Summary: No impact from the latest North Korean missile test. Polls suggest Tories still ahead for the June 8 election. Prospects of an Italian election this year weighed on Italian stocks and bonds. The markets of the world’s two largest economies, the US and China were closed on Monday, May 29. As one would expect, capital markets were mostly quiet. Even the launch of another ballistic missile test by North Korea, the ninth this year, which followed on the heels of the G7 pledge to increase pressure on the rogue nation to abandon its efforts, failed to have much impact. Korea’s Kospi set a new record high before retreating into the close and losing 0.1% on the day. The Korean won also slipped by

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada Gross Domestic Product, EUR, EUR/USD, Eurozone M3 Money Supply, Featured, FX Trends, GBP, Germany, Italy, JPY, newslettersent, USD, USDJPY

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

No impact from the latest North Korean missile test.

Polls suggest Tories still ahead for the June 8 election.

Prospects of an Italian election this year weighed on Italian stocks and bonds.

The markets of the world’s two largest economies, the US and China were closed on Monday, May 29. As one would expect, capital markets were mostly quiet.

Even the launch of another ballistic missile test by North Korea, the ninth this year, which followed on the heels of the G7 pledge to increase pressure on the rogue nation to abandon its efforts, failed to have much impact. Korea’s Kospi set a new record high before retreating into the close and losing 0.1% on the day. The Korean won also slipped by about the same among, while most of the regional currencies fell a little more.

The MSCI Asia Pacific Index eased 0.1%. It is the second consecutive decline and the fourth losing session in the past five. That said, it was up 1.3% last week, which brought the regional benchmark to its best level in two years. The Dow Jones Stoxx 600 say half the decline (or 0.05%). It was the third consecutive losing session. It reached its best level since August 2015 near the middle of the month and had been consolidating its recent gains over the past two weeks.

Of note, the Italian stock market (FTSE MIB Index) fell 2%, with bank shares off 3.4%. It is the biggest drop for financials in more than three months. It is the fourth consecutive loss for Italian shares. The Italian bond market also sold off sharply, with the 10-year yield rise in almost nine basis points and the two-year yield ring nearly three basis points.

The trigger were signs that Italy may be moving toward a fall election. The parliamentary session ends next spring, but there may be a deal between the PD’s Renzi, who is fresh from a primary victory, the never-to-be-counted-out Berlusconi, and the Five-Star Movement head Grillo. Reports suggest that the essence of electoral reform has been agreed. It will be a purely representative system, with no bonus seats for the majority winner and the threshold for participation may be increased, which could minimize the political fragmentation. If the early reform proposal looked more like Greece, the new one looks more like Germany.

The speculation is that the election could be held at the same time or nearly the same time as the German election in late September. Recent polls suggested a statistical dead head between the PD and the Five-Star Movement. However, without the possibility bonus seats, the risks of a Five Star government seems to be reduced. That said, given the serious economic straits, high unemployment, unresolved banking challenges, the election, whenever it is held, poses significant risks.

UK Prime Minister May thought the odds favored her when she engineered the snap election, having to maneuver around the law the Cameron had signed that sought to avoid this practice and set a formal election schedule. Initially, polls showed the Tories with as much as a 20 percentage point lead over the seemingly hapless Labour Party. The polls closed considerably following the latest Tory reversal (on the extent of elderly responsibility for their own health care costs). This appeared to weigh on sterling last week when it suffered its largest weekly decline in six months (-1.8%).

As many as six polls were reported over the weekend showed the Tories are still set to win the coming weekend election. All the results gave the Tories a wider lead than the YouGov poll before the weekend, which put the lead at five percentage points. On average, the weekend polls gave the Tories an average of a 10-point margin. Sterling was the strongest of the major currencies, gaining about 0.3% against the dollar and euro.

Merkel’s comments at a CSU campaign rally over the weekend caused a stir. It followed an acrimonious NATO and G7 meeting. The US President stuck to his narrow definition of defense spending, so as not to include the spending associated with past military action, like the refugee crisis, and failed to reaffirm his commitment to Article 5 of the joint defense treaty. At the G7 meeting, Trump was awkward, and separated himself, such as riding a golf cart while the other heads of state walked to an event. The US President refrained from endorsing the Paris Agreement and shortly after the G7 meeting, word leaked not from the so-called “deep state” but apparently from his own team, that he will announce his lack of support for the Paris Agreement later this week.

