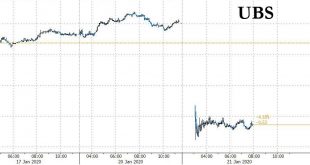

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals. As Saxobank notes, “UBS has been hit by wealth management outflows, negative...

Read More »Neon banking app slashes fees in growth drive

Neon appears to be aiming to be Switzerland’s answer to Revolut. (Neon) Swiss financial services company Neon says it will scrap card fees for customers shopping abroad to spearhead an ambitious drive to boost the number of clients to 250,000 in the next two years. The Zurich-based fintech company has laid down a challenge to foreign competitors, such as Revolut and N26, with its announcement. From Monday (January 20) customers will no longer have to pay a combined...

Read More »Calling Things by Their Real Names

One does not need money to convey one’s thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week’s explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.: Thank you, Charles, for calling out the Fed for their evil ways. We have to properly name things before...

Read More »Money, Inflation, and Business Cycles: The Cantillon Effect and the Economy

Money, Inflation, and Business Cycles: The Cantillon Effect and the Economy by Arkadiusz Sieroń Abingdon: Routledge, 2019 x + 162 pp. Abstract: Austrian economists hold that money matters a great deal in concrete terms in the immediate short run and has permanent long-run effects. Sierońs book investigates the Cantillon effect, which indicates that money is not neutral because inevitabily it is injected unevenly, creating economic distortions. These distortions are...

Read More »Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight US President Trump and French president Macron agreed to take a step back from the digital tax dispute The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light The UK reported firm jobs data for November; BOJ kept policy steady, as expected Moody’s downgraded Hong Kong by a notch to Aa3 with stable outlook; data out of Asia suggest...

Read More »Central bank group to assess potential cases for central bank digital currencies

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions. The group will assess CBDC use cases; economic, functional and technical design choices, including cross-border...

Read More »FX Daily, January 21: New Respiratory Illness Saps Risk-Taking Appetites

Swiss Franc The Euro has risen by 0.05% to 1.0743 EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spread of a new respiratory illness in China has spurred a wave of profit-taking in equities and risk assets more generally. All of the markets in the Asia Pacific region tumbled, with Hong Kong hit the hardest (-2.8%) after posting a key reversal yesterday. The sell-off continued...

Read More »USD/CHF consolidates in a range, below 0.9700 handle

USD/CHF consolidates Friday’s goodish intraday positive move. The prevalent cautious mood seemed to have capped the upside. The USD/CHF pair was seen oscillating in a narrow trading band below the 0.9700 mark on Monday and consolidated the previous session’s goodish positive move. A combination of supporting factors helped the pair to gain some follow-through positive traction for the second consecutive session on Friday and build on the previous session’s modest...

Read More »Davos 2020: What to watch for at this year’s World Economic Forum

This year, as the WEF marks its 50th anniversary, a new urgency hangs over the Alpine town. (Keystone / Gian Ehrenzeller) World leaders, chief executives, thinkers and celebrities are gathering in the Swiss mountain town of Davos for the World Economic Forum’s annual meeting. The event, which begins on Tuesday, has earned a reputation for high-altitude pontificating as the global elite gather to pitch their takes on topics picked by WEF founder Klaus Schwab, from...

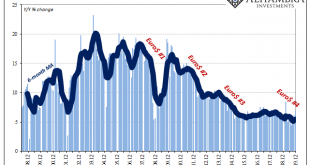

Read More »China Enters 2020 Still (Intent On) Managing Its Decline

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it. Rather than suggest the global economy is picking up, or ended last year in a “good...

Read More » SNB & CHF

SNB & CHF