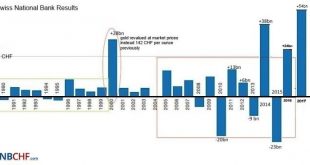

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Switzerland spent CHF 11.4 billion on environmental protection in 2016

Neuchâtel, 26 April 2018 (FSO) – In 2016, 11.4 billion francs were spent on the environment, equivalent to 1.7% of gross domestic product (GDP). Since 2008, environmental expenditure has increased by 5%. Two thirds were spent on wastewater and waste management. Overall, expenditure in these two areas decreased by 5%, while it increased by 34% in the other environmental sectors. These initial estimates are based on the...

Read More »Swiss travel and watch firms named best places to work

Swiss International Air Lines has been ranked as the most attractive employer in a survey on the 150 largest companies in Switzerland. Zurich Airport came in second, followed by watchmaker Patek Philippe. The survey, published by Dutch recruitment agency Randstadexternal link on Thursday, asked 4,800 people aged 18-65 where they would like to work. The study took 16 criteria into account, including work environment,...

Read More »FX Daily, April 27: Dollar Puts Finishing Touches on Best Week Since November 2016

Swiss Franc The Euro has fallen by 0.08% to 1.1958 CHF. EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week’s gains to change market’s...

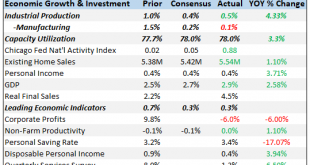

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

Read More »From Fake Boom to Real Bust

Paradise in LA LA Land More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf. Normally, judgment would be passed on a Thursday, but we are making an exception. - Click to enlarge For example, here in the land of...

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice

BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice: Liliane Held-Khawam L’endettement et la spéculation sont au coeur de la stratégie de la BNS. On met quand et comment le stop? Il semblerait que la BNS fasse des pertes sur ce premier trimestre 2018 de 5 milliards. Une paille au vu de ce que nous pourrions craindre pour l’avenir. Mais le scoop n’est pas là. Il est dans la composition des causes de...

Read More »FX Daily, April 26: Euro Remains Soft Ahead of Draghi

Swiss Franc The Euro has risen by 0.03% to 1.1957 CHF. EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the...

Read More »Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

USD/CHF The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is...

Read More » SNB & CHF

SNB & CHF