Merkel essentially said to her followers, that Europe could not “fully rely” on the US going forward and that “We Europeans must really take our destiny into our own hands.” While these comments and sentiment are not new, many parts of the international media (and social media) gave it extra significance. However, few noticed this put Germany and the US on the same page. For many years, the US has harangued Europe to 1) spend more on its own defense, 2) be more vigilant it guarding its own neighborhood (e.g. Bosnia, Libya, etc.), 3) facilitate stronger economic activity, including resolving the legacy of bad loans and a semi-permanent crisis in Greece, and 4) promote freer, less mercantilist trade policies.

EUR/USDThe euro peaked on May 23 a little shy of $1.1270. It fell to almost $1.1160 by the end of last week, and consolidated below $1.12 on Monday and held the pre-weekend low. Options worth nearly one billion euros expire at $1.12 on Tuesday. The data highlight of the week is the preliminary estimate of May CPI. The key question is how much of the recent surge was unwound. |

EUR/USD - Euro US Dollar, May 31(see more posts on eur/usd, ) |

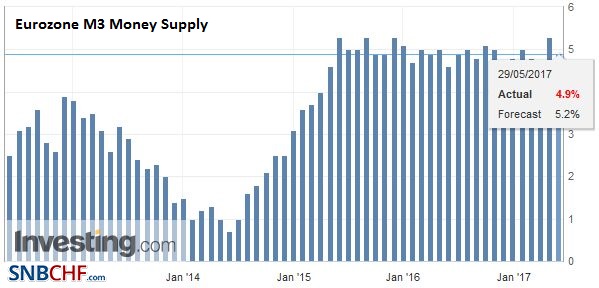

EurozoneData on Monday showed slower money supply growth (M3 rose 4.9% in April after 5.3% year-over-year in March), while credit extended to the private sector edged up to 2.0% from 1.9%. Separately, speaking before the EU Parliament, Draghi played down the likelihood of a significant policy adjustment coming from next week’s ECB meeting. While Draghi acknowledged that the tail risks have diminished “measurably,” the regional economy continued to require significant support. |

Eurozone M3 Money Supply YoY, April 2017(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

USD/JPYThe dollar was largely confined to a 15 pip range on either side JPY111.30, which is the middle of its pre-weekend range. Nearly $1.6 bln of options expire tomorrow struck between JPY111.00 and JPY111.30. |

USD/JPY - US Dollar Japanese Yen, May 31(see more posts on USD/JPY, ) |

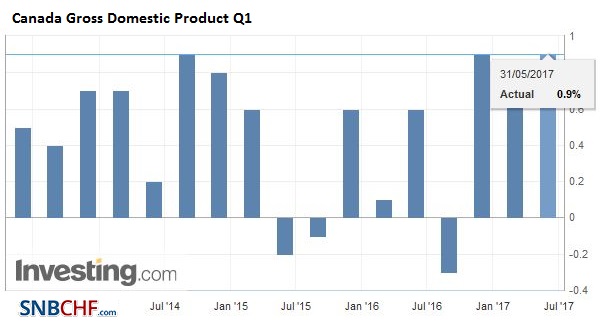

CanadaThe Australian dollar was flat in less than a quarter cent range. On Tuesday, A$565 mln option struck at $0.7450 roll-off. After being repelled by offers near CAD1.35 before the weekend, the greenback pushed below the CAD1.3433 low. Demand for US dollar was seen last week a little below CAD1.3400. The data highlight of the week for Canada is the Q1 GDP estimate due Wednesday. The Canadian economy is expected to have grown more than 4%, which would put it on the top of the G7. |

Canada Gross Domestic Product (GDP) Q1 2017(see more posts on Canada Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Canada Gross Domestic Product,eur/usd,Eurozone M3 Money Supply,Featured,Germany,Italy,newslettersent,USD/JPY