The Swiss watchmaking industry is one of Europe's hungriest consumers of stainless steel: it uses up to 120,000 tonnes of it per year. The sector is facing increased pressure to reduce its environmental impact and local entrepreneurs are presenting solutions. A waste management centre in canton Bern has established a recycling chain to enable valuable raw material to be re-used. They collect unsold watches and defective watch parts from some 20 brands in the region. The different materials...

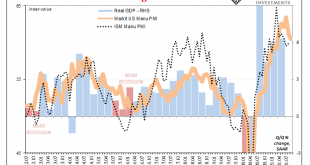

Read More »Soaring Energy Prices Lift Yields, Weigh on Equities and the Greenback Pops

Overview: Rising energy prices and yields are helping lift the US dollar and weighing on equities. November WTI has pushed above $76, while Brent traded above $80, and natural gas is up for the fourth consecutive session, during which time it has risen by about 25%. The US 10-year yield has surged to almost 1.53%, up more than 20 bp since the middle of last week. Near 32 bp, the US 2-year yield is at a new 18-month high. European yields are 3-5 bp higher, with...

Read More »Reading Jeff Snider: Liquidity Risk Concerns Given Credit Risk ‘Solutions’ [Ep. 110]

Jeff Snider reviews the recent Bank of Japan experience with quantitative and qualitative easing. The central bank starts off on the wrong foot, focusing on credit quality issues instead of market participants' liquidity preferences; it goes sideways from there. A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "36mm" by Jobii at Epidemic Sound. ----------WHAT----------...

Read More »Swiss government defends its strategy ahead of second anti-Covid vote

Source: Facebook On 28 November 2021, Swiss voters will be asked whether they accept laws passed by the government on 19 March 2021 that paved the way for the introduction of Switzerland’s Covid certificate, a system that provides proof of vaccination, recovery or a negative test. This is the second time a vote has been organised to challenge the government’s response to the Covid-19 pandemic. On 13 June 2021, voters were given a chance to reverse the first batch of...

Read More »CBDC-Test: Ripple arbeitet mit der Zentralbank von Bhutan zusammen

Die Zentralbank von Bhutan hat sich mit Ripple zusammengetan, um eine CBDC zu pilotieren, die die finanzielle Inklusion des Landes bis 2023 um 85 Prozent steigern könnte. Die Royal Monetary Authority (RMA) – die Zentralbank von Bhutan – hat sich mit Ripple zusammengetan, um eine digitale Version der Landeswährung einzuführen. Die Institution erwartet, dass die Initiative die finanzielle Eingliederung des Landes in den nächsten zwei Jahren um 85 Prozent steigern...

Read More »Duckenmiller: Krypto ist die Lösung für das von der Federal Reserve geschaffene Problem

Der US-Dollar könnte aufgrund der umstrittenen Politik der Fed seinen Status als globale Reservewährung verlieren und durch ein Ledger-basiertes System ersetzt werden, so Druckenmiller. Nach jahrelanger Suche nach dem wahren Problem, das es zu lösen gilt, haben Kryptowährungen es endlich gefunden, so der milliardenschwere Investor Stanley Druckenmiller. In einem aktuellen Interview glaubt der 67-Jährige, dass die US-Notenbank Fed und andere Zentralbanken die Stärke...

Read More »Why Everyone Should Read These Two Essays by Ludwig von Mises

Like virtually all of the work of Ludwig von Mises, these two essays, his 1958 Liberty and Property and his 1950 Middle-of-the-Road Policy Leads to Socialism are timeless. They are as important now as they have ever been and will increase in relevance as the growth of government continues almost unabated. The growth of government constitutes an assault on private property and individual freedom by politicians, bureaucrats, and interest groups who seek to keep for...

Read More »Reading Jeff Snider: If a Fed Taper Falls in the Woods… [Ep. 109]

The Fed's expected taper is just empty, insignificant theater. The Fed is tapering never once having answered for headwinds, false dawns, and the world’s true wealth repeatedly suffering under stagnation and decline. A reading, by Emil Kalinowski. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Born in the 90's" by Ameryh at Epidemic Sound. ----------WHAT---------- Previewing The Taper Theater:...

Read More »Jeff snider 2. the bitch Of the truthers

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain. Deflation, too. On the contraction side, demand might fall off a bit for...

Read More » SNB & CHF

SNB & CHF