UBS already implements a zero interest policy for savings accounts with over half a million Swiss francs. (© Keystone / Gaetan Bally) As of June 1, Switzerland’s largest bank will stop paying interest on adult savings accounts. Funds deposited in UBS savings accounts currently earn a rate of 0.01%, just like at Credit Suisse, the other major Swiss bank. Almost all other Swiss banks pay a small interest on saving...

Read More »Weakening Japanese momentum behind strong GDP figures

Japan’s latest GDP report reveals some notable weakness in the economy despite the strong headline figures. The preliminary reading of Japanese GDP for Q1 shows that the economy grew by 2.1% q-o-q annualised, beating the consensus forecast of -0.2%. However, behind the strong headline figures, details of the GDP report reveal some broad-based weakening in momentum. Declining corporate capex and sluggish household...

Read More »Keith Weiner, PhD, CEO & Founder of Monetary Metals

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »Keith Weiner, PhD, CEO & Founder of Monetary Metals

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

Read More »FX Daily, May 22: Sterling Can’t Get Out of Its Own Way

Swiss Franc The Euro has fallen by 0.24% at 1.1253 EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a nervous calm in the capital markets. Yesterday’s rally in US shares failed to excite global investors. China, Hong Kong, and Taiwan markets fell, while Japan was mixed. Foreign investors continued to sell Korean shares, but the...

Read More »Women represented on all top Swiss company boards

Women, such as Swiss Railways chairwoman Monika Ribar, are still in a minority, but the gap is slowly closing. (© Keystone / Peter Klaunzer) For the first time, all of Switzerland’s top 20 companies have at least one woman in the boardroom. The finding by consultancy firm Russell Reynolds shows the slow but steady progress towards gender equality in the management of Swiss firms. Russell Reynoldsexternal link found that...

Read More »Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading. For example, the ability to find substitutes for the more expensive tariff imports could be a critical part of the evaluation....

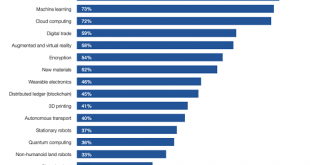

Read More »Two Intertwined Dynamics Are Transforming the Economy: Technology and Financialization

If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state. The two dynamics transforming the economy–technology and financialization–are intertwined yet widely viewed as unrelated. Critics and proponents of each largely ignore the other dynamic: critics of institutionalized fraud and other manifestations of financialization implicitly...

Read More »FX Daily, May 21: Equities Find Some Traction while the Dollar Firms

Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

Read More » SNB & CHF

SNB & CHF