Swiss Franc The Euro has risen by 0.13% at 1.1056 EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are happy for the weekend. Between the ECB, Brexit, and next week’s FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data...

Read More »Swiss Central Bank under Pressure as Franc Rises

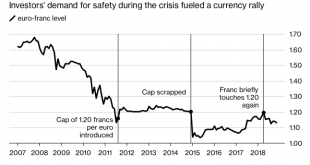

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Source: Valeriya Potapova - Click to enlarge Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and...

Read More »BREXIT UNCERTAINTY TO WEIGH ON YIELDS

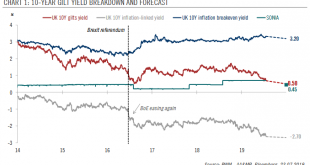

We expect the BoE to cut rates in November, even if a Brexit deal is reached by October. UK sovereign bond (gilts) yields have fallen this year, with the 10-year yield dropping by 59 basis points (bps) to 0.69%1, in concert with other core sovereign bond yields. The Brexit saga, along with the global slowdown forcing many central banks to turn dovish, are the main factors behind this steep fall. Taking stock of this...

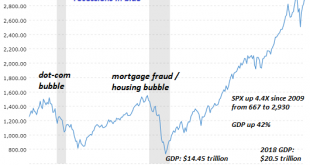

Read More »It’s Not Just the News That’s Fake–Everything’s Fake

That we fall for the fakes and cons is understandable, given that’s all we have left in the public sphere. What do we mean when we say corporate media is fake? We mean it’s a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader’s confidence in a narrative that serves the interests not of the citizenry but of a select...

Read More »Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today. The result of the weeks-long internal party election will be announced today and there are increasing concerns about the outlook for the UK economy and sterling due to the poor...

Read More »FX Daily, July 25: ECB Takes Center Stage

Swiss Franc The Euro has risen by 0.71% at 1.1045 EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are...

Read More »Swiss Railway Tracks Buckle under the Heat

Tracks being cooled with water The hottest day of the year in Switzerland caused a headache for the Swiss Federal Railways. Track damage occurred on Wednesday in the Zurich Oberland, canton Aargau near Brugg and in the Geneva area. Railways spokesman Raffael Hirt confirmed that lines had been interrupted in Zurich between Pfäffikon and Wetzikon and in Aargau between Wildegg and Brugg. In Geneva the stretch between...

Read More »Germany Struggles On

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike. The aftermath of that crisis, particularly the...

Read More »BNS, les taux vont encore être baissés

Je vous ai parlé de long en large de la BNS : ici : https://www.crottaz-finance.ch/blog/tag/bns/ De son bilan démesuré supérieur au PIB suisse De ne pas avoir vendu les euros achetés quand elle le pouvait D’avoir dû abandonner le taux plancher de 1.2 CHF pour 1 EUR sous la pression du marché (je l’avais prévu, mais la BNS a quand même tenu 3 ans et demi) Qu’avec les taux négatifs, les caisses de pensions (donc les...

Read More »Financial Media Elite Defensively Bash “Useless” Gold

Actually, Keynes’ “barbarous relic” remark was made not about gold itself but about the gold standard for currencies. Keynes wasn’t denying gold’s use as money. But that is the least of the problems with Wolf’s reply. Who cares about the prices of useless metals? “No significance in the modern world”? For starters, governments themselves care. That’s why central banks, against Wolf’s advice, continue to hold huge...

Read More » SNB & CHF

SNB & CHF