Poverty can also affect people on a more short term basis than the statistics usually consider. Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

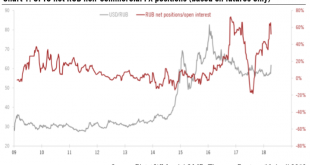

Read More »Russian rouble: significantly undervalued but quite risky

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them...

Read More »The history of Swiss chocolate

Cailler is Switzerland’s oldest chocolate manufacturer. However, resting on its laurels is not an option in today’s chocolate business: innovation is a must. A look back at the past shows the milestones in the history of Swiss chocolate. It was at the beginning of the 20th century that chocolate conquered the world. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss...

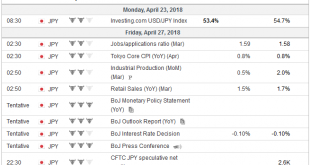

Read More »FX Weekly Preview: Markets and Macro

Worries about a trade war appear to have eased, at least for the moment, but that does not make investors worry-free. The concerns have shifted toward rising US interest rates, perhaps more than anything else, but general anxiety seems elevated. The unpredictableness of Trump Administration is not helpful, and even though oil prices recovered, they did react quickly, losing a dollar a barrel in response to his tweet....

Read More »Emerging Markets: What Changed

Summary The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections. Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador. Stock Markets In the EM equity space as measured by MSCI, Qatar (+4.8%), Russia (+3.3%), and Singapore...

Read More »Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

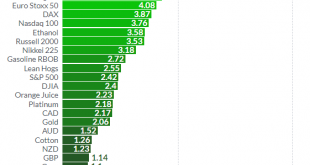

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in...

Read More »Euro area core inflation to rise again after Easter

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »Healthcare costs rise further in Switzerland

Statistics published today show a further rise in Swiss healthcare costs. © Aviahuismanphotography | Dreamstime.com - Click to enlarge In 2016, spending on healthcare rose by 3.8% reaching over CHF 80 billion, 12.2% of GDP. In 2015, Swiss healthcare spending was equal to 11.9% of GDP. The challenge of rising healthcare costs is not confined to Switzerland. In the UK in 2015, healthcare costs rose 3.6% to reach 9.9% of...

Read More »Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

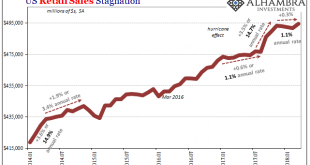

Read More »The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months. US Retail Sales, Jan...

Read More » SNB & CHF

SNB & CHF