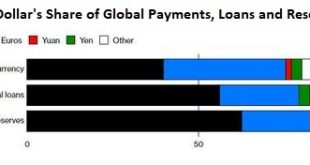

If China wants superpower status, it will have to issue its currency in size and let the global FX market discover its price. Quick history quiz: in all of recorded history, how many superpowers pegged their currency to the currency of a rival superpower? Put another way: how many superpowers have made their own currency dependent on another superpower’s currency? Only one: China. China pegs its currency, the yuan (RMB)...

Read More »Image of Swiss banks improves among public

Swiss banks are generally considered reliable and secure by the public The image of Swiss banks has returned for the first time to pre-financial crisis levels, according to a survey by the Swiss Bankers Association (SBA). Cybercrime remains a concern, however. “The banks’ positive image is the result of a combination of their commercial success and social responsibility, and the respondents’ positive experiences with...

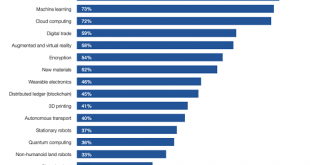

Read More »Technology Is Not Just Disruptive, It’s Disastrously Deflationary

Deflation eats credit-dependent, mass-consumption economies alive from the inside. While AI (artificial intelligence) garners the headlines, the next wave of disruptive technologies extend far beyond AI: as the chart of technologies rapidly being adopted shows, this wave includes new materials and processes as well as the “usual suspects” of machine learning, natural language processing, data mining and so on. While...

Read More »OECD lowers Swiss growth forecasts for 2019-2020

Swiss exports are expected to stagnate this year before recovering in 2020. (Keystone / Steffen Schmidt) The Organisation for Economic Cooperation and Development (OECD) has revised its growth forecasts for Switzerland downwards for the next two years due to a global economic slowdown. After a strong 2018 (+2.5%), gross domestic product (GDP) growth should slow in 2019 (+1%), the OECD said on Tuesday. This compares...

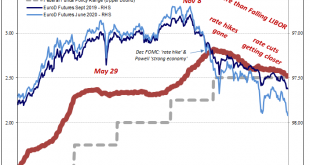

Read More »The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand. Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to...

Read More »Charles Hugh Smith on the U.S.-China Trade War

Click here for the full transcript: http://financialrepressionauthority.com/2019/05/23/the-roundtable-insight-charles-hugh-smith-on-the-u-s-china-trade-war/

Read More »Charles Hugh Smith on the U.S.-China Trade War

Click here for the full transcript: http://financialrepressionauthority.com/2019/05/23/the-roundtable-insight-charles-hugh-smith-on-the-u-s-china-trade-war/

Read More »FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Swiss Franc The Euro has fallen by 0.43% at 1.121 EUR/CHF and USD/CHF, May 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

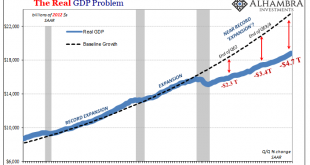

Read More »Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture: This neglect of other aspects of the system has been made easier by another...

Read More » SNB & CHF

SNB & CHF