It is a widely held belief that political inclusion has been an integral part of Swiss life since women gained the right to vote in 1971. Democracy, however, is a work in progress. To this day, some people remain excluded from Swiss political life. The move towards full democracy has happened in small, sometimes surprising, steps. One example is a historical 2020 vote in canton Geneva: 75% of voters agreed that citizens with mental or physical disabilities were entitled to full voting...

Read More »Myth versus Ideology: Why Free Market Thinking Is Nonideological

I’ll begin with a provocative thesis: socialism is ideological and free market thinking, while involving myth, is nonideological. I will show why socialism is ideological and why free market thinking involves myth but is nonideological by defining the terms myth and ideology and distinguishing them from each other. The term “myth” has several connotations. The most common connotation today is that myth represents false belief. Thus, we see many uses of the term myth...

Read More »How to Build and Destroy a Pension Fund System in 22 Easy Steps

CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission. Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town (the falling interest rate). Then when...

Read More »Now That Housing Is Rolling Over, Is That Fixer-Upper a Deal?

So-called “cosmetic work” can cost tens of thousands of dollars. Now that housing is finally rolling over due to rising mortgage rates and bubble valuations, many of those who have been priced out of the market are hoping to take advantage of lower prices. In many cases, the most affordable segment is fixer-uppers, homes that are distressed for any number of reasons: a lack of maintenance; construction or drainage deficiencies; obsolete or defective foundations,...

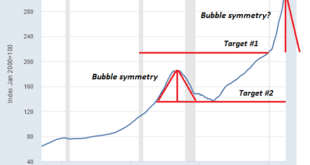

Read More »Home prices are now falling, piling on the Fed pivot from near and dear to the FOMC (models).

As if there aren't enough suspects which could end the Fed's rate hikes regime (more importantly represent serious threats to the economy and markets), now we have confirmed falling home prices to add to the already-toxic environment. The empty suits at the FOMC are glued to the CPI which reflects last year's home prices while this year's indicate rapid deterioration. What a world. Eurodollar University's Money & Macro Analysis Ben Bernanke July 2005...

Read More »Coup d’Etat planétaire, le livre qui annonçait le great reset en 2019 en lecture libre.

Chers amis lecteurs, Après le succès de la diffusion de Dépossession en libre accès, voici la suite indispensable Coup d’Etat planétaire. Ce livre est la suite de Dépossession et je le mets lui aussi en libre accès. coup_etat_planetaire_liliane_held_khawamTélécharger Je rappelle que ce livre a été publié en septembre 2019, soit plusieurs mois AVANT le Covid-circus. Or, il y est soigneusement décrit les bases contractuelles (Traités supragouvernementaux) qui...

Read More »Twitter arbeitet an Crypto-Wallet

Noch bevor Elon Musk den Staffelstab offiziell übernimmt, kommen Gerüchte auf, dass Twitter an einer Crypto-Wallet arbeitet. Bereits Jack Dorsey war dafür bekannt, den Crypto-Markt auf der Social Media Plattform einbinden zu wollen. Crypto News: Twitter arbeitet an Crypto-WalletDie Meldung kommt allerdings nicht von offizieller Seite und wurde von Twitter weder bestätigt noch verneint. Jedoch kommt sie von einem Developer, der bereits in der Vergangenheit...

Read More »Consolidative Tuesday

Overview: The yen and sterling are trading quietly after the recent drama, but with the Party Congress ending, the Chinese yuan has been permitted to fall faster. It approached the 2% band today and its loss of about 0.65% today makes it the weakest among the emerging market currencies. Most of the major currencies seem to be consolidating. Chinese stocks pared earlier losses as foreign buying via the Hong Kong link returned after large sales yesterday. Asia Pacific...

Read More »Wie Deutschland deindustrialisiert werden sollte. Der Morgenthau Plan und an was er heute erinnert

Die Konsequenzen der Energiewende und der Deindustrialisierung Deutschlands erinnern an den amerikanischen Morgenthau Plan von 1944. Dieser sah neben der territorialen Zerstücklung die Umwandlung Deutschlands in einen Agrarstaat vor. Zehn bis zwanzig Millionen Menschenopfer sollten in Kauf genommen werden. Erst 1947 wurde der Morgenthau-Plan offiziell fallen gelassen und 1948 durch die Marshallplanhilfe ersetzt. Worin bestanden die Zielsetzungen des...

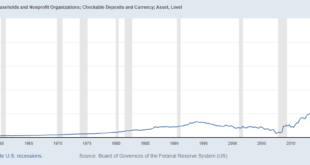

Read More »Powell’s Epiphany: There is No Free Lunch p2 Neutralizing the Money is Inflationary

Pandemic Wealth Effect The top 1% of the US made about $14T or $4.2M per person. The next 19% made about $20T or $318,000 per person. The next 30% made about $5T or $50,000 per person. The bottom 50% made about $1T or $6,000 per person. The resulting inflation is at a 40yr high and Powell wants the money back. Let’s recap what happened in the last 2 to 3 years. In addition to the Fed providing liquidity during the pandemic, there was a coordinated effort between...

Read More » SNB & CHF

SNB & CHF