Auch zum der Franken kann sich der Dollar erholen und wird aktuell zu 0,9066 Franken gehandelt, nachdem er im frühen Geschäft bis 0,9036 gesunken war. Entsprechend ist der Euro zum Franken nicht weiter gefallen und kostet kaum verändert 1,0737 Franken. Am Dienstag war die Gemeinschaftswährung auf den tiefsten Stand seit Jahresbeginn gefallen. Damit dürfte auch der Druck auf die Schweizer Nationalbank (SNB), am Markt zu intervenieren, wieder nachlassen,...

Read More »Credit Suisse to face ‘tuna bonds’ trial

The bank will face a trial over its role in Mozambique’s $2 billion (CHF1.8 billion) “tuna bonds” scandal, a fresh blow as it struggles to shake off a succession of crises that have plagued the group in recent years. The High Court judge presiding over a London lawsuit brought by creditors against Credit Suisse set a date last month of September 2023 for a 13-week trial, according to people familiar with the matter. The re-emergence of an eight-year-old scandal is a...

Read More »While the Herd Slumbers, Risk Is Rocketing Higher

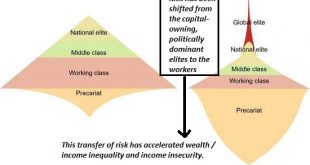

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy. One of the most consequential financial trends of the past 50 years has been ignored to the point of invisibility. I’m referring to the transfer of risk from the top tier to the middle and working classes. This transfer of risk has been broad-based, covering the...

Read More »End the Shutdown, Again

Sixteen months ago, in March 2020, we argued for an end to government-imposed shutdowns of businesses, schools, churches, restaurants, and events due to the covid virus: The shutdown of the American economy by government decree should end. The lasting and far-reaching harms caused by this authoritarian precedent far outweigh those caused by the COVID-19 virus. The American people—individuals, families, businesses—must decide for themselves how and when to reopen...

Read More »Yield Purchasing Power – Keith Weiner

Monetary Metals CEO, Keith Weiner gave a talk at an AIER (American Institute for Economic Research) dinner. The title of his talk is Yield Purchasing Power. Most people think in terms of purchasing power of money. How much can one’s cash buy? This shifts the focus on consumer prices and the liquidation value of assets. While this may be the prevailing view, it fails to capture the full damage done by our modern monetary malpractice. We suggest a different approach - Yield...

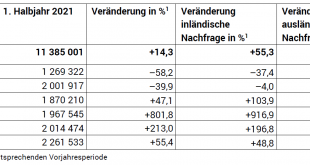

Read More »Swiss hotel sector: 14.3 percent rise in overnight stays in first six months of 2021

04.08.2021 – The hotel sector registered 11.4 million overnight stays in Switzerland in the first half of 2021, representing an increase of 14.3% (+1.4 million) compared with the same period of 2020. With a total of 9.2 million units, domestic demand rose by 55.3% (+3.3 million). Foreign visitors registered a 45.4% decrease (–1.8 million) with 2.2 million overnight stays. These are the provisional results from the Federal Statistical Office (FSO). . Download press...

Read More »Moving from Gold-Redeemable to Irredeemable Currency

When we saw the following comment from a prominent otherwise-free-marketer, we knew it was time to write this article. “…the value of the Fed’s “liabilities”(which are so in name only) [scare quotes and parenthetic comment in original] bears only a very loose connection to the value of its assets.” This statement seems so simple. The Fed is the issuer of America’s and the world’s reserve currency (mainstream pronunciation “muhn-ee”). Observing that this paper has...

Read More »Swiss think it’s vital that other people reduce CO2 emissions

Respondents thought reducing driving was necessary – for other people Keystone / Urs Flueeler A majority (70%) of Swiss believe it’s important to avoid emissions in their everyday lives, although fewer are likely to back up their views with action, according to a survey. There were no significant differences between women and men, but the over-50 age group believed it was more important to avoid emissions than younger age groups, said a surveyExternal link by...

Read More »How the Federalists Bullied Rhode Island into Joining the United States

Doughty, courageous little Rhode Island was the last state left. It is generally assumed that—even by the most staunchly Antifederalist historians—Rhode Island could not conceivably have gone it alone as a separate nation. But such views are the consequence of a mystique of political frontiers, in which it is assumed that a mere change in political frontiers and boundaries necessarily has a profound effect in the lives of the people or the validity of a territory or...

Read More »Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries. This from the IMF’s July 30, 2021, statement gleefully announcing its governing body(ies) has(d) agreed to a general allocation of $650 billion in SDR’s, biggest in history, according to existing quotas. The purpose: “to boost existing liquidity.” This really does sounds very...

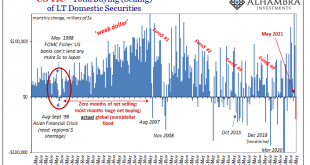

Read More » SNB & CHF

SNB & CHF