Escaping the Hurricane BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash. A satellite image of hurricane Matthew taken on October 4. He didn’t look very friendly. Image via twitter.com - Click to enlarge “Evacuate or die,” we were told. Not wanting to do...

Read More »MACRO ANALYTICS – 10 11 16 – Bankers Crippling the Global Supply Chain – w/Charles Hugh Smith

ABSTRACT: http://gordontlong.com/Macro_Analytics.htm#Smith-10-12-16 A Follow-up Post to Video: GLOBAL SUPPLY CHAIN: "Don’t ask 'what is being counterfeited, but what isn’t!' " https://matasii.com/global-supply-chain-dont-ask-what-is-being-counterfeited-but-what-isnt/

Read More »FX Daily, October 11: The Dollar Remains Bid

Swiss Franc EUR CHF - Euro Swiss Franc, October 11 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger...

Read More »Swiss central bank can cut rates further if needed, says bank president Jordan

© Yulan | Dreamstime.com - Click to enlarge The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted...

Read More »Swiss central bank can cut rates further if needed, says bank president Jordan

© Yulan | Dreamstime.com - Click to enlarge The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted...

Read More »Australian property bubble on a scale like no other

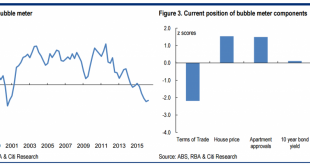

Australian property bubble on a scale like no other Yesterday Citi produced a new index which pinned the Australian property bubble at 16 year highs: Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: the record run up in commodity prices and...

Read More »Australian property bubble on a scale like no other

Australian property bubble on a scale like no other Yesterday Citi produced a new index which pinned the Australian property bubble at 16 year highs: Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: the record run up in commodity prices and...

Read More »Gold Sector Correction – Where Do Things Stand?

Sentiment and Positioning When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit. Gold – just as nice to look at as it always is, but slightly cheaper since last week. Photo...

Read More »Gold Sector Correction – Where Do Things Stand?

Sentiment and Positioning When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit. Gold – just as nice to look at as it always is, but slightly cheaper since last week. Photo...

Read More »Great Graphic: Euro is Approaching Year-Long Uptrend

Summary: The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany. This Great Graphic, composed on Bloomberg shows the euro against the dollar since the start of the year. It shows the trendline drawn off the...

Read More » SNB & CHF

SNB & CHF