Lending standards are already being tightened in a way we don't see outside of serious recession. Loan officers are battening down the hatches preparing for the financial storm which wouldn't be coming if the economy was heading for a soft landing. As credit dries up, the job cuts get amped up. Eurodollar University's Money & Macro Analysis SLOOS https://www.federalreserve.gov/data/sloos/sloos-202301.htm April 2008 FOMC Transcript...

Read More »“Fundamentals and technical analysis are two sides of the same coin”

Interview with Laurent Halmos For most die-hard physical gold investors and students of history like myself and most of my readers and clients, technical analysis is often seen as a bit of a taboo, or at best something irrelevant to our worldview and investment approach. Nevertheless, to paraphrase the old saying about politics, just because you are not interested in the charts doesn’t mean that the charts are not interested in you. I met Laurent...

Read More »No Turn Around, but Consolidation Featured

Overview: After large moves yesterday, the capital markets ae quieter today. Stocks are mostly firmer, and the 10-year US yield is a little softer near 3.62%. Strong nominal wage increases in Japan and a hawkish hike by the Reserve Bank of Australia helped their respectively currencies recover, though remain within yesterday's ranges. The euro briefly traded below $1.07, and sterling has been sold through $1.20. That said, a consolidative tone is the main feature...

Read More »The Swiss view of free movement within the EU

Livia Leu, Switzerland's chief negotiator with the European Union, has been talking about the challenges ahead in 2023, especially when it comes to the free movement of people. For about 20 years, Switzerland has regulated its relations with the EU in bilateral agreements, an alternative to EU membership that it would like to maintain. But the rules governing EU market access have now changed so the bilaterals need updating. The EU and Switzerland are discussing how to package their...

Read More »How popular votes made Switzerland a global democracy leader

With its second federal constitution of 1874, Switzerland was suddenly catapulted to the forefront of democracy development worldwide. No canton had voted so strongly in favour of radical change as Schaffhausen. Adopting the new federal constitution marked a milestone in Swiss history. It brought about several important improvements, making up for just about everything the original constitution lacked. Many of these improvements would not have happened without what became known as the...

Read More »The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison? Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a consequence, money from central banks in many countries ceased to flow to governments. Have...

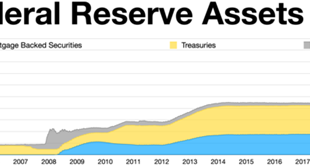

Read More »The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Every so often, I check my investment portfolio to see how it is doing. (I stay out of stocks these days, but that is due to my personal situation and is not to be taken as investment advice.) Portfolios are collections of various financial instruments that one is holding, and one always hopes that their value will head in the right direction over time. When I purchase a financial instrument, I do so because I hope it will perform well in the future. I certainly do...

Read More »Managing Money Is as Important as Making It: The Sad Case of Athletes Going Broke

Lacking a solid team is a recipe for organizational failure, and those intending to excel in business—or any other sector—must invest in management. Considering that many professional athletes encounter bankruptcy shortly after retiring, they are a demographic that could greatly benefit from quality financial management teams. Elite athletes earn millions of dollars during a short time, but few succeed at multiplying their earnings to create wealth. An investigation...

Read More »Weekly Market Pulse: Happy Days Are Here Again!

Your cares and troubles are gone There’ll be no more from now on! Happy days are here again! The skies above are clear again Let us sing a song of cheer again Happy days are here again! Lyrics: Jack Yellen, Music: Milton Ager That’s certainly how it’s felt since the turn of the new year with the NASDAQ up nearly 15%, European stocks continuing to recover, emerging markets anticipating a Chinese recovery and a solid January for the S&P 500. Bonds have been...

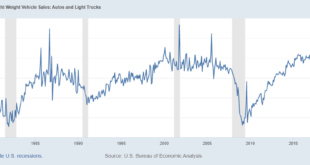

Read More »Markets right now are pricing the worst.

Even after Friday's "stellar" payrolls in the US, markets worldwide cling to extreme levels of inversion which means radical pessimism. But why? If there is a worst case set of scenarios, these are what they would be. It's not necessarily a crash, but what more likely what comes after. Eurodollar University's Money & Macro Analysis Stock & Watson; Has the Business Cycle Changed and Why? https://www.nber.org/papers/w9127 Bernanke; The Great Moderation...

Read More » SNB & CHF

SNB & CHF