Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

Read More »The Washington Post: Useful-Idiot Shills for a Failed, Frantic Status Quo That Has Lost Control of the Narrative

Don’t you think it fair and reasonable that anyone accusing me of being a shill for Russian propaganda ought to read my ten books in their entirety and identify the sections that support their slanderous accusation? I was amused to find my site listed on the now-infamous list of purportedly Russian-controlled propaganda sites cited by The Washington Post. I find it amusing because I invite anyone to search my 3,600-page...

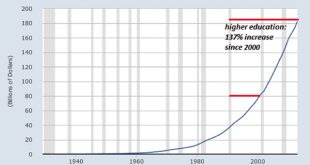

Read More »The Burrito Index: Consumer Prices Have Soared 160 percent Since 2001

Our real-world experience tells us the official inflation rate doesn’t reflect the actual cost increases of everything from burritos to healthcare. In our household, we measure inflation with the Burrito Index: How much has the cost of a regular burrito at our favorite taco truck gone up? Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can track the real-world...

Read More »Swiss Financial Accounts, 2015 edition

Institutional sector Non-financial corporations: 1106 bn CHF of assets, 1987 bn liabilities Almost half of financial assets of non-financial corporations are accounted for by the shares and other equity item and a quarter by loans. Total financial assets increased by CHF 34 billion to CHF 1,106 billion in 2015, mainly as a result of corporate acquisitions abroad and corporate group reorganisations. The liabilities...

Read More »Emerging Markets: What has Changed

Summary China President Xi raised the possibility of sub-6.5% growth. Fitch moved the outlook on Indonesia’s BBB- rating from stable to positive. The Philippine central bank raised its 2017 inflation forecasts for 2017 and 2018. The Hungarian central bank lowered the cap on the amount commercial banks can keep at its 3-month deposit facility. Turkish Energy Ministry met with major power companies and asked them to...

Read More »The Disaster of Inflation-For the Bottom 95 percent

Central banks seeking to boost inflation are waging financial war on the bottom 95% of households. Central banks are obsessed with boosting inflation, but the “why inflation is good” arguments make no sense for households being ravaged by inflation. The basic argument is that inflation makes it easier for debtors to service their debts. But this is only true if income rises along with costs. If income stays flat while...

Read More »Seven banks fined in Swiss probes of rate-rigging cartels

Switzerland handed out about $100 million in antitrust fines against seven U.S. and European banks for participating in cartels to manipulate widely used financial benchmarks. JPMorgan Chase & Co. was fined 33.9 million francs ($33 million) for operating a cartel with Royal Bank of Scotland Group Plc for more than a year, with the aim of influencing the Swiss franc Libor benchmark, which is tied to the London...

Read More »Modi’s Fantastic Promises

India’s Currency Ban, Part VII This article continues right where Part VI left off (for earlier updates on the demonetization saga see Part-I, Part-II, Part-III, Part-IV, and Part-V). There is still huge support for Modi even among the poor. A big carrot is dangled before them, which makes many stay numb to their current suffering. During his election campaign in 2014, Modi promised to deposit more than Rs 1.5...

Read More »FX Daily, December 23: Markets Edge into Holiday Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, December 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and...

Read More »Sentiment appears positive as investors close their books for the year

SMI Ahead of the Christmas break, trading volumes were thin this week amid a lack of new market catalysts. Swiss and European equities were generally unchanged through the week, tracking global stock markets. Overall, sentiment appears to be positive as investors close their books for the year. SMI Index, December 23 - Click to enlarge Economic Data The European banking sector was this week’s main story with...

Read More » SNB & CHF

SNB & CHF