As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global “helicopter money“, by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks). According to the latest weekly breakdown of what the...

Read More »Where Do US Companies Hire Abroad?

Summary: High-wage economies of Canada, EU, Japan and Australia account for nearly half of US corporate employment abroad. And even in low-wage regions, the high-wage parts tend to draw more US employment. The new US administration may have second thoughts about pivot to Asia, but US companies may not. US Flag Around the Earth --- Image by © Images.com/Corbis - Click to enlarge The US economy created roughly...

Read More »Interpreters in short supply

Many people who don’t speak one of Switzerland’s national languages have to rely on an interpreter. In recent years, the number of hours worked by interpreters has increased markedly. This is because there is a lack of well-trained interpreters in Switzerland. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

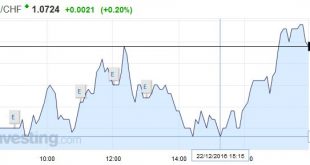

Read More »FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

Swiss Franc EUR/CHF - Euro Swiss Franc, December 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due...

Read More »FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

Swiss Franc EUR/CHF - Euro Swiss Franc, December 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due...

Read More »Inflation Sensation: The New Big Deal

It’s finally coming. Inflation. President-Elect Donald Trump’s promised a whole lot of infrastructure spending, raising the prospects for a great slug of price pressure the likes of which we haven’t seen in years. Analysts’ forecasts and financial markets show a dramatic shift in view on the outlook for inflation. These charts show some metrics worth watching. Investors have raised bets on a price pickup. Inflation’s...

Read More »Why the Massive Expansion of “Money” Hasn’t Trickled Down to “The Rest of Us”

if you create and distribute money only in the apex of the wealth/power pyramid, it can only benefit the few rather than the many. There are numerous debates about money: what it is, how we measure it, and so on. In recognition of these debates, I’m referring to “money” in quotes to designate that I’m using the Federal Reserve’s measure of money stock (MZM). Nowadays, “money” is often credit. We buy stuff not with...

Read More »The hidden cost of Christmas gifts

If you haven’t had a chance to go Christmas shopping don’t despair, gifts destroy value. For example, someone on a diet is unlikely to place much value on a box of chocolates. The difference between what was paid for the chocolates and what the recipient would have paid represents destroyed value. They could have been left on the shelf for someone who would have fully valued them. Economists call this deadweight loss. ©...

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More »Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Kosten eines Vollgeld-Systems sind hoch Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle. Der Präsident des Vereins Monetäre Modernisierung Hansruedi Weber (Mitte) und zwei verkleidete Aktivisten reichen im Dezember 2015 bei der...

Read More » SNB & CHF

SNB & CHF