TwitterFacebookPinterestLinkedin(Disclosure: Some of the links below may be affiliate links) For a lot of people, having a strict routine will help remember essential things. It is the case for me. I like routines. Each month, I am following the same personal finance routine for my budget. You can see most of the results in my monthly finance reports. In this post, I am going to describe the steps I am doing every month.I think it is great to have a routine. It helps you get more efficient, and like this, you do not forget to do everything. And once you start doing it routinely, it becomes automatic, and you will save time.Of course, you do not need to follow the same steps as me. You should probably not have the same steps. Every people can have different things to do based on the way

Topics:

Mr. The Poor Swiss considers the following as important: budget, Financial Independence

This could be interesting, too:

Baptiste Wicht writes A few ways to simplify our life

Baptiste Wicht writes Retire Early: The Simple Guide – I wrote a book

Mr. The Poor Swiss writes 9 Reasons to Aim for Financial Independence

Mr. The Poor Swiss writes How to Open an Interactive Brokers Account in 2021?

(Disclosure: Some of the links below may be affiliate links)

For a lot of people, having a strict routine will help remember essential things. It is the case for me. I like routines. Each month, I am following the same personal finance routine for my budget. You can see most of the results in my monthly finance reports. In this post, I am going to describe the steps I am doing every month.

I think it is great to have a routine. It helps you get more efficient, and like this, you do not forget to do everything. And once you start doing it routinely, it becomes automatic, and you will save time.

Of course, you do not need to follow the same steps as me. You should probably not have the same steps. Every people can have different things to do based on the way they are investing or based on their situation.

But I would encourage you to define your at least a monthly routine clearly. You can use mine as a base template if you want. And why not even a weekly routine?

So, here are the 13 steps of my monthly personal finance routine.

1. Pay my monthly bills (after salary)

Neon Neon is the best digital bank in Switzerland. And it is free!Use the F9YMGT code to receive 10CHF for free!

Once I receive my salary, the first of my personal finance routine steps I do is to pay my monthly bills for next month.

These bills are my rent, my taxes, my insurances, my credit card bills, and sometimes exceptional bills like Billag or some bi-annual bills. My salary goes into my checking account. I also receive some bills in my mailbox that I pay at the end of the month.

Why am I doing this first?

For the simple reason that I want to know how much I have left for next month. And I want to know how much money I can invest this month. I do not believe in the “Pay Yourself First” philosophy. It does not make any sense. If you save as much as you can, there will be something left to pay yourself. Pay yourself first simply make you complacent thinking you cannot save more.

2. Check my emergency fund

I always keep about two months of monthly expenses in my emergency fund. My emergency fund holds about 10’000 CHF.

I directly keep my emergency fund into my checking account. If you have access to high-interest savings accounts, you should use them instead. But in Switzerland, we do not get any interest in bank accounts.

So, once I have paid my monthly bills, I am checking how much I can move to my broker. I always keep about 10’000 CHF in my checking account. I invest everything higher than that.

3. Invest my extra savings

Once I know how much I can move, I directly move it. I do a bank transfer from my checking account to my broker account. It generally takes one working day for the money to arrive at Interactive Brokers. After I receive the money on my broker account, I directly invest it. For instance, I can invest all the money in my VT ETF.

I am using the new amount to rebalance my portfolio. I am investing in the fund that is the most below its allocation. It is how I am doing balancing month by month. Hopefully, this should help me not having to do a big rebalance at the end of the year. It is in check with my overall investment strategy.

I am also investing a little money into P2P Lending. For this, I am using my credit card to top up my Revolut account. With this, I can exchange money for free in EUR. And from Revolut, I am sending EUR with bank transfers to platforms such as Mintos. I generally invest about 500 EUR per month.

4. Check my spending and budget (on the 1st)

At the beginning of each month, I take a look back at the budget of the past month. I try to do this as early as possible, ideally on the first of the month. I check every expense and earning for mistakes. Once I am sure of my expenses, I take note of my savings rate (can still change with the next two steps).

I am doing my budget in a straightforward way with multiple categories and an amount per category. For me, the budget allocations are not as important as expense tracking.

