(Disclosure: Some of the links below may be affiliate links) It is time for a complete review for DEGIRO for 2020. I am going to go over all the good things and the bad things about DEGIRO.DEGIRO is a great European broker with extremely low fees. I have used their broker account for two years. And I want to bring you my unbiased review of this broker.We are going to see the different account types and the detail of DEGIRO fees. I am also going to go over the fees of the broker as well as its limits. And we will end up with the pros and cons of this service.So, let’s see whether you should use DEGIRO or not in 2020.Investing involves risks of losses. Make sure you are aware of that before you start investing. Contents show Who is DEGIRO? Before the review, let’s start with who is

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

It is time for a complete review for DEGIRO for 2020. I am going to go over all the good things and the bad things about DEGIRO.

DEGIRO is a great European broker with extremely low fees. I have used their broker account for two years. And I want to bring you my unbiased review of this broker.

We are going to see the different account types and the detail of DEGIRO fees. I am also going to go over the fees of the broker as well as its limits. And we will end up with the pros and cons of this service.

So, let’s see whether you should use DEGIRO or not in 2020.

Investing involves risks of losses. Make sure you are aware of that before you start investing.

Who is DEGIRO?

Before the review, let’s start with who is DEGIRO.

DEGIRO was founded in 2008, so it is a pretty new broker. Their headquarters are in the Netherlands. It only opened to the public in 2013, in the Netherlands. They started support for Switzerland in 2016. But they are now available for 18 different European countries.

Since their inception, in 2008, they have been growing very fast. DEGIRO develops all its tools in-house. And they are now employing more than 200 people.

DEGIRO bases its business on four primary values:

- Access to exchanges of the entire world

- Low Fees

- In-House development of their tools

- Regulated Activities

Over time, they have been working on improving on these four pillars. As a result, they are now one of the most popular brokers in Europe.

DEGIRO has now more than 450’000 customers. In 2018, they managed more than 17 million transactions. They are generating more than 40 million euros in revenue per year. They are in excellent financial health.

What can you invest in?

When you choose a broker, it must give you access to all the investing instruments you need. If you are a very simple passive investor, you may only need access to Exchange Traded Funds (ETFs). But if you are a more sophisticated trader, you may want access to futures and other advanced instruments.

DEGIRO gives you access to a vast array of investing instruments.

First, you can invest in shares in 30 stock exchanges: 22 Stock Exchange from Europe, four from North America and four from Asia and Oceania. They have access to the most important stock exchanges in the world.

For bonds, the choice is slightly more limited. You can trade in bonds from 6 European Stock Exchanges. These are the most prominent European Stock Exchanges.

You can trade Exchange Traded Funds (ETFs) in 19 different stock exchanges: 17 in Europe and 2 in Asia and Oceania. DEGIRO should give you access to the essential European ETFs.

Finally, you also have access to advanced instruments. You can trade futures in 14 different exchanges. And you can also trade options in 12 different stock exchanges.

Overall, DEGIRO offers access to an extensive range of investment products. This offer should satisfy every European Investor. For me, this is entirely more than enough products for investors.

DEGIRO Account Types

DEGIRO has several account types: Basic, Custody, Active, Trader, and Day Trader.

We can split them into two families: On one side, Custody and on the other side all the other fours.

Let’s start with the Basic account. It is the default account and the most versatile. You have access to every feature except for leverage. And you have no extra fees or limitations compared to the other accounts. Active, Trade, and Day Trade account types are very similar to Basic except that you have access to leverage. The leverage limitations are different for each account. For most investors, the Basic account is more useful than the other three here.

One thing that is important to know is that with this first family of account, DEGIRO can lend your shares to other investors. When some investors are selling short, they are selling shares they do not yet have. Therefore, somebody needs to lend shares. In this case (and a few others), DEGIRO will lend your shares to the other investor.

DEGIRO will guarantee the lending with collateral of 104% of the value of the shares. Moreover, the short seller will also need to meet margin requirements. However, there is minimal risk with this.

