Investec Switzerland. Swiss Market Index (SMI) is set to close lower this week, underperforming global stocks after a stronger Swiss franc hurt domestic firms and Brexit fears weighed on investor sentiment. © James53145 | Dreamstime.com On the other side of the Atlantic, the S&P 500, an index which tracks the share prices of the top 500 US companies, hit a seven-month high after Federal Reserve Chair Janet Yellen painted a mostly upbeat picture of the economy on Monday but gave little guidance on when another rate hike might occur. In her remarks, Yellen said that the Federal Reserve has lingering concerns that may take several months to resolve, particularly with the Brexit vote so close on the agenda. US energy stocks also received a boost this week after the oil price advanced to over a barrel. European investors however remained nervous throughout the week after polls showed that more Britons favor a vote to leave the European Union at a June 23 referendum than those who want to stay. The pound tumbled and volatility surged as investors trimmed stock market holdings.In Switzerland, foreign-currency reserves jumped in May, suggesting that the central bank intervened in currency markets last month in an effort to weaken the persistently strong franc.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, SMI Brexit, Swiss franc Brexit

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

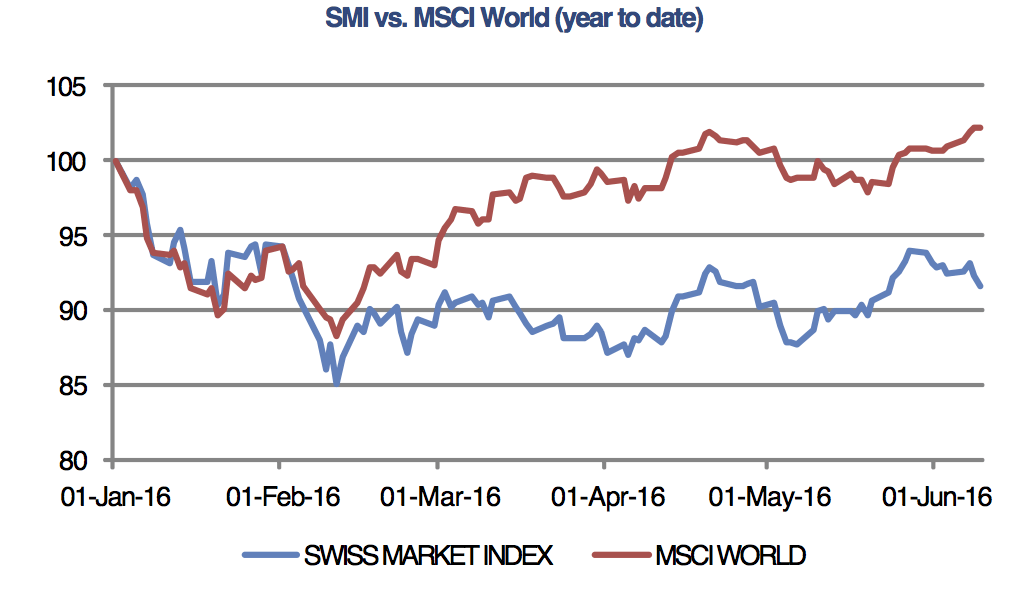

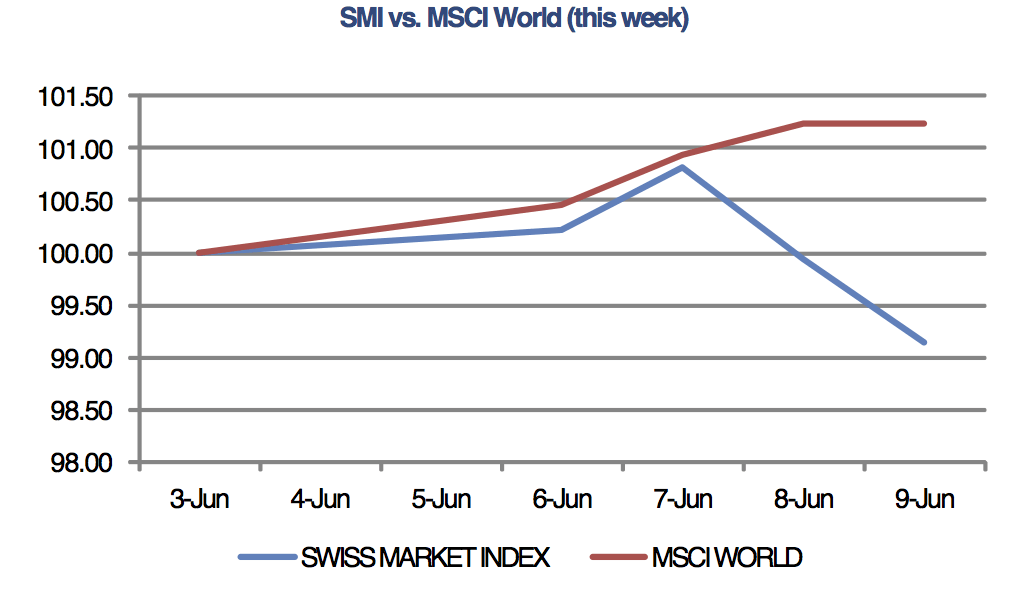

Swiss Market Index (SMI) is set to close lower this week, underperforming global stocks after a stronger Swiss franc hurt domestic firms and Brexit fears weighed on investor sentiment.

© James53145 | Dreamstime.com

