy day of trading but almost no net movement whatsoever, with the percentage difference on buying Swiss Franc rates since the opening bell at a paltry 0.01%. Why the quiet market? We are at the back end of the month now, with little economic news of note to be released for markets to trade on. As such, unless large political forces are at play, rates are unlikely to be shifting heavily at any one moment. Furthermore, it could be argued that due to the escalation of threat level in the UK to critical, it is likely that more active trading on the Pound is suspended, with high street institutions cautious on buying up to hold Sterling with the likelihood for further attacks in the UK having risen. When this is downgraded I would expect normal buying activity to resume. So seemingly in the near term little rush to engage in currency conversions but this can change very quickly and with little warning. |

GBP/CHF - British Pound Swiss Franc, May 25(see more posts on GBP/CHF, ) |

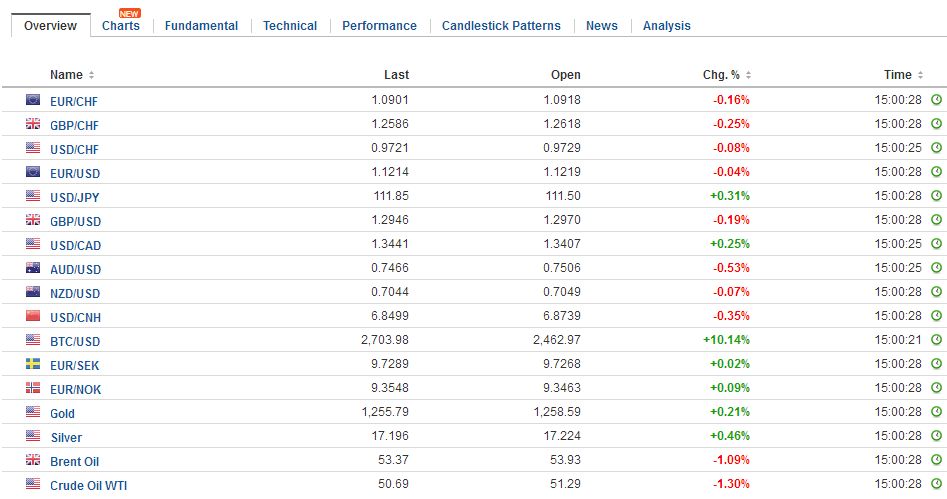

FX RatesThe Dollar Index is heavy, just above the lows set earlier this week set near 96.80. However, this exaggerates the dollar’s weakness because the weight of the euro and currencies that shadow it, like the Swiss franc and Swedish krona. As the North American session is about to start, the dollar is higher against the dollar-bloc currencies and the Japanese yen. The Scandi’s are flat and sterling is turning lower. That leaves the dollar weakness limited to the euro and Swiss franc. The euro reached a high earlier this week just shy of $1.1270. It has run out of steam today near $1.1250. Between $1.1175 and $1.1200, there are nearly 1.4 bln euros in options expiring. |

FX Daily Rates, May 25 |

| Equities are marching higher. US equities have recovered from last week’s slide. This helped support global equities today. The MSCI Asia-Pacific Index rose 0.7% to reach a new two-year high. Korea’s Kospi rallied 1.1% to new record highs. As widely expected, the central bank left rates on hold. Taiwan’s Taiex rose about half as much as Korea, but sufficient to record new two-year highs. The Hang Seng advanced 0.8% to also record a new two-year high. Perhaps most interesting is the 1.4% rally in Shanghai. It is the biggest rally in a month and some suspect that state funds were active.

OPEC is poised to extend its six-month production cuts for another nine months. This has been expected and helps account for the recent rally that help lifted Brent by 17.5% since May 5, while light sweet crude has rallied 18.7%. Prices are off 0.3%-0.5%, the second day of losses. It could be the first back-to-back decline since May 1 and May 2. The market looks vulnerable to buy the rumor sell the fact type of activity. Following the slippage in US yields yesterday, Asian and European bonds have followed suit today. Australia’s 10-year yield fell nearly give basis points, while European core bond yields are off three-four basis points and the peripheral yields off two-three basis points. Greek bond yields have bucked the trend and pushing higher amid disappointment with the lack of closure and negotiations to release the next tranche. |

FX Performance, May 25 |

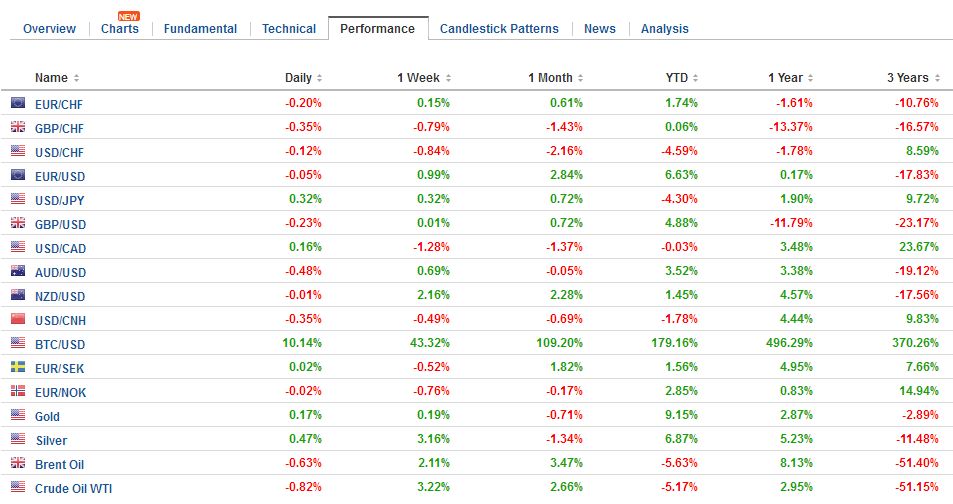

United KingdomSterling was sold in response to the downward revision in Q1 GDP to 0.2% from 0.3%. The UK economy had expanded by 0.7% in Q4 16. Services and production were revised lower and net exports took 1.4 percentage points off GDP, a record drag. There are nearly GBP270 mln options struck at $1.2940 that roll-off today. Sterling has not closed below its 20-day moving average (~$1.2940) since April 10. We note that the technical condition for sterling may be deteriorating. The MACDs and RSI show bearish divergence. |

