Gold Is Money While Currencies Today Are “IOU Nothings” Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. - Click to enlarge What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills,...

Read More »Bi-Weekly Economic Review

[embedded content] Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018. Related posts: Bi-Weekly Economic Review: Embrace The Uncertainty Bi-Weekly Economic Review Bi-Weekly Economic Review: One Down, Three To Go Bi-Weekly Economic Review: A Whirlwind of Data Bi-Weekly Economic Review: Don’t Underestimate...

Read More »UBS publishes agenda for the Annual General Meeting of UBS Group AG on 3 May 2018

- Click to enlarge Zurich, 3 April 2018 – The Board of Directors of UBS Group AG is proposing Jeremy Anderson and Fred Hu for election as new members of the Board of Directors for a one-year term. Jeremy Anderson (born 1958) was Chairman of Global Financial Services at KPMG International from 2010 until November 2017. He previously held various senior positions at KPMG and was appointed to lead KPMG’s UK Financial...

Read More »FX Daily, April 04: Trade Specificities Rattle Markets

Swiss Franc The Euro has risen by 0.31% to 1.1799 CHF. EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations...

Read More »French strike affects Swiss rail connections

Train connections to Switzerland were completely cancelled on Tuesday and several flights between Zurich and Paris were also affected. (Keystone) - Click to enlarge Nationwide strikes in France against railway reforms have resulted in all rail connections to Switzerland being cancelled on Tuesday. The so-called Black Tuesday marked the first day of a series of strikes expected to last until the end of June....

Read More »Has Switzerland blown its crypto-opportunity?

The 'Crypto Valley' of Zug established itself as a leading global hub for ICOs last year (Keystone) - Click to enlarge Legendary United States crypto investor Tim Draper believes Switzerland has missed the boat in establishing itself as an attractive global hub for blockchain start-ups. Draper has invested in Tezos, which ran into a damaging governance row in Switzerland shortly after its initial coin...

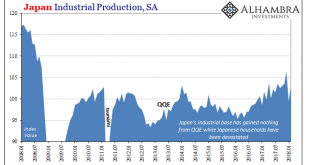

Read More »The Best ‘Reflation’ Indicator May Be Japanese

Japanese industrial production dropped sharply in January 2018, Japan’s Ministry of Economy, Trade, and Industry reported last month. Seasonally-adjusted, the IP index fell 6.8% month-over-month from December 2017. Since the country has very little mining sector to speak of, and Japan’s IP doesn’t include utility output, this was entirely manufacturing in nature (99.79% of the IP index is derived from the manufacturing...

Read More »Mountain guides are becoming rare

Being outside and showing people around Switzerland's magnificent scenery: it sounds like the makings of a dream job, yet not enough people are showing interest in becoming mountain guides anymore. Swiss Public Television, SRF found out why. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

Read More »French-speaking Swiss artists take the rap scene by storm

In the past, the French-speaking Swiss rap scene was dominated by Sens Unik and Stress. Today's stars are Slimka, Makala and Di-Meh. What makes their music so popular? (RTS/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »Weekly Technical Analysis: 02/04/2018 – Gold, WTI Oil Futures, GER30 Index, USD/JPY

USD/CHF The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target. We reminding you that confirming breaching 0.9581 will push the price to visit 61.8% Fibonacci correction level at 0.9675 before any new attempt to...

Read More » SNB & CHF

SNB & CHF