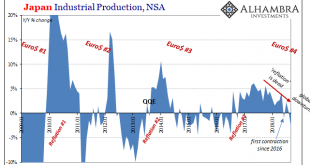

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc. It does seem as if someone flipped a switch...

Read More »Three Things that may Disappoint Investors

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada. It is not clear what a “handshake agreement” really...

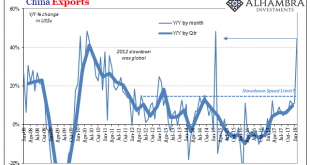

Read More »China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative. A strengthening U.S. recovery is helping underpin China’s outlook as Asia’s biggest economy seeks to cut excess capacity and transition to reliance on...

Read More »More Thinking about Trade as Pence and Ross Head to Tokyo

Summary: Pence and Ross may “feel out” Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem. US Vice President Pence and Commerce Secretary Ross will go to Japan this week. In addition to regional...

Read More »The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it. On September 17, 2014, almost exactly fourteen years...

Read More »The Exiling of Risk

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index: NAAIM Exposure Index,...

Read More »Swiss Tourism: More Swiss Guests, Less Asian Guests

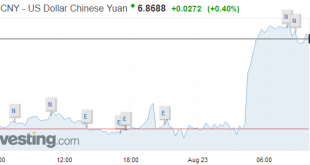

In the summer months, the Swiss hotels registered more guests from Switzerland. from the United States and from Europe. But there was a sharp decline of guest from Asia. 100’000 more overnight stays from Switzerland could not recover the decrease of 200’000. One important reason for decline is the weakening Chinese currency, that reduced their purchasing power, in dollar but also in CHF. CNY is Weakening and...

Read More »On the Road to Panicville

An Alert for the Global Posse of Liquidity Junkies In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging market currencies, but more importantly, it is seen as a symptom of accelerating capital flight from China. USD-CNY, daily; onshore yuan rate USD-CNY, daily (a rising price denotes yuan weakness)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org