Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: US election results accelerated forces that were already present. Interest rates have appeared to bottom, fiscal stimulus in Canada and Japan already evident, and divergence between US and EMU/Japan monetary policy. US stimuli may reach when the economy...

Read More »FX Weekly Review, November 07 – November 11: The Trump Reflation Trade

Swiss Franc Currency Index and the Trump Reflation Trade The Swiss Franc Index rose sharply, shortly after the U.S. elections. But then the Trump reflation trade came. Trump may fulfills the wet dreams of many economists. With tax cuts he might extend the U.S. fiscal deficit up to 10% per year. This resulted in: Gains on U.S. stocks and other dollar-denominated assets. In particular by yield-seeking Japanese pension...

Read More »Great Graphic: Growth in Federal Spending

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Federal spending growth under Obama is lower than under the previous four presidents. Subsequent to the chart, US federal spending has increased. It will likely increase more under the next President. The US policy mix is changing. The trajectory of...

Read More »An English Breakfast Causes Less Indigestion than the British Brexit

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide...

Read More »Dissection of the Long-Term Asset Bubble

The Long Term Outlook for the Asset Bubble Due to strong internals, John Hussman has given the stock market rally since the February low the benefit of the doubt for a while. Lately he has returned to issuing warnings about the market’s potential to deliver a big negative surprise once it runs out of greater fools. In his weekly market missive published on Monday (entitled “Sizing Up the Bubble” – we highly...

Read More »Which Government System Is The Best For People’s Wealth?

Via HowMuch.net, We have created a map which shows the per-capita GDP based upon the type of government in a country. The larger the country appears on the map, the higher the GDP per capita. GDP for Republics The map above shows the GDP per capita of countries with the republic form of government in red, including the United States. Among countries with this form of government, Singapore has the highest GDP per capita...

Read More »Great Graphic: Shifting Trade-Weighted Exchange Rates

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The dollar’s trade-weighted index is firming and a couple percentage points from the year’s high set in January. The yen’s trade-weighted index is at several month lows, but remains dramatically higher year-to-date. The euro’s trade-weighted index has...

Read More »Swiss National Bank agrees to pay out 1 billion francs annually

Today, the Swiss National Bank (SNB) announced a new agreement with the Federal Department of Finance, to pay the Swiss confederation and cantons CHF 1 billion per year, as was previously the case. The deal will run from 2016 to 2020, according to an official press release. © Phillip Judd The deal differs from the past because it requires shortfall payments. In years when the SNB doesn’t have enough reserves, the...

Read More »SMI: Trump win boosts pharma and financials

SMI A rally in pharmaceutical and banking shares helped boost the Swiss Market Index this week as investors weighed the prospect of a Trump’ presidency in the United States. SMI Index, November 11 - Click to enlarge Economic Data Stocks in the healthcare sector jumped after Donald Trump’s victory as drug pricing reforms, proposed by Hillary Clinton, are now unlikely to materialize. Pharma heavyweights Roche...

Read More »Toward a New World Order, Part II

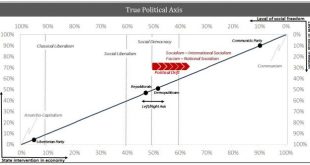

True Political Axis One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil. Which party representing good and...

Read More » SNB & CHF

SNB & CHF