Those watching the gold price and price of silver will have noticed the sharp uptick following the Federal Reserve’s announcement, yesterday. This was despite the Fed doing exactly what everyone expected them to do. For now, the Federal Reserve is sticking to its relatively well-telegraphed plan but how long will it be until they need to move the goalposts in order to do so? . Gold and Silver prices rose sharply on the Fed’s statement on Wednesday. The change of...

Read More »The Fed Is Already Flashing Signs It’s Done Raising Rates

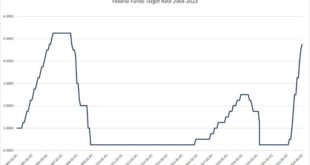

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 4.75 percent, an increase of 25 basis points. With this latest increase, the target has increased 4.5 percent since February 2022, although this latest increase of 25 basis points is the smallest increase since March of last year. Indeed, the FOMC has slowed its rate of increase over the past three months. After four 75 basis...

Read More »Corruption report: nepotism and conflicts of interest should be Switzerland’s focus

© Ngampol Thongsai | Dreamstime.com The 2022 Corruption Perceptions Index (CPI), published on 31 January 2023, shows that most countries are failing to stop corruption. The CPI ranks 180 countries and territories around the world by their perceived levels of public sector corruption, scoring on a scale of 0 (highly corrupt) to 100 (very clean). The global average remains unchanged for over a decade at just 43 out of 100. More than two-thirds of countries score below...

Read More »Legislators Seek Repeal of Wisconsin’s Controversial Sales Tax on Gold and Silver

Madison, Wisconsin – (February 4th, 2023) – A large bipartisan contingent of Wisconsin legislators seek to end Wisconsin’s controversial practice of levying sales tax on purchases of gold and silver. Senate Bill 33, primarily sponsored by Sen. Duey Strobel (R – Saukville) and Sen. Rachael Cabral-Guevara (R – Appleton), and cosponsored by Rep. Shae Sortwell, enjoys wide support – and would align Wisconsin with the policies of 42 other U.S. states. Senate Bill 33...

Read More »2023 Libertarian Scholars Conference

Join the Mises Institute at the 2023 Libertarian Scholars Conference on Saturday, September 23. We’ll meet at the Grand Hyatt in Nashville, Tennessee. The first Libertarian Scholars Conference was held in New York City in 1972 under the aegis of the Center for Libertarian Studies. The conference was held annually (except for 1973) throughout the 1970s in New York or Princeton, New Jersey (1977, 1978), with the 8th and last “national” conference taking place at the...

Read More »Ep. 431: Bill Bonner Interview with Michael Covel on Trend Following Radio

My guest today is Bill Bonner, an American author of books and articles on economic and financial subjects. He is the founder of Agora Financial, as well as a co-founder of Bonner & Partners publishing. Bonner has written articles for the news and opinion blog LewRockwell.com, MoneyWeek magazine, and his daily financial column Bill Bonner's Diary. The topic is his book Hormegeddon: How Too Much Of A Good Thing Leads To Disaster. In this episode of Trend Following Radio we discuss: ▪️...

Read More »You won’t believe what they just reported.

Payroll data is supposed to give us a good idea of what's really going on in the labor market therefore the whole economy. Instead, the BLS estimates for January were shot through with revisions, adjustments, control factors, and recoding. In the end, we're left facing the same mess as before. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com https://www.PortfolioShield.net...

Read More »Will Switzerland sort out its differences with the EU in 2023?

In 2021, the Swiss government broke off negotiations with the EU on an institutional framework agreement to govern future relations. Now both sides are looking for a new path. In this video, Larissa Rhyn, a correspondent for Swiss Public Television, SRF, explains what’s at stake. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »History is repeating. Again. And it can cost you big.

Equity markets cheered the Fed's position, major stock indices surging to record highs when policymakers confirmed they were open to rate cuts. The punchbowl, Goldilocks, the Greenspan put. Nah. The last hurrah before much harsher reality set in. There is no punchbowl and curves told everyone exposing the Fed's fraud. Eurodollar University's Money & Macro Analysis Dow, S&P break records; CNN https://money.cnn.com/2007/10/09/markets/markets_0500/ Fed explains the big rate cut;...

Read More »This wasn’t just expected, it has been practically inevitable.

What *was* behind the Fed's aggressive hawkishness from just a couple weeks ago? A whole lot of bad assumptions. What *is* behind the Fed's sudden conversion? The inevitable consequences of those assumptions. Lessons from history for what's going on right now. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com https://www.PortfolioShield.net RealClearMarkets Essays:...

Read More » SNB & CHF

SNB & CHF