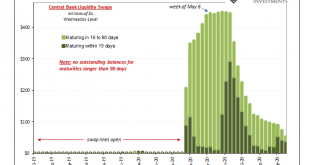

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday. Six months after Jay Powell conducted what he called a “flood”, with every financial media outlet reporting as fact this stream of digital dollars into every corner of the world, how can there be anything greater than zero in overseas liquidity swaps? Six months is an eternity....

Read More »What the Trade Balance Means for a Currency’s Purchasing Power

In July this year the US trade balance stood at a deficit of $63.6 billion against a deficit of $51 billion in July last year. Some commentators regard a widening in the trade deficit as an ominous sign for the exchange rate of the US dollar against major currencies in the times ahead. For most economic commentators a key factor in determining the currency rate of exchange is the trade account balance. In this way of thinking, a trade deficit weakens the price of the...

Read More »Inflation as a Tool of the Radical Left

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch its currency….Lenin was certainly right. There is no subtler, no surer way of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”1 Keynes does not provide a concrete source backing his words...

Read More »How to Tackle the Depression Head On: MN Gordon

https://rebrand.ly/rawealthpartners5 Get More Info Now How to Tackle the Depression Head On: MN Gordon , Keyword “I want to see people get money.” – Donald J. Trump, U.S. President, September 17, 2020 “Now is not the time to worry about shrinking the deficit or shrinking the Fed balance sheet.” – Steven Mnuchin, U.S. Secretary of the Treasury, September 14, 2020 Money for the People The real viral contagion that has infected the American populace is not an illness of the body. It’s...

Read More »Paternity Leave: ‘Nobody is talking about the indirect costs’

Yasmine Bourgeois, a member of the Zurich city parliament for the centre-right Radical-Liberal party. swissinfo.ch Switzerland doesn’t need two weeks of paternity leave, says Radical-Liberal politician Yasmine Bourgeois. The mother of three says if the proposal is accepted on September 27, left-wing groups will keep asking for more and more. As a mother who is not only against paternity leave but who is a member of the opposition committee, Yasmine Bourgeois is...

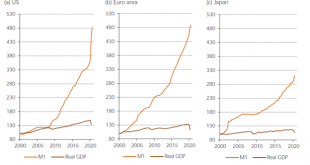

Read More »Monetary Policy Flapping in the Wind

Stephanie Kelton’s new book has attracted much attention, and Bob Murphy and Jeff Deist have already reviewed it, with devastating results. Why another review? The policies proposed in the book are so pernicious that further exposure of what she has in store for us is needed, and I have some new points to offer for your consideration. Besides, there are few things I enjoy more than writing a critical review. Kelton, who teaches economics at Stony Brook University,...

Read More »Risk Appetite Ebbs Ahead of BOE Decision

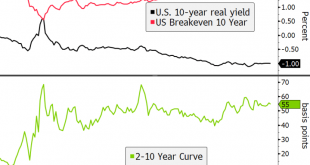

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday Fed manufacturing surveys for September will continue to roll out; weekly jobless claims will be reported; Brazil left rates unchanged at 2.0% but introduced some additional dovish guidance BOE is expected to deliver a dovish hold; UK government reached a...

Read More »Federal Judge: Pennsylvania’s Stay-at-Home Order Is an Assault on Human Rights

A federal judge on Monday ruled that Pennsylvania governor Tom Wolf’s covid-19 stay-at-home orders and forced business closures were unconstitutional. US district judge William Stickman IV of the US District Court for the Western District of Pennsylvania ruled that Wolf’s orders violated the Constitution in three ways. They violated the First Amendment right to freedom of assembly, and they violated both the due process and equal protections clauses of the...

Read More »FX Daily, September 18: When Every Thing is Said and Done, More is Said than Done

Swiss Franc The Euro has risen by 0.13% to 1.0775 EUR/CHF and USD/CHF, September 18(see more posts on EUR/CHF, USD/CHF, ). FX Rates Overview: Asia Pacific equities have taken the march on the US. Led by a 2% rally in Shanghai, most regional markets but Australia closed the week with gains. A two-week fall in the MSCI Asia Pacific Index has been snapped. European stocks are little changed, and the Dow Jones Stoxx 600 is holding on to its second week of gains. It...

Read More »Weekly View – No breakfast at Tiffany’s

The impact of political tensions on business is ever more apparent: LVMH of France will not, after all, proceed with the purchase of Tiffany of the US. If, as seems likely, the hand of the French government was involved, this is solid evidence that political sensitivities are increasingly influencing cross-border deals – something that is likely to remain the case just as M&A in general has been declining. Volatility is on the rise across most assets,...

Read More » SNB & CHF

SNB & CHF