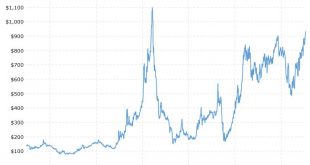

Gold and silver rise as stocks fall sharply after Barcelona attack Gold, silver 0.6% higher in week after last weeks 2%, 5% rise Palladium +36% ytd, breaks out & reaches 16 year high (chart) Gold to silver ratio falls to mid 75s after silver gains last week Perfect storm of financial and geopolitical tensions is driving safe haven demand and should see higher prices Weekly close over $1,300 could see gold quickly...

Read More »Swiss Asset Manager Settles US Tax Evasion Charges

Under the US Department of Justice’s 2013 ‘Swiss Bank Program’, 80 Swiss or Swiss-based banks paid $1.36 billion in fines for helping clients evade US taxes (Keystone) The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010....

Read More »Higher Swiss health premiums for those with high deductibles challenged by commission

In June 2017, Switzerland’s Federal Council announced plans to reduce the discounts offered to those willing to risk paying the first chunk of their annual medical bills. The plan included reducing the maximum premium discounts given for opting for deductibles, the amount paid by the insured before insurance kicks in. © Ginasanders | Dreamstime - Click to enlarge On Tuesday, according to 20 Minutes, a commission for...

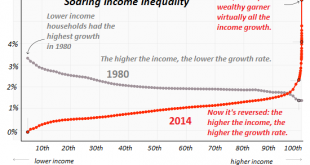

Read More »Why We’re Doomed: Our Economy’s Toxic Inequality

Anyone who thinks our toxic financial system is stable is delusional. Why are we doomed? Those consuming over-amped “news” feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency. The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart. While the...

Read More »Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video) Savings destroyed by currency creation and now negative interest rates Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living $20 food and beverages basket of 1971 cost $120.17 in 2017 Household items increased by average of 2000% and oil by 5,373% since...

Read More »Markets Exaggerate, That is what They Do

Summary: FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact. First, we told you that the FOMC minutes were not as dovish as the dollar and US Treasury yields may have suggested to many observers. Neither timing of the balance sheet adjustment (Sept announcement) or the odds of a rate hike before year-end changed. The dollar and...

Read More »Swiss companies pull out of Venezuela

Nicolas Maduro (blue shirt) at the tomb of former Cuban leader Fidel Castro in Santiago on August 15 (Keystone) Swiss firms have been cutting hundreds of jobs in long-established branch offices in Venezuela, as the oil-producing country experiences an economic and political crisis. “The disaster – economic, social, political and humanitarian – which is engulfing Venezuela with the government of [president] Nicolas...

Read More »L’explosion de la fortune des plus riches en France grâce au Casino. Liliane Held-Khawam

2007. Crise des subprimes. De l’argent public se déverse en abondance dans les circuits financiers mondiaux qui turbinent à la monnaie centrale. Comprenez que c’est de l’argent scripturale bancaire qui a été élevé au rang d’argent garanti par les Etats via leurs banquiers centraux. 2011. Crise des banques européennes. De nouveau, des décisions prises pour soutenir les banques sont prises par les grandes banques...

Read More »United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general. But even in our domestic...

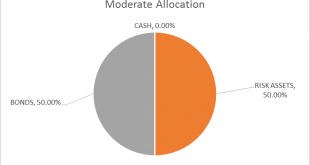

Read More »Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More » SNB & CHF

SNB & CHF