Federal Railways has the personal data of some 3.7 million commuters. (SRF-SWI) Swiss Federal Railways is coming under fire for using the personal data of commuters for advertising purposes. The data commissioner and a watchdog group have sounded the alarm bell as the volume of data being harnessed grows. Thanks to the increasing digitisation of its services, the Federal Railways now has customer names, addresses, age, sex, telephone numbers, photos, details of trips...

Read More »USD/CHF registers four-day losing streak as coronavirus keeps risk-tone heavy

USD/CHF holds onto losses amid fears of coronavirus outbreak. Soft coronavirus statistics from China fail to counter widespread disease data from the rest of the globe. China’s ability to meet phase-one deal terms seem to gain a little appreciation among traders. The US New Home Sales, Swiss ZEW Survey can offer intermediate moves. USD/CHF flashes 0.03% loss while trading around 0.9760 during early Wednesday. In doing so, the quote declines for the fourth day in a...

Read More »Schaetze To That

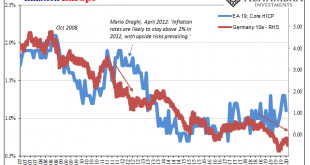

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil. The non-standard “flood of liquidity” was an about-face from his predecessor (who had been raising rates in 2011 before the wheels...

Read More »Seven Big-Picture Considerations for Covid-19

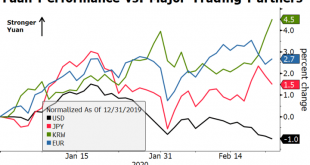

Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy. Lastly, we are concerned that the virus may provide further momentum for the...

Read More »Gold May Rise To $2,000/oz This Year Due To Strong Coin and Bar, ETF and Central Bank Demand

IGTV interviewed Mark O’Byrne, Research Director at GoldCore about the outlook for gold and silver bullion. He is bullish on both precious metals in the medium and long term. The fundamentals are very strong with strong central bank demand and ETF gold holdings reaching an all time record high due to deepening political and economic risks. Silver at $18/oz and one eightieth of the price of gold is fundamentally undervalued and at some stage it will surge in value to...

Read More »The WTO Is Both Irrelevant and Unnecessary

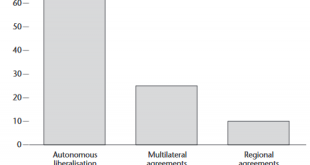

The World Trade Organization (WTO) is in a state of crisis. When it comes to trade negotiations among large states like the US, India, and China, the WTO has been shown to be an organization that is largely irrelevant. Despite grandiose dreams of a global trade organization that would enforce global bureaucrats’ broad vision for multilateral trade agreements, the world looks more and more like it neither wants nor needs an organization like the WTO. CNBC reports...

Read More »FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Swiss Franc The Euro has fallen by 0.27% to 1.0592 EUR/CHF and USD/CHF, February 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday’s moves were in excess. Japanese markets, which were...

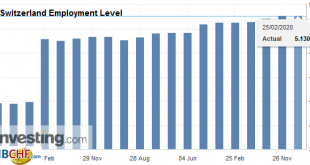

Read More »Employment Barometer in the Q4 2019: Uninterrupted employment growth in Switzerland for 10 years

25.02.2020 – In the 4th quarter 2019, the total employment (number of jobs) in Switzerland rose by 1.2% in comparison with the same quarter a year earlier (+0.2% with previous quarter). Employment growth has thus been uninterrupted for a decade. In full-time equivalents, employment in the same period rose by 1.1%. The Swiss economy counted 3700 more vacancies than in the corresponding quarter of the previous year (+5.0%) while the employment outlook indicator fell...

Read More »USD/CHF Price Analysis: Bearish spinning top keeps sellers hopeful

USD/CHF snaps two-day losing streak. Bearish candlestick formation, sustained trading below 200-day SMA favor further selling. Bullish MACD, 50-day SMA question the bears. USD/CHF registers fewer moves while trading around 0.9790 during the pre-European session on Tuesday. The daily chart forms a bearish candlestick pattern but bullish MACD and 50-day SMA could limit further declines. That said, the bears will be more powerful to aim for 0.9700 if breaking a 50-day...

Read More »Wertpapierdepots klettern um fast eine Billion Franken

Aktiendepots bei Schweizer Banken befinden sich auf Rekordniveau (Bild: shutterstock) Ende 2019 erreichte der Wertschriftenbestand in den Depots der Schweizer Banken laut den neuesten Daten der Schweizerischen Nationalbank SNB einen neuen Rekordstand von 6,72 Bio. Fr. Die Zunahme belief sich auf fast eine Bio. Franken. Genau waren es 961 Mrd. Fr. bzw. 16,7%. Dieses aussergewöhnliche Wachstum ist vor allem den haussierenden Aktienmärkten zu verdanken. So schnellte...

Read More » SNB & CHF

SNB & CHF