However, some people feel uncomfortable with DEGIRO lending their shares. So, people can also opt for the Custody account instead. But this will incur a few more fees. There is especially one fee that can be expensive, and it is about dividends. For each dividend you receive, you will pay one euro and 3% of the dividend. You will also pay one euro and 0.1% of each coupon processed for you. But coupon processing is not something that will concern most users.

I do not think like there is considerable risk with securities lending. Your shares are not held directly by DEGIRO but by SPV, a separate legal entity. So if DEGIRO shutdowns very unexpectedly, you can still arrange to get back your shares from SPV. If nobody borrowed your shares, there would not be any issues regardless of your account type. If somebody borrowed your shares, you still have a right to these shares, and the borrower still has to give them back.

If the borrower cannot give back the shares, the collateral should cover your losses. If the borrower defaults at the same time as DEGIRO, then you will be in trouble. But this should be an incredibly rare event. It is up to you to decide if this is too much to take on or not.

Keep in mind that you cannot change your account type for free! So, you need to make sure to choose the account type you want before creating an account.

If you want all the details about the different DEGIRO Account Types, you should read their Profiles document. It contains all the information about the different account types. However, it is not very easy to understand.

DEGIRO Fees

If we talk about DEGIRO, we need to talk about fees. They have been getting a lot of clients because of their very low fees.

As an example, I am going to take the fees for Swiss investors. DEGIRO fees are different from country to country. However, they are not very significant differences.

Let’s start with stocks. The price you will pay for stocks will depend on the exchange you are using. Here are some examples:

- Switzerland: 5.00 CHF + 0.05%

- United States: 0.50 EUR + 0.004 USD per share

- France: 4 EUR + 0.05%

- Hong Kong: 10 EUR + 0.06%

All these prices are very low. But if you are a passive investor like me, you are probably more interested in Exchange Traded Funds (ETFs). Fees for ETFs are straightforward at DEGIRO: 2 EUR and 0.03%. This fee is the same regardless of where you invest.

And there is something even better with DEGIRO: You can trade some ETFs for free! Every month, you can make one trade (buy or sell) for one of the free ETFs. If, during the month, you make another trade in the same direction for the same ETF, it will also be free. If your portfolio is mostly in free ETFs, you will significantly reduce your fees.

If you buy an ETF that is not in your account currency, you will pay fees on the currency exchange. By default (Auto FX Trader), you will pay 0.10% of the transaction value. You can also opt for manual exchanges. In that case, you will pay 10 EUR + 0.02%. Manual exchanges are only worth it for very large transactions (more than 12’500 EUR). Keep in mind that you will pay this fee in both directions (buy and sell).

The final fee you are going to pay is a connectivity fee for each stock exchange you are using. This fee is 2.5 EUR per year per stock exchange. The stock exchange for your home country will be free (SIX for Swiss investors).

Overall, DEGIRO fees are very low. You will not find another European broker with such low prices!

If you want more details about DEGIRO fees, I have the perfect article for you. I have made a full comparison of DEGIRO vs Interactive Brokers for a European portfolio.

There are two things I do not like about their fees. First, the currency exchange fee is a bit too high. As soon as you start making large trade, it will be significantly higher than the transaction fees.

The other thing I do not like about these fees is the fact that their prices are not the same from country to county. I wish they would unify their pricing system.

If you want more details, you can consult DEGIRO Fees for Switzerland.

Is DEGIRO safe?

You do not want your investment to sit with an unsafe broker.

First, you want your broker account to be secure. I have not heard of any security breach at DEGIRO. It is a good sign because there were many breaches of many online services over the years. The other thing you want is Two Factor Authentication (2FA). It is imperative to secure your account. And DEGIRO offers it. So, from a technical security point of view, everything is in order.

Now, you also want to protect your assets from the broker itself. In the case DEGIRO goes bankrupt, you want to keep access to your shares. None of your shares are held directly by DEGIRO. They are all held by a separate legal entity (SPV). It means there is complete asset segregation. And this is a great thing. If DEGIRO goes bankrupt, your assets are safe inside SPV.

