James Rickards holds a gold bar in a vault near Zurich, Switzerland. The bar is a so-called LBMA “good delivery” bar which weigh 400 ounces (over 99.9% purity), and is worth about $700,000 at current market prices. In 1971 it was worth $14,000. ◆ WHY GOLD? That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the...

Read More »Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek On Friday Dave from X22 and I discussed the planned “Cultural Revolution 2020” led by “the anointed” technocrats and whether we have to accept their reality as ours – or not? [embedded content] This work is licensed under a Creative Commons Attribution 4.0 International License....

Read More »FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

Swiss Franc The Euro has fallen by 0.31% to 1.0743 EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The...

Read More »Swiss develop first see-through mask

The transparent HelloMask allows non-verbal communication between patients and nursing staff Visualisation: EPFL A fully transparent surgical mask that filters out germs but allows facial expressions to be seen has been developed by Swiss scientists. Caregivers should be able to wear them from the summer of 2021. “For some segments of the population – like children, the elderly and the hearing impaired – the [current] masks are a major obstacle to communication,”...

Read More »Coronavirus: WHO changes advice on masks

© Haris Mulaosmanovic | Dreamstime.com The World Health Organization (WHO) recently changed its advice on face masks. It now recommends healthy people wear them in public when social distancing is not possible, stating that they could provide a barrier for potentially infectious droplets. The WHO had previously said there was not enough evidence to recommend healthy people should wear them, although it has always advised that medical face masks should be worn by...

Read More »Jeff Snider! Huge Money Printing Speaks For Itself

Full Document transcript go to:https://www.financialanalysis.tv Contact advertising: Would you like to place ads on my youtube channel? Email: [email protected] Skype: akira10k Join discussion on Topic on Fan Page https://www.facebook.com/Economicpredictions/

Read More »Our Latest Thoughts on the Dollar

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows. Dollar Index, 2015-2020 - Click to enlarge RECENT DEVELOPMENTS There is a growing debate as to the root causes of recent dollar weakness. Is it the burgeoning national debt? The poor US...

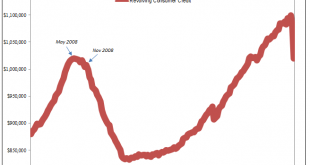

Read More »A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail. Leaning more and more on credit cards during the...

Read More »Monetary Metals Provides Gold Loan to Sector Resources

The loan is denominated in gold with interest and principal paid in gold Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed. Monetary Metals’ innovative business model enables gold-owning investors to lease or lend gold to businesses that use gold....

Read More »The Search for Yield

A no-holds-barred discussion of the economy after the coronavirus shutdown and George Floyd protests. Are we facing another Great Depression? Can there be a V-shaped recovery or is this wishful thinking? What will all the new money and credit created by Congress and the Fed mean for the dollar? What kind of economic mess will Trump or Biden inherit in 2021? How far will Fed chair Powell go to keep markets propped up? And how can you protect yourself and your...

Read More » SNB & CHF

SNB & CHF