And most importantly, I take a look at how much we spend on every category. I try to understand what went well and what did not go well. It will help me improving month after month.

5. Check my credit cards

Cumulus MasterCard The Cumulus MasterCard is a free credit card with 0.3% cashback. This is currently the best Swiss credit card.

I am also checking that all the expenses from my credit cards are in my budget. I also check every credit card expense for a possible mistake. Several times I forgot to add small expenses to my budget from my credit card. But the biggest benefit is to make sure that they are no errors or frauds on my credit card statements.

It is also an excellent time to check if I could buy more things with my credit card. Now that I have several credit cards, it is a good thing to check if some expenses are not using the correct credit card. I want to minimize as much as possible my fees. And maximize the small bonus I get for spending with my credit card.

6. Check all my accounts

After my credit cards, I check all my accounts. My goal is to get the value of each of them.

Fortunately, I do not have many. I have a checking account, one at Migros Bank, and another one at Neon Bank. For each of my checking accounts, I verify all the transactions. I also make sure I have put each of these transactions in my budget. It is generally the only account that is moving significantly.

Mintos Invest in thousands of P2P loans with Mintos, at no cost! The largest P2P Lending platform in Europe.

I also check my third pillar at VIAC. And I have a few P2P Lending accounts that I also check monthly, for instance, Mintos and Fast Invest.

I also have an account at Interactive Brokers for my investment. I check the value of each of my investments. Once I have all these values, I can carry on to my next step.

7. Update my net worth

Now, I got the values of all my accounts and all my investments. It is time to put them together in my net worth tracking application. Once it is done, I get my new net worth!

From my net worth, I can see how much it increased (or decreased) from last month. I also keep track of how much my net worth grew from the beginning of the year.

For me, these are important metrics to keep in mind.

8. Keep track of the trends

One thing I also like is to compare the trend of several things. In the previous step, I can compare the direction of my net worth. It should, of course, go up. But it should ideally accelerate its ascent.

I am also checking the trend of my expenses. For instance, I keep track of the pattern of my expenses over time. One thing that is very important for me is the 12-months average. For example, for my expenses (in black):

Ideally, I would like the average to go down to 4500 CHF. But these days it is not great. I cannot even keep it below 5000 CHF. The average is more important than the value of each month. Because you may have some lousy months and some perfect months. But the average should stabilize. I am also checking the trend of my income. And very importantly, I am reviewing the trend of my savings rate. It is the most important trend for me.

Since I started to improve my finances in 2017, my average savings rate has been consistently going up. It is an excellent sign.

I also check the rate of my income and earnings. Most of my income is very regular since it is my salary. But I also get some little income from this blog. And I like to check how this is going.

9. Check my Financial Independence (FI) Ratio

After I am done with all the data, it is time to get the final numbers out. I can check my savings rate, of course. And its trend as seen in the previous section. But the last value I am checking is my Financial Independence (FI) Ratio. This metric tells me how far away I am from being Financially Independent. I can also check the trend:

My FI ratio should always go up. For now, it is increasing quite slowly. I am working on making it grow faster. But I am not stressed as to when I will be able to retire.

