Marc Chandler opposes conventional understanding of international economics by suggesting the challenge modern economies face is not scarcity, but surplus.

Read More »Marc Chandler-Does the World Have Too Much Capital?

Marc Chandler opposes conventional understanding of international economics by suggesting the challenge modern economies face is not scarcity, but surplus.

Read More »FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

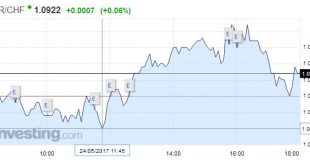

Swiss Franc EUR/CHF - Euro Swiss Franc, May 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Labour gains ground The Conservatives were in a very strong position following the election announcement. A snap election historically causes the currency in question to weaken, but on this occasion the opposite occurred. A Torie victory is deemed to be positive for the UK economy. Investor confidence grew and...

Read More »Poverty in Switzerland has more to do with age than any other factor

© Lisavan | Dreamstime.com A recent report classifies 570,000 people in Switzerland as poor. This number represents 7% of the population, and relates to 2015. In 2014, the same percentage was 6.6%. The report, which looks only at income, defines as poor a single person with income less than CHF 2,239 per month or a family of four with income below CHF 3,984 per month. Data from the survey of 7,500 households, around...

Read More »Four Numbers to Watch in FX

Summary: The dollar’s downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen. The US dollar’s downside momentum faded today. While one should not read much into it, it could be an early sign that the market has discounted the recent news stream,...

Read More »Novartis to shed 500 jobs in Basel

The Basel-based firm employs 120,000 people worldwide. The Swiss pharmaceutical giant Novartis has announced that it plans to cut 500 jobs at its Basel headquarters in Switzerland over the next 18 months. It says it will also create 350 new posts, mostly in its biotech business. Novartis said in a statement on Thursday that it planned to cut up to 500 jobs in the Basel area or to relocate workers to other sites over the...

Read More »Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

Tech is the umbrella word for all things fashionable to invest in right now. Take the recent flotation of Snap Inc. (parent company of teen and narcissists’ favourite app SnapChat), everyone wanted in on the $20 billion flotation. Snap is likely a sign of a tech bubble that will cost a lot of savers and investors huge amounts of money … again. Before putting your savings into the likes of SnapInc we think there are some...

Read More »Staying Stuck

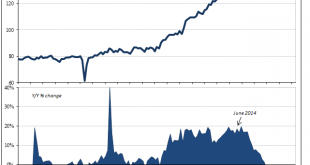

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

Read More »FX Daily, May 23: Greenback Remains Soft

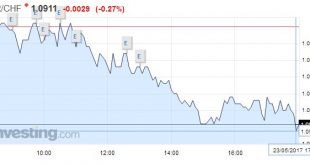

Swiss Franc EUR/CHF - Euro Swiss Franc, May 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny...

Read More »Swiss agriculture under fire at WTO

The Swiss agriculture sector is “vulnerable” to competition, says the WTO. (Keystone) The European Union and the United States have criticised Switzerland for the over-protection of its agricultural sector. Responding to the questions raised at the Geneva-based World Trade Organization (WTO), Switzerland said it would make an effort to ease protections, on condition that other member states do likewise. The statements...

Read More » SNB & CHF

SNB & CHF