Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past. Spending and consumer sentiment used to track each other very closely and in terms of...

Read More »The Dea(r)th of Economic Momentum

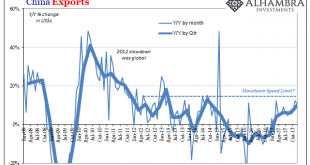

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape. China Exports,...

Read More »FX Daily, January 16: Dollar Given a Reprieve

Swiss Franc The Euro has risen by 0.19% to 1.1783 CHF. EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments...

Read More »Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

USD/CHF The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday’s mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now. Therefore, we are waiting for more decline in the upcoming sessions, noting that breaching 0.9656 might push the price to achieve some intraday...

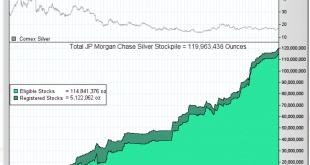

Read More »Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”– JP Morgan continues to accumulate the biggest stockpile of physical silver in history– “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler– Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today – Money managers showing more optimism towards silver through record buying– “Near...

Read More »Jobless in Switzerland need more education, say social groups

Much paperwork awaits in this social services centre in Zurich. (Keystone) Two leading Swiss organisations for social action and further education have called for big investment in training opportunities for the unemployed. At a press conference on Monday in Bern, the Swiss Conference of Social Institutions and the Swiss Federation for Further Education called on the state to invest in a schemeexternal link that they...

Read More »Swiss fact: nearly 50 percent of Swiss GDP comes from 4 cantons

Switzerland is made up of 26 cantons – technically six are half cantons1 – each with its own distinct taxes, education system, hospitals and government. © Anna Hristova | Dreamstime.com Land area varies significantly, from 37 sq/km Basel-Stadt to 7,105 sq/km Graubünden. Population is also highly varied, from tiny Appenzell Innerrhoden (16k) up to Zurich with nearly 1.5 million. Unsurprisingly, the range of economic...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

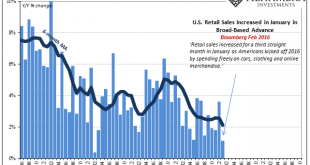

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

Read More »Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. © Valeriya Potapova _ Dreamstime.com At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany. The Swiss National...

Read More »Swiss inheritance wealth doubles in last 20 years

Staying on good terms with parents can pay off – increasingly so (Keystone) The Swiss are passing on more inheritance wealth to family, friends and other beneficiaries than ever before – the CHF63 billion ($65 billion) bequeathed in 2015 is double that of 20 years ago, according to the NZZ am Sonntag newspaper. The Office for Work and Social Politics Studies estimates than an additional sum of between CHF16 billion and...

Read More » SNB & CHF

SNB & CHF