See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Cost of Carry The prices of both metals were down this holiday-shortened (Labor Day in the US) week, especially on Friday. The decline corresponded to a spike in interest rates. Of course everyone watched the action of the stock market on Friday. Whatever the proximate cause, the root is credit. When borrowing to...

Read More »FX Daily, September 12: Markets Off to a Wobbly Start

Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »Swiss Real Estate: Empty dwellings back to 2001 levels

12.09.2016 09:15 – FSO, Economic Surveys (0353-1608-80) The Swiss Real Estate Bubble and Rents The number of empty dwellings is an important indicator for the Swiss real estate bubble. Prices of Swiss real estate had risen by 5%-8% per year between 2009 and 2014, while rents for existing contracts are regulated and have not followed this path yet. Landlords can only introduce higher prices levels for new buildings...

Read More »Emerging Markets: Week Ahead Preview

EM ended last week on a soft note. Perhaps it was the North Korean nuclear test (see below). Perhaps it was disappointment in the ECB or rising Fed tightening odds. Whatever the trigger was, EM FX weakness persisted and appears likely to carry over into this week. Indeed, as the September 21 FOMC meeting approaches, markets are likely to get even more jittery and choppy. Just to keep things in perspective,...

Read More »Getting a new heli hub off the ground

Experts at helicopter air rescue, the Swiss are hoping to gain greater recognition in order to capitalize internationally. (SRF/swissinfo.ch) The former military airport of Mollis in canton Glarus is becoming a hub for the helicopter industry. It’s a joint venture between the local authorities, the canton and local helicopter companies. Currently there are only a few smaller companies here, but there’s plenty of room for more. Among the main ones are the Swiss air rescue service, REGA,...

Read More »If Everything Is So Great, How Come I’m Not Doing So Great?

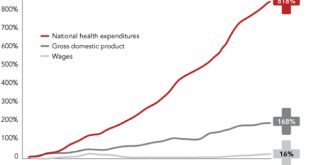

While the view might be great from the top of the wealth/income pyramid, it takes a special kind of self-serving myopia to ignore the reality that the bottom 95% are not doing so well. We’re ceaselessly told/sold that the U.S. economy is doing phenomenally well in our current slow-growth world — generating record corporate profits, record highs in the S&P 500 stock index, and historically low unemployment (4.9% in...

Read More »FX Weekly Preview: Capital Markets in the Week Ahead

Summary: Global bonds and global stocks ended last week on a weak note and this will likely carry into this week’s activity. The Bank of England meets, but the data may be more important. Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week. The week ahead will likely be shaped by a combination of...

Read More »Case For -2 percent Rates, Banning Cash? Jim Grant Blasts Lunatic Proposals

Submitted by Michael Shedlock via KMichTalk.com, Looking for group think, extrapolation of extreme silliness, linear thinking, and belief in absurd models? Then look no further than Fed presidents, their advisors, and academia loaded charlatan professors. Today’s spotlight is on Marvin Goodfriend, a former economist and policy advisor at the Federal Reserve’s Bank of Richmond, and Ken Rogoff, a chaired Harvard...

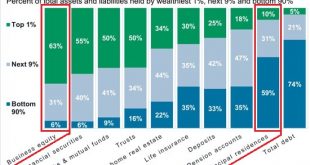

Read More »Control What You Can and the Asset Ownership of the Wealthy

Our society does not make it easy to control what you can control. One of the aphorisms to live by here at Of Two Minds is control what you can.We don’t control the erosion of our money from inflation, the state’s vast criminalization machinery, the nation’s foreign policies or the central bank’s free money for financiers policies. So what do we control? Amazingly enough, we still control a few things. We control what...

Read More »Death in the mountains, an unsettling topic

Every year mountains take the life of dozens of people. Caught between guilt and judgement , the families of the deceased sometimes find it difficult to talk about the circumstances surrounding the accidents. (RTS, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to...

Read More » SNB & CHF

SNB & CHF