U.K. Gross Domestic Product (GDP) QoQ, Q1 2017(see more posts on U.K. Gross Domestic Product (QoQ), ) Source: Investing.com - Click to enlarge |

U.K. Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

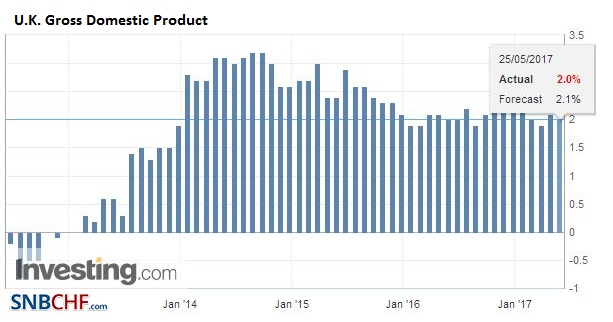

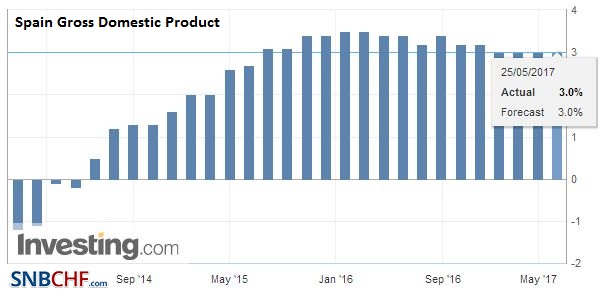

Spain |

Spain Gross Domestic Product (GDP) QoQ, Q1 2017(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Spain Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

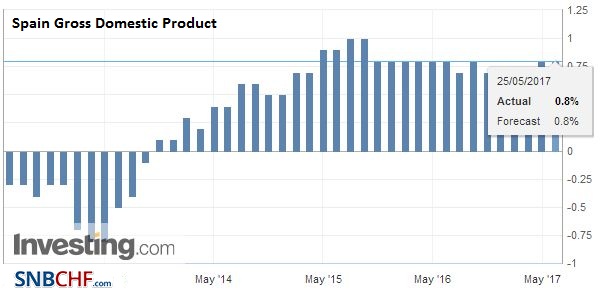

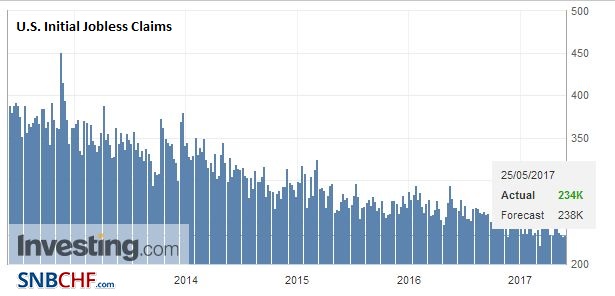

United StatesThe US reports the advanced look at the April merchandise trade balance, wholesale and retail inventories, and weekly jobless claims. The trade and inventory data will impact Q2 GDP estimates, though the key point is that nearly everyone is expecting the economy to accelerate after the unusually weak Q1. The national employment report is out next week and the early call is for a respectable 175-180k increase and a 0.3% rise in hourly earnings, which could lift the year-over-year rate to 2.6% from 2.5%. |

U.S. Initial Jobless Claims, April 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Separately, when US President Trump began this extended trip, many thought that Israel would object to the Administration’s handling of intelligence, but it turns out the British seem more concerned. The BBC reports that Prime Minister May will raise the issue at the highest levels following the British police have stopped sharing information with US officials.

Minutes from the FOMC meeting seems to confuse some. To be sure, the market continues to believe that a hike next month is as done of a deal as these things can get. Our calculations suggest fair value for the June Fed funds futures contract, assuming a hike and some softness at the end of the quarter, is about 1.04%, while the contract currently implies 1.015%.

Some are trying to explain the pullback in US bond yields as a response to the FOMC statement that more evidence that weakness in Q1 was transitory before removing more accommodation. We read this as a justification for not hiking rates this month, rather than change in forward guidance. The December Fed funds futures contract implied yield was 1.215% at the end of last week. It closed yesterday at 1.23%.

The Fed’s balance sheet strategy is evolving. The minutes confirmed expectations that the Fed is thinking to begin the process of not replacing maturing issues slowly and then increasing them. It is a rolling start that was one of the common scenarios discussed by investors. However, the FOMC did not how much it may begin with, though subjectively we thought $5-$10 bln divided, even if not evenly, between Treasuries and MBS. The other important question is what size balance sheet does the Fed eventually want. Bernanke recently suggested $2.3-$2.8 trillion.

Eurozone

European shares are mostly higher, but less energetically so. The Dow Jones Stoxx 600 is up around 0.1%. It is held back by the DAX, which is the weakest of the major European bourses. Over the last five sessions, it has been alternating between gains and losses as it consolidates the gains from the first half of the month that brought it to record highs.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Featured,FX Daily,GBP/CHF,newslettersent,Spain Gross Domestic Product,SPY,U.K. Gross Domestic Product,U.K. Gross Domestic Product (QoQ),U.S. Initial Jobless Claims