When I took my high school’s twentieth-century world history class, both the teacher and workbooks claimed repeatedly that World War II took us out of the Great Depression. Why would anyone question this? After all, unemployment went down. The US Bureau of Labor Statistics measured the unemployment rate from 1929 onward. In 1939 the unemployment rate stood at 17.2 percent. By 1942 it was at 4.7 percent, and by 1944 it was at 1.2 percent. Professor Friedrich Hayek...

Read More »Juice launch: The ESA mission to Jupiter lifts off

After postponing its launch due to risk of lightning, the Jupiter Icy Moons Explorer (JUICE) has successfully begun its eight-year journey to Jupiter on April 14. For the next three years, the probe will orbit the giant gas planet as well as Jupiter’s three icy moons of Jupiter to search for, among other things, traces of life. The University of Bern contributed to the development of several key instruments. The European Space Agency mission is also specifically targeting...

Read More »The Current Farm Bill Fraud: Government as Usual

The 2018 Farm Bill is due to expire this year, and US lawmakers have already begun working out the next version. This food-related omnibus bill was introduced ninety years ago as a “temporary” measure during the Great Depression. It’s been reauthorized by Congress every five years since, and recent ones cobble together two seemingly unrelated programs, the Supplemental Nutrition Assistance Program (SNAP), formerly called food stamps, and federal farm subsidies....

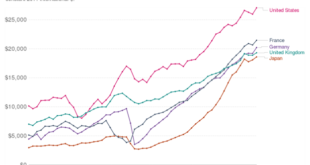

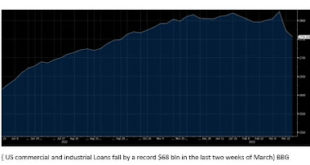

Read More »Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites have returned. Equities and yields are mostly higher. The dollar is seeing yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese stocks, with the Nikkei advancing 1%. Several other markets in the region also gained more than 1%, including Australia and South Korea. China's CSI was an exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6% through the European morning, and bank...

Read More »Switzerland to tax electric vehicles from 2024

Vehicles imported into Switzerland are subject to a 4% tax, with the exception of electric vehicles that attract none. This week, the government decided to end the exception from the beginning of next year. Photo by Hyundai Motor Group on Pexels.comThe import tax, along with fuel and other taxes, is used to build and maintain roads. Given current federal budget pressures, and the logic of charging all road users, the federal government has decided to tax the...

Read More »How to Think about the Economy: A Primer Audiobook

How to Think about the Economy was written to accomplish something big: economic literacy. It is intentionally kept very short to be inviting rather than intimidating. You will gain a life-changing understanding of how the economy works in practically no time. Narrated by John Quattrucci. Download the complete audiobook (12 MP3 files) in one ZIP file here. This audiobook is also available on Soundcloud and via RSS. Purchase the Audiobook on Audible/Amazon, or...

Read More »How Australia and New Zealand Helped Provoke and Escalate the First World War

Every year on April 25, Anzac Day is observed in Australia and New Zealand. It originally commemorated Australians and New Zealanders who served and died during the First World War. It has since become a day of remembrance for all Australians and New Zealanders who have served and died in military conflicts. One can understand the desire to mourn the dead. However, the loyalist nature of the commemorations—military and government figures are prominent, and there is...

Read More »The Extended Holiday Makes for Subdued Price Action

Overview: The holiday continues. In the Asia Pacific region, Hong Kong, Australia, and New Zealand, and the Philippines markets were closed. The regional bourses advanced but China. European markets remain closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is off nearly three basis points to about 3.36%. The dollar is trading quietly mostly within ranges seen before the weekend. It is slightly softer against most of the G10 currencies, but...

Read More »Jeff’s Farewell To The Human Action Podcast

Jeff and Bob review the history and impact of The Human Action Podcast—formerly Mises Weekends—and discuss where the podcast is headed. Get Jeff's new book A Strange Liberty: Politics Drops Its Pretenses: Mises.org/Strange [embedded content] [embedded content] Tags: Featured,newsletter

Read More »The Gold Family

This episode explores precious metals. Gold (Au) is the main precious metal, followed by Silver (Ag), Platinum (Pt), and Palladium (Pd). These are distinct from valuable industrial metals such as copper (which served as money historically), nickel, and zinc, which have served as token coins in modern times. There are many different ways and forms you can own precious metals. Be sure to follow Minor Issues at Mises.org/MinorIssues. [embedded content]...

Read More » SNB & CHF

SNB & CHF