10. Update our goals

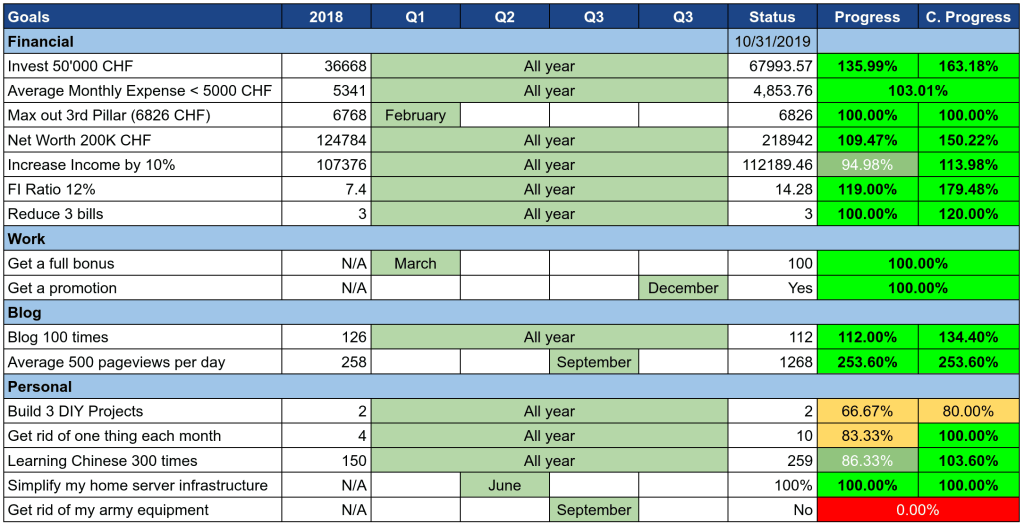

Finally, I have now all my numbers. It is time for me to check the current status of my goals. Every year, I try to set a few goals for the entire year. And every month, I am checking how the goals are going.

For instance, here is one report of these goals from 2018:

It helps me to have a good idea of where I am. I also help me see what I should do better to reach my goals. In 2018, many goals were achieved early than I thought. In 2019, I have set some better goals:

Although they are not perfect, I already feel they are much better. You can improve your goals year after year.

11. Set next month goals

Once I have finished inspecting my yearly goals, I am trying to set a few goals for the next month. For instance, if I have spent too much one month, I am going to set a very strict limit on spending in the following one. I am also setting soft goals like:

- Research credit cards to find a better one

- Research bank accounts to find a better one

- Find out what is the best Employee Share Purchase Plan (ESPP) strategy

And so on. I try to put 4-5 goals for each month. I do not always report them on the blog. Generally, I write them down on a piece of paper.

And once I have my goals completed, I try to make a small plan of what I can do to improve on my goals.

12. Study the analytics of the blog

This blog is my only side hustle. So, I am incorporating it into my monthly personal finance routine. If you have other side hustles, it would be good to check them every month as well.

For me, I am checking how much traffic this blog got and comparing this to the previous month. I am using Google Analytics for this. If some pages are getting more traffic than usual, I am trying to understand why. And if the traffic is going down, I am also trying to understand why.

I am also checking if my blog consumes too much power on my hosting plan. I am using SiteGround to host this blog. Since I am using one of their cheap plans, I need to make sure I do not use too much. If I use too much, the experience of the readers will be impacted negatively. If it is too high, it means it is time to go to a higher hosting plan.

I do not focus on monetization very much on this blog. I am just trying to break even. So I am not making big plans for my blog. I am just focusing on filling my schedule with quality posts.

13. Post on the blog

Finally, the last item on my routine list is to post my monthly report on this blog. If you do not have a blog, you may write a small report on your computer. Or you could keep track of the numbers for the next month.

For instance, you can check out the most recent monthly report. This post has the details of my expenses and income. It also contains the current status of my goals. And of course, some information about things that happened during the month. And my expectations for next month.

Why am I doing this?

I am mostly doing this for me. I want to keep track of my financial status. I also believe it makes me more accountable. And it helps to keep me motivated. And since I like reading monthly reports, maybe some people will enjoy reading mine!

What I do not do

You may have seen that there are also some things I do not do.

First, even though I check the value of my funds, I do not plan any action for them. I do not want to sell or buy based on the price of the funds. I buy as soon as the money reaches my broker account. And I do not sell as long as I do not need the money. It is essential for long-term passive investing.

You have also have seen that my routine is entirely manual. I do not automate any of my money things. I think that automating your personal finances is a mistake. I much prefer to be in control.

Conclusion

Here you have it! My 13-steps monthly financial routine system!

Following this system helps me being very aware of what is going on with my finances. What is good and what is bad. I want to have as much information about possible with my budget. And I want to avoid missing a step.

These steps are personal. Of course, not everybody will have the same. However, I believe everyone should have a bit of a financial routine. Even with you have only a few steps, it helps to do them regularly and each month.

Enough about me! What about you? Do you have a financial routine? How many financial steps you do each month?