It was love that first brought Doris Hofer to Turkey, where she then became one of the country’s leading fitness bloggers. The current political situation however, has her evaluating her options. An intimate portrait by Swiss public television, SRF, of a local online rising star. (SRF, swissinfo.ch) Doris Hofer is 41 years old and for the last 12 years has been a resident of Istanbul. A leading nutrition and fitness book author and blogger, she has an estimated quarter of a million people...

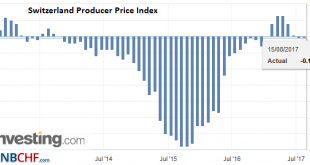

Read More »Swiss Producer and Import Price Index in July 2017: -0.1 YoY, -0,1 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »ALERT ! ! ! USA’S DAY OF ECONOMIC RECKONING 2017 – Charles Hugh SMITH

Please Click Below to SUBSCRIBE for More "Special Report Radio" Subscribe & More Videos: https://goo.gl/1bvkco Thank for watching, Please Like Share And SUBSCRIBE!!! #dollarcollapse2017, #geraldcelente

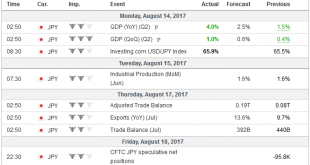

Read More »FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

Swiss Franc The Euro has risen by 0.64% to 1.1425 CHF. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past...

Read More »Weekly SNB Interventions and Speculative Positions: Investors do not take North Korea dispute seriously

FX Despite the tensions between Donald Trump and North Korea’s Kim Jong-un, the EUR/CHF only depreciated to a low of 1.1284. Headlines Week August 14, 2017 On June 27, Draghi told the audience at the annual ECB Forum that transitory factors were holding back inflation. This has boosted the euro against both USD and CHF. Our opinion, however, is that this “transition” is very long, possibly comparable to the Japanese...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

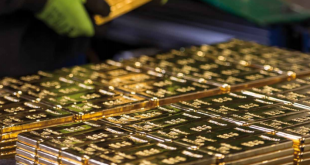

Read More »The West lost at least another 1000 tonnes of large gold bars in 2015

Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India. This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it...

Read More »“Under Any Analysis, It’s Insanity”: What War With North Korea Could Look Like

Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic...

Read More »FX Weekly Preview: Synthetic FX View — Macro and Prices

Summary: Economic data due out are unlikely to change macro views. Swiss franc’s price action suggests some return to “normalcy” despite rhetoric remaining elevated. Sterling’s 3.25 cent drop against the dollar looks over. An escalation of threatening rhetoric by the United States and North Korea emerged as the key driver last week. The US was unable to build on the success it enjoyed at the UN on August 5...

Read More »La mondialisation de l’esclavage permet la croissance des entreprises. Dossier.

Un Indien travaillant dans une fabrique de briques à l’extérieur de Calcutta, le 7 mai 2017. DIBYANGSHU SARKAR / AFP Nous avons parlé ces derniers temps d’excédents et de déficits de balances commerciales. Pourtant aucune rubrique de cette comptabilité de l’ »intégration » d’un Etat dans le monde globalisé ne pénalise celui-ci en matière d’abus de travailleurs, voire d’esclavagisme. Pire, les abus sont en croissance....

Read More » SNB & CHF

SNB & CHF