[unable to retrieve full-text content]This is the fiftieth anniversary of the demise of the gold standard and the beginning of the current fiat paper standard. Many will say “good riddance” to gold and “thank goodness” for the “good ole greenback”! Reflection, however, produces an alternative conclusion.

Read More »FX Daily, August 17: Antipodeans and Sterling Bear Brunt of Greenback’s Gains

Swiss Franc The Euro has fallen by 0.20% to 1.072 EUR/CHF and USD/CHF, August 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Concern about the economic impact of the virus and new efforts by China to curb “unfair” competition among online companies has triggered a dramatic response by investors. A lockdown in New Zealand and the Reserve Bank of Australia signaling it will respond if the economic fallout...

Read More »Deepfake hunters

Deepfakes are often used in ads and films, for instance when actors play younger versions of their characters. However, the technology also offers high potential for misuse. A spin-off of the Swiss Federal Institute of Technology Lausanne is using AI and deep learning to create software to help specialists detect fraud. Artificial intelligence helps detect anomalies inside images. The software then marks any manipulated areas. Detectors are also programmed to recognize manipulated faces,...

Read More »Can China help African cocoa producers outmanoeuvre Big Chocolate?

Adding value to cocoa can bring in more revenue for West African producers. Keystone / Legnan Koula In a bid to grab a bigger slice of the chocolate pie, cocoa-producing countries Ivory Coast and Ghana are turning to China for funding and a new marketplace. The move could pose a threat to the Swiss chocolate industry’s profit margins and its supply of raw materials. Despite the Covid-19 pandemic, VIPs in smart suits and traditional Ivorian dress gathered at an...

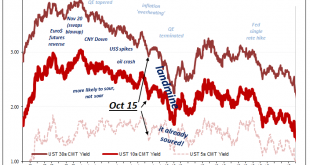

Read More »Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary. Taper. Then the tantrum. Except, no, it wasn’t sulking rage over the prospects for fewer...

Read More »A Look Back at Nixon’s Infamous Monetary Policy Decision

Putting the World on a Paper Standard Half a century ago one of the most disastrous monetary policy decisions in US history was committed by Richard Nixon. In a television address, the president declared that the nation would no longer redeem internationally dollars for gold. Since the dollar was the world’s reserve currency, Nixon’s closing of the “Gold Window” put the world on an irredeemable paper monetary standard. The ramifications of the act reverberate to...

Read More »Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren’t bugs, they’re intrinsic features of Neoliberalism’s fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all. This is known as...

Read More »Weekly View – 50 years later

The rosy US employment picture helped push equities to a new high as US inflation moderated in July. Those looking to fill roles now exceed those looking for work, compelling some small and mid-sized companies to raise wages. Higher prices seem to be keeping the US consumer in check, however, with consumer sentiment hitting its lowest level in a decade. We will be watching how this evolves given the US consumer’s key to the growth recovery story. The US earnings...

Read More »Businesses urged to back Swiss Covid-19 vaccination strategy

Berset insists that more people need to be vaccinated to defeat the pandemic. Keystone / Peter Schneider Health Minister Alain Berset has urged companies to back the government’s Covid-19 vaccination campaign, arguing it is in the economy’s interest to get as many people vaccinated as possible. Speaking to the SonntagsBlick newspaper on Sunday, Berset said thatExternal link: “Greater commitment from business is needed.” Earlier this week, the government said that...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

Read More » SNB & CHF

SNB & CHF