On the other side of the Atlantic, the S&P 500, an index which tracks the share prices of the top 500 US companies, hit a seven-month high after Federal Reserve Chair Janet Yellen painted a mostly upbeat picture of the economy on Monday but gave little guidance on when another rate hike might occur. In her remarks, Yellen said that the Federal Reserve has lingering concerns that may take several months to resolve, particularly with the Brexit vote so close on the agenda. US energy stocks also received a boost this week after the oil price advanced to over $51 a barrel.

European investors however remained nervous throughout the week after polls showed that more Britons favor a vote to leave the European Union at a June 23 referendum than those who want to stay. The pound tumbled and volatility surged as investors trimmed stock market holdings.

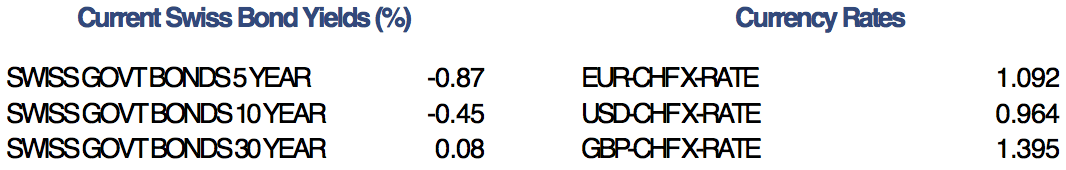

In Switzerland, foreign-currency reserves jumped in May, suggesting that the central bank intervened in currency markets last month in an effort to weaken the persistently strong franc. The Swiss National Bank has said previously that it is keeping its options open for continued currency intervention if necessary. Uncertainly around the UK’s Brexit may increase demand for the Swiss franc, which is often seen as a safe haven investment.

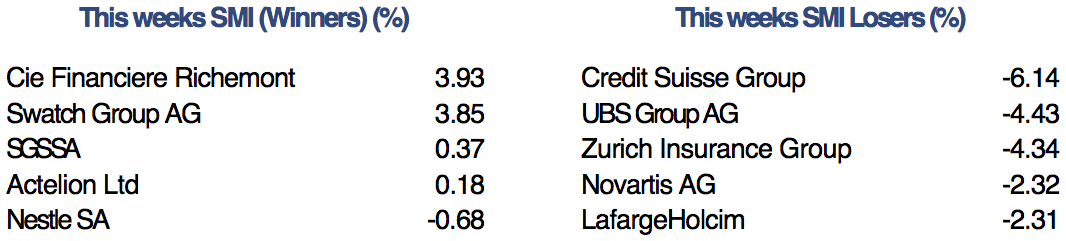

In company news, Swatch gained after the firm announced that Geely of China and Swatch Group subsidiary, Belenos, signed a deal to start producing an innovative new battery. The battery, co-developed with ETH Zurich, is said to be 30 percent superior to existing models. Zurich Insurance was among the SMIs worst performing stocks this week and said that it has begun a process of reshaping and simplify its structure to create a better framework for future success.