Your cash is also not kept by DEGIRO but invested in money market funds. And the money in these money market funds is also kept separate from the fund provider.

I mentioned securities lending before. Securities lending on DEGIRO will only incur a real risk if both DEGIRO and the borrower go bankrupt at the same time. It is an improbable event. But there is still this risk that you may want to take into account.

DEGIRO is safe and well-regulated. The various regulations around them and the asset segregation system is reliable.

DEGIRO Reputation

The reputation of a broker is essential. You do not want to store your hard-earned money with an untrustworthy broker.

DEGIRO has won many awards since its creation. At the time of this writing, they have won 63 international awards.

The press is generally praising them as the best broker in Europe. They have received many positive reviews from the media.

But what do the users say about DEGIRO? It is often more important than the press. On TrustPilot, there are almost 800 reviews about DEGIRO. Out of these 800 reviews, DEGIRO got a 3.9 score out of five 5. It is a good score, but some

When we read the positive comments, we can see that people like the low-fees and the simplicity of the platform. They also mention that the platform improves very quickly.

On the other hand, there are also some negative comments. 15% of the comments are giving a score of 1 out of 5. Here are some of the complaints of the users:

- Poor customer service. This one comes a lot in the negative comments.

- Slow bank transfers to and from DEGIRO.

- Low amount of research available on stocks.

- People are losing access to their accounts while moving to another country.

You have to take some of the comments with a grain of salt. Indeed a lot of people do not even read the fees before trading. Then they are surprised by a charge they did not know about. Do not make the same mistake! You need to do your research, always.

I never had any issue with the customer service, it is pretty fast in Switzerland, both by email and by phone. But I did not have to use it a lot. And I would not be surprised if it was not good in Europe. Companies that are growing very fast can often not keep up with customer service.

As for the bank transfers, I would have to agree on that one. It is quite slow. But since I do a transfer a month, I do not care about that.

And for research, I never needed any research since I do my research myself. And you do not need fundamentals for an ETF anyway.

And finally, for people losing their accounts, this is due to regulations. They need to keep regulated to avoid troubles. They probably could handle it better indeed. But they have to do it.

For me, it is still concerning to have 15% of Bad reviews. However, most of them are on customer service and some from people who do not do any research themselves. So, I do not think it is a blocker. But there are brokers with a better reputation than DEGIRO out there.

My experience with DEGIRO

It is time to talk about my own experience with DEGIRO.

Overall, I am very satisfied with my usage of DEGIRO. It is very straightforward to use. When I started using this broker, I was a total beginner in investing. I feel like DEGIRO is a perfect broker for beginners.

However, there have also been a few quirks with my usage of DEGIRO. In the early months, there was a time when a transfer to my account was blocked for more than one week. It turned out that there was a problem with the bank they were using in Switzerland. This kind of thing can (and will) happen. However, they did not communicate well. I had to call them several times to get the status of my transfer. They should have sent an email to every Swiss customer about this issue.

It is also way too complicated to change bank accounts. I understand the protection in only accepting one bank account. But changing bank accounts should be at least faster. When I changed bank accounts, I had to contact the support, make a transfer from my new account, and wait for them to acknowledge it. It took more than a week to change my bank account. It is too long.

Finally, the last issue I have with DEGIRO is with their handling of United States Exchange Traded Funds. In early 2019, DEGIRO stopped offering access to ETFs from the U.S. The reason for that was that new regulations (FinIA/FinSA) that would only let Swiss investors invest in certain kind of funds.

I have an entire article about why we are losing access to the best funds in the world. So, I am not going to go into detail here. However, when DEGIRO did that, they did it earlier than the law required. And my biggest issue is that they did it without any communication. One day, I could not purchase more of my ETFs. And I had to contact the support to understand why. It is terrible communication! They should have sent an email to every Swiss investor to let them know about that.

We can also take a look at my experience with the different steps of the process: account creation, using the web application, and using the mobile application.

Account Creation

Creating an account at DEGIRO is a straightforward process.

You have to go to the website, click on Open An Account and they will guide you through the process. You will need to scan your ID to prove your residency. It is also when you will have to choose your account type. Choosing an account type is an important step since you cannot change it later.

Once you have filled all the necessary information, you will have to transfer some money to your account. Your account will only be activated once the money is there. You can use an instant deposit for free during the activation. Like this, you can create an account in a few minutes.

Creating an account on DEGIRO is simple. I do not think it could be any simpler. There is only one thing that I dislike about this: you cannot change the account type.

Web Application

I like the fact that DEGIRO also has a web application. I am old-school and prefer web applications.

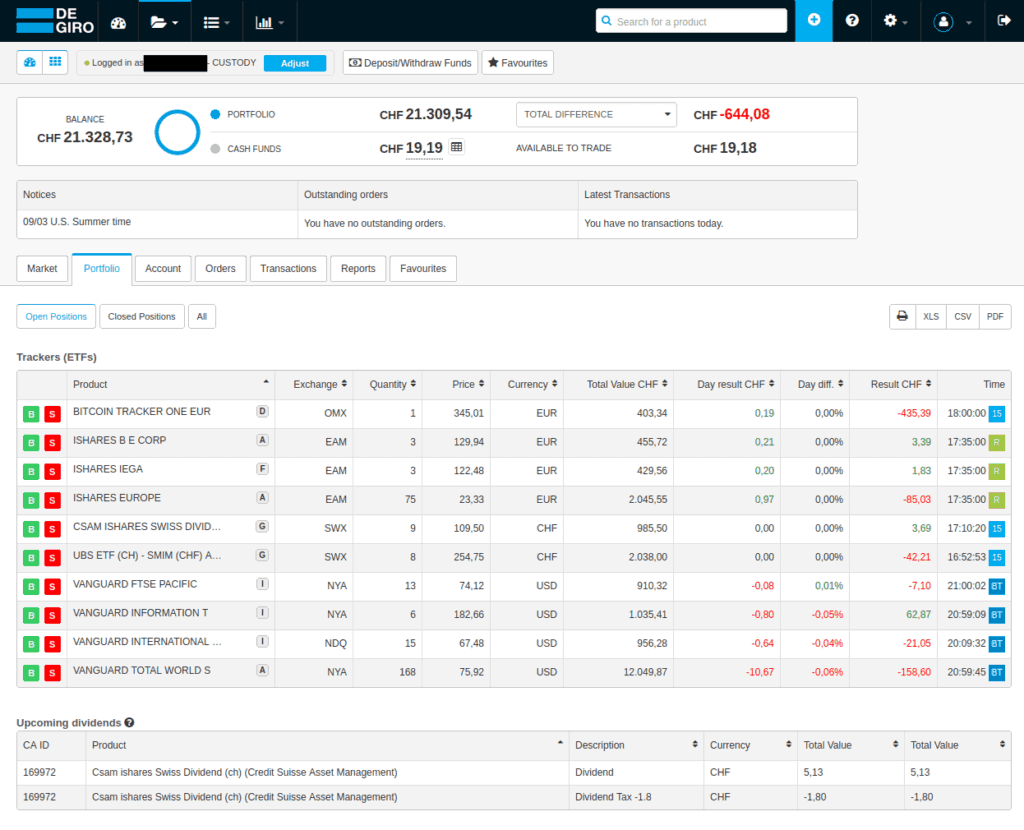

The web application is straightforward to use. It is not the prettiest thing in the world, though. And several of the reports are simplistic. Overall, I think it would need some polishing, but it gets the jobs done.

From the web application, you can do everything:

- Buy and sell shares

- See your portfolio results

- See information about a stock or position

- See general information about the market

- Manage your account

I think like the web application could give a bit more information on the shares and the portfolio. Some better statistics and graphs on my returns would be great.

One thing I would like to see in the DEGIRO application is some more transparency for fees. For instance, you cannot see how much you have paid for currency transaction fees. For each transaction, there should be a breakdown of all the fees incurred on that transaction.

Mobile Application

DEGIRO also has a mobile application.

You can do most things from the mobile application. There are just a few things that you cannot do to manage your account. But overall, this should not block you.

The one thing that is done well on the mobile application is that it is easy to use. It is a great thing, especially for beginner investors.

However, the mobile application is not great. The views are not very well optimized, and it could show much more information. Some features are also a bit difficult to find out. For instance, to get the total results, you have to touch the daily results. It took me more several months to find out, by mistake.

I also feel like it is not well thought together. Like some of the views do not match other views. Keep in mind that I dislike mobile application to start. So I may be biased. But this mobile application could profit from some extra work.

And the last thing I do not like about the mobile application is the fact that a five digits password can unlock it. For me, this is not enough! You should be able to use a full password for this.

DEGIRO Pros

We can recap the main advantages of DEGIRO.

The first obvious advantage is the very low fees. DEGIRO is the cheapest European broker. It is an important fact. And this is on what they are building their entire business. You can save a lot of money by trading with them.

And the fact that you can trade one ETF for free every month is also a great thing in favor of DEGIRO. If you take this into account when you build your portfolio, you can significantly reduce your overall fees.

A great thing with DEGIRO is that it is straightforward to use. I never had any issue trading on either the web application or the mobile application. It is important if you are starting investing. You do not want a significant barrier to invest.

For me, another good advantage is that they offer both a mobile and a web interface. Nowadays, some brokers only offer one of these. I much prefer trading on my computer than on my phone. But it is great to be able to access my stocks from my phone as well.

DEGIRO is a fast-growing broker. It has been profitable for several quarters in a row. They are adding new clients very quickly to their platform. In 2019, they had more than 450’000 clients, and they processed more than 50 billion euros in transactions. They are still adding tools and new features to their platform. I think this is an excellent sign of a healthy broker.

DEGIRO Cons

We also need to list the main disadvantages of DEGIRO.

One thing that I am not a big fan of is that by default, they lend shares of their customer. I realize this is one of the ways they keep the fees very low. However, this should be an option for the customer, not the default option. The risks are not significant with this process. But there are still some risks. Therefore, it should not be the default option. Nevertheless, I still think that the risk is not significant enough to warrant the dividend fee.

For me, the biggest con of DEGIRO is their lack of access to United States ETF. Since 2019, DEGIRO stopped offering access to these ETFs because of the future laws that would prevent brokers from offering these products in Europe. If you compare with other European brokers, this is not a big deal since they all stopped offering them. However, this is still a disadvantage if you compare it with Interactive Brokers.

The fact that you cannot change to a new account type at all is also pretty bad. For instance, if you want to change from the Custody account to the Basic account, you cannot do that easily. You have to create a new account with the new account type. And then, you have to pay internal transfer fees to the transfer to the new account. It is pretty bad!

Finally, I wish that DEGIRO would communicate better sometimes. When they stopped offering access to U.S. ETF, they did not communicate. They stopped the ability to purchase them. Most investors had to find out for themselves why. It is stupid. And the same thing happened when their bank in Switzerland had an issue for several days: no communication.

Conclusion

DEGIRO is an excellent broker with very low fees. It has extremely low fees. And it provides several interfaces that are very easy to use. Because of that, I believe DEGIRO is the best broker for European Investors.

Of course, not everything is great. Their customer service is not always top-notch, and their communication skills are quite lacking. Also, their applications are not as good as they could be.

But, overall, I still believe that DEGIRO is a great broker and an excellent choice for European investors.

The only thing you cannot do with DEGIRO is investing in U.S. Exchange Traded Funds. For this, you will have to go with Interactive Brokers. Unfortunately, this is only possible for Swiss investors, not other European investors.

If you want to open an account, I have a guide on how to open a DEGIRO account.

Have you ever used DEGIRO? What did you think of it?