Ice-skating robots have proven a popular ambassador for Swiss innovation on the sidelines of the World Economic Forum. While companies and innovators are excited about their tremendous potential, the rise of robots is a source of anxiety for many who worry their jobs will disappear. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »Ice-skating robots showcase Swiss innovation

Ice-skating robots have proven a popular ambassador for Swiss innovation on the sidelines of the World Economic Forum. While companies and innovators are excited about their tremendous potential, the rise of robots is a source of anxiety for many who worry their jobs will disappear. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »Switzerland scores well on youth job market conditions but suffers from skills mismatch

A recent report places Switzerland second in a ranking of 33 european countries on conditions in the youth labour market in 2016 – youth are those between 15 and 24. ©-Tea-_-Dreamstime.com_ - Click to enlarge Switzerland’s overall score of 5.67 out of 7.00 is close to Denmark’s 5.72. Switzerland’s highest scores are for employment rate (6.01) and working conditions (5.77), with education (5.36) and smoothness of...

Read More »Gentrified Urban America Will Be Hit Hard by the Recession

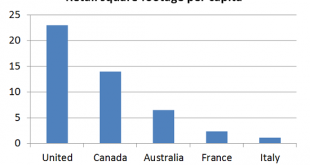

Combine sky-high commercial rents in homogenized, gentrified urban areas and sharp declines in the incomes of the limited populace who can afford gentrified urban areas and what do you get? A number of macro dynamics have set up gentrified urban America for a big fall in the coming recession. What does gentrified mean? Gentrified means only the gentry (top 10%) can afford to enjoy the urban amenities as commercial rents...

Read More »CHARLES HUGH SMITH RED ALERT – Why We Are Going Toward Venezuela’s Path

The Awakening Is Now Going World Wide, The Movement Has Started:Charles Hugh Smith

Today's Guest: Charles Hugh Smith Website: Of Two Minds http://oftwominds.com Blog https://www.oftwominds.com/blog.html Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject matter. The representative artwork included with these videos shall not be construed as the actual events that are taking place. Intro Music: YouTube Free Music Hey Sailor by Letter Box Fair Use Notice: This video contains some...

Read More »FX Daily, January 23: Markets Walk Tightrope after Yesterday’s US Equity Drop

Swiss Franc The Euro has risen by 0.03% at 1.1327 EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have fared better than the 1.4% slide in the S&P 500 yesterday may have implied. Asian markets were mixed, with China, Korea, Hong Kong, Thailand advancing. The Dow Jones Stoxx 600 from Europe is a little changed...

Read More »ECB Preview: Worries Increase but Not Quite Ready to Act

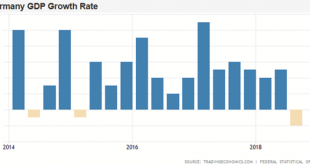

The ECB meets Thursday, and it may be best conceived as a transition meeting. It will lay the rhetorical groundwork for two things: a likely downgrade to the staff’s growth forecasts and moving toward a new round of long-term loans (targeted long-term refinance operations). Draghi’s speech last week to the European Parliament anticipated the themes he can be expected to develop in his press conference on Thursday. The...

Read More »Swiss unemployment lowest in 10 years

© Erix2005 | Dreamstime.com Switzerland’s unemployment rate, now 2.6%, hasn’t been so low for 10 years, according to the latest figures from Switzerland’s State Secretariat for Economic Affairs (SECO). A weakening of the Swiss franc helped boost Switzerland’s economic growth, creating more jobs. The unemployment rate among young workers (15-24) dropped 0.7% to 2.4% as did unemployment among the 50+ (-0.3% to 2.5%). All...

Read More »Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin Shaky China: Chinese landing could be harder than expected Brexit and EU Breakage: “I have long thought the EU will eventually fall apart” Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold We may see “yellow vests” spread globally: Economics is about to get interesting … by John Mauldin via Thoughts from the Frontline For a...

Read More » SNB & CHF

